Recent weeks have seen a rapid reversal of sentiment and the short-term trend on the stock market. Over the past three weeks, the broad S&P 500 index has lost more than 5%, and the Nasdaq 100 has lost more than 7%.

- Although there is no single direct cause for this correction, and the US earnings season has been fairly solid, it seems that the main reasons remain: uncertainty about the state of the economy, in the absence of the latest data (government shutdown), high stock valuations, and the risk of excessive concentration of capital in a narrow group of selected companies' shares.

- Investors are beginning to price in less optimistic scenarios and are uncertain about the continued AI bull market, as we can see, for example, in the declines in CoreWeave (CRWV.US) and Japan's Softbank — perceived as the “most aggressive” players in the artificial intelligence infrastructure industry.

- Concerns about the impact of the government shutdown on the economy, weaker consumer sentiment, and a weakening labor market. One clear indication of such weakness is the recent results of Home Depot (HD.US), which is clearly warning of an economic downturn.

- In these circumstances, the FOMC has begun to signal in recent weeks that a rate cut in December is not as certain as it seemed to the market until recently. The chances of a rate cut in December have fallen from around 40% last week to 20% this week. Stock valuations reacted “allergically” to this scenario.

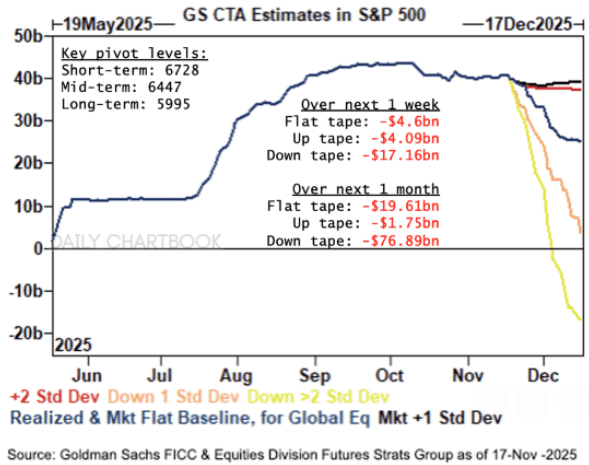

After the S&P 500 index fell below 6,728 points, CTA funds joined the sellers. Due to the specific nature of their activities and strategies, they did not contribute to the declines as long as the index remained above the 50-day EMA. Now, however, so-called “systemic strategies” are complicating Wall Street's chances for a sudden reversal of sentiment and a rebound, as CTAs have to sell “along with the market". In the short term, Nvidia's results and the FOMC's position, which the central bank will communicate on Wednesday, remain indicators for the further direction of the market.

Źródło: Goldman Sachs FICC

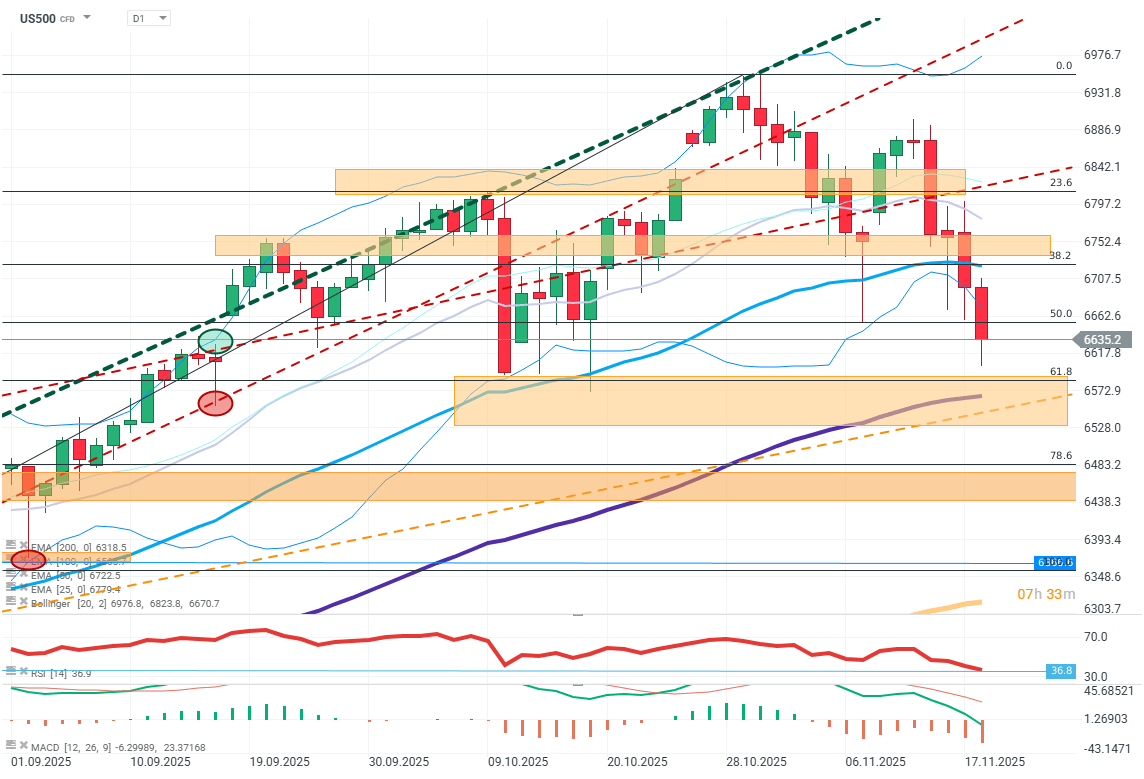

US500 (D1)

Futures on S&P 500 (US500) loses more than 1% today, falling below EMA50.

Source: xStation5

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?