Today is one of the most important events in recent weeks - the economic symposium in Jackson Hole, where Federal Reserve Chairman Jerome Powell will speak. In the past, this symposium was used by central bankers to present important positions. However, this happened primarily over a decade ago when Ben Bernanke was leading the Fed. In recent years, the statements of central bank heads have been more measured.

What to expect from Powell? There's a considerable gap between the July and September meetings, and since then, we've received data that may fully support the Fed's initiation of monetary policy normalization in September. Markets are pricing in even more than one rate cut next month. The market clearly expects Powell to announce interest rate cuts, but further details of his speech may determine larger changes.

What are the possible scenarios?

- Powell admits that interest rates have been restrictive for a long time and it's time for revision (neutral or slightly positive for Wall Street);

- Powell says that we still have a few publications ahead that will decide on the interest rate cut in September (uncertainty here, negative for Wall Street, positive for the dollar);

- Powell admits that rates were at a restrictive level for too long, leading to a stronger cooling of the job market, considering the recent NFP and employment revisions for the last year by BLS (positive for Wall Street);

- Mention of the possibility of a 25 bp and 50 bp cut (positive for Wall Street);

- Indication that the job market has slowed down too much and recession risks have emerged (negative for Wall Street and negative for the dollar);

- Cuts will occur, but the market overestimates the scale of the Fed's action (neutral or slightly negative for Wall Street, positive for the dollar).

It's worth mentioning that studies will be presented at the symposium showing that the Fed should be very careful in cutting interest rates and that rates are not at a very restrictive level. The studies also indicate that the slowdown in the job market is not significant and interest rates don't need to be cut quickly and sharply. According to these works, the economy is set to recover quickly after cuts, due to faster transmission of monetary policy to the real economy. However, Bloomberg believes that Powell will not be guided by these guidelines and will look from the perspective of unemployment data, as it has been consistently rising in the last 4 months, reaching a level of over 4.3% - significantly above Fed forecasts.

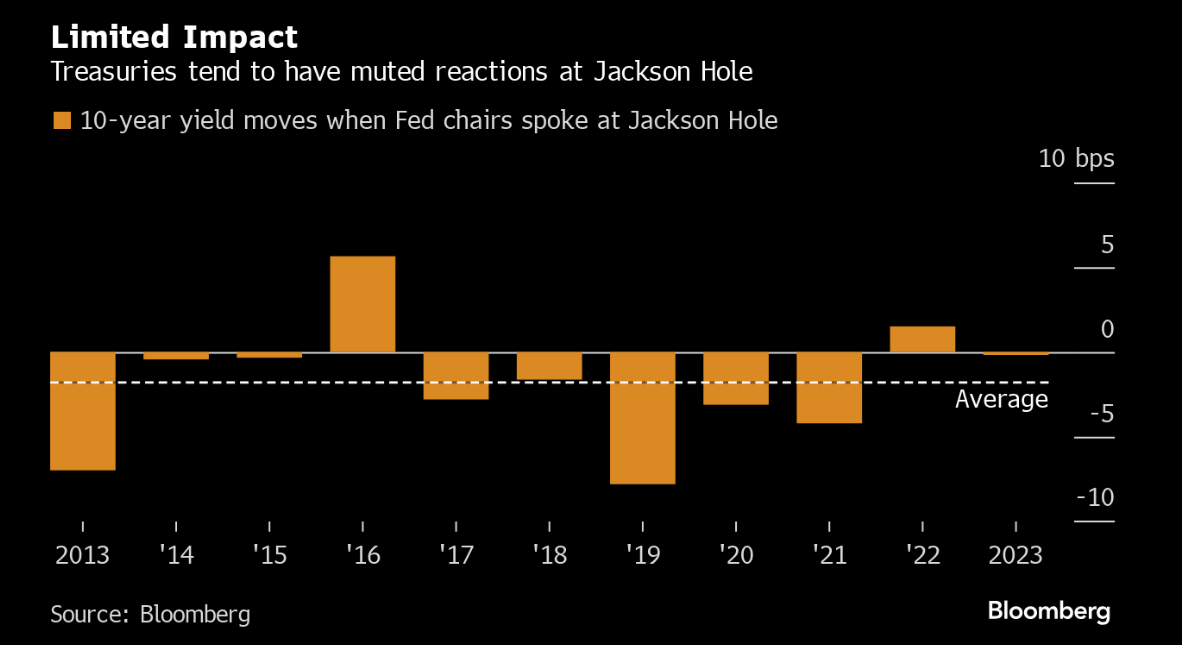

Does Jackson Hole matter? There's a good chance that Powell will repeat his words from the July meeting and minimally signal readiness for cuts. If he doesn't refer to the job market, reactions may be minimal. On the other hand, in July he was more dovish than the FOMC consensus, so there's a chance for such a surprise. Nevertheless, as we can see, recent conferences in Jackson Hole have not led to large volatilities in yields, which are key from the perspective of the dollar and Wall Street.

Source: Bloomberg Finance LP

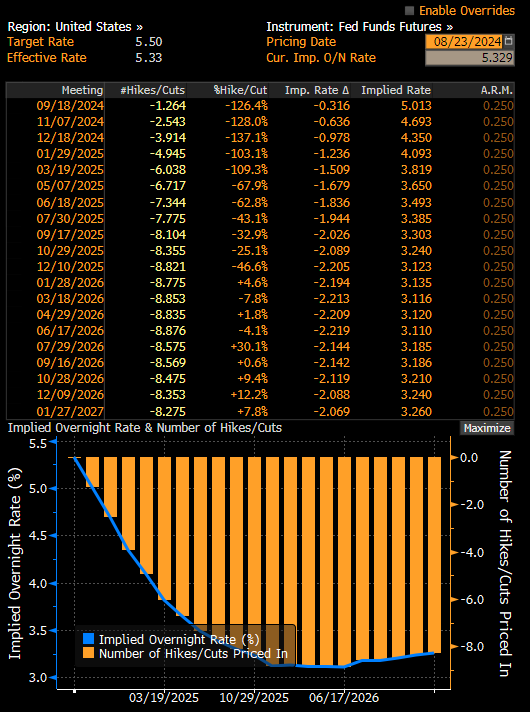

The market still sees significant cuts this year. If Powell doesn't meet dovish expectations, the market may start pricing in fewer cuts, which could help the dollar but shouldn't harm Wall Street much. Source: Bloomberg Finance LP

How will the market react? US500 is recovering a large part of yesterday's losses, setting up for Powell's dovish speech. Lack of announcement of a cut could result in a return below 5600 points. If Powell is dovish and doesn't try to reduce market expectations for cuts and perhaps opens the door to a 50 bp cut, then it will be possible to test 5650 points. A minimally dovish or neutral stance should keep US500 in the range of 5620-5630 points.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?