Tuesday marks another day of US dollar strengthening with the greenback being the best performing G10 currency at press time. While US yields are a touch lower on the day, they remain at elevated levels following bond sell-off in recent days. 10-year US yields is sitting at 4.54% - near the highest levels since 2007. This is putting pressure on equities as well as gold - Wall Street indices are trading 1% lower while gold drops 0.6% and closes in on the $1,900 per ounce area.

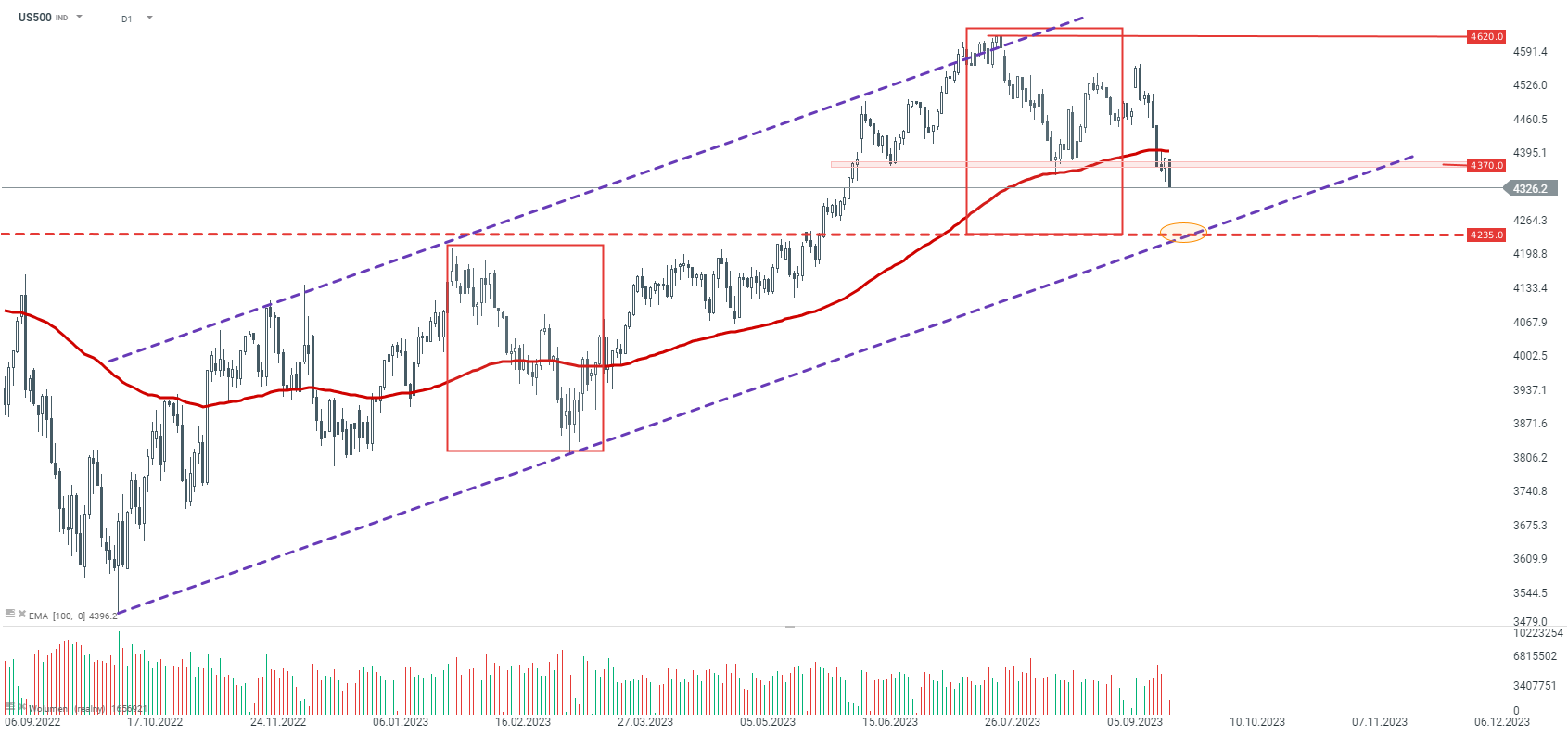

S&P 500 futures (US500), as well as the other US indices, are trading under pressure today. While the index launched yesterday's cash session lower and began to recover almost immediately, no such recovery move can be spotted after today's cash session opening. US500 dropped to a fresh 3-month low today and is threatening to deliver a decisive break below the 4,370 pts support zone. Clearing this hurdle would pave the way for sellers to test a key near-term resistance in the 4,325 pts area, where the lower limit of the Overbalance structure as well as the lower limit of the upward channel can be found.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers