On Friday, US stocks opened slightly higher amidst mixed sentiments after the release of the Federal Reserve's preferred inflation measure, the core personal consumption expenditures (PCE) price index. This data confirms a continuous easing of inflation. Despite pre-market dips and mixed futures, major indices are poised for their eighth consecutive winning week. On the final day of the week, improved market sentiment is also supported by a weakening dollar and falling bond yields.

Despite recent dynamic declines, the dollar (USDIDX) is currently at a key level around 100 points. Historically, these ranges have twice been a turning point or a place of temporary consolidation. Source: xStation 5

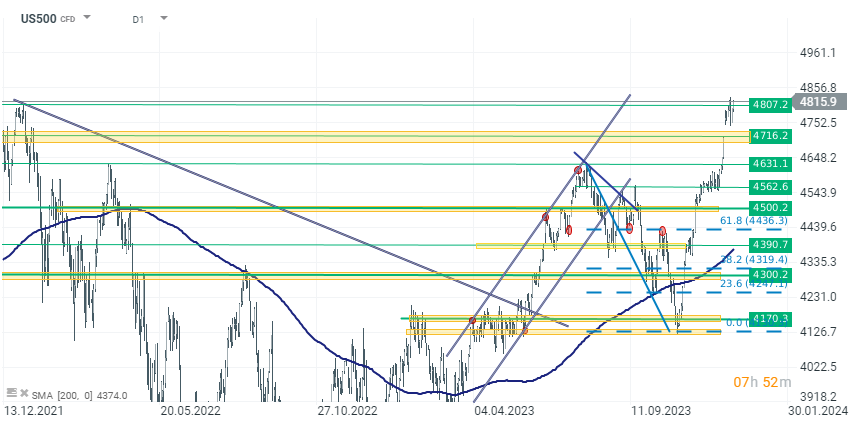

After several attempts this week, the US500 is once again testing historical highs above 4810 points. If the bulls manage to maintain these levels at the daily close, it will be the highest historical level. Looking at support levels, the 4700 area remains the first range in case of a correction on the US500. Source: xStation 5

Company News

Rocket Lab (RKLB.US) shares surge as much as 20% after the satellite company won a $515 million US government contract, which Citi analysts said is positive for the stock given it more than doubles the backlog for its Space Systems business

NetEase (NTES.US) tumbles by 17% and Bilibili (BILI.US) falls by 4%, leading a drop among US-listed Chinese stocks after China issued a raft of new measures that limit players’ spending within video games, stoking fears of another industry crackdown in the world’s biggest mobile gaming arena.

Ansys (ANSS.US) jumped over 10% on Friday following news that the company is considering a sale. Investment firm Oppenheimer has indicated that the company could be valued at up to $400 per share if acquired. Currently, the company is priced at $330 per share.

Nike (NKE.US) tumbles 12% after the sportswear giant flagged that it’s looking for as much as $2 billion in cost savings and issued a weak forecast for the second half of the company’s fiscal year. The update prompted Cowen to downgrade its rating on the shares.

Source: xStation 5

Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report