- US indices opened higher today, with the US500 and US100 rising around 0.60% and 0,30% respectively

- US labor data show the first signs of weakening, as the unemployment rate unexpectedly rose to 3.8%

- News from Dell Technologies (DELL.US), MongoDB (MDB.US), and Broadcom (AVGO.US)

US indices opened slightly higher today, as markets are betting that the end of the rate-hiking cycle is behind us. This week was particularly important, as several macroeconomic releases suggested that the lagging labor market is beginning to weaken. Mid-week, the job openings report showed a sudden drop in open vacancies, and today at 1:30 pm BST, we received another labor data pack. This showed the unemployment rate unexpectedly rising above forecasts to 3.8%. The actual report indicated a small beat in both non-farm and private payrolls. Wage growth data came in slightly lower than expected at 4.3% YoY.

However, it should be noted that the FOMC expects the unemployment rate to pick up by the end of the year. The Federal Reserve may view the latest labor data as a mixed bag that does not necessarily warrant immediate action on interest rates. While the addition of 187,000 jobs in August beat expectations, the previous release was revised to the downside and the unemployment rate unexpectedly rose to 3.8% from 3.5%, largely due to an increase in labor force participation. These factors could give the Fed some room for caution. It can be interpreted that the labor market is gradually normalizing but not overheating.

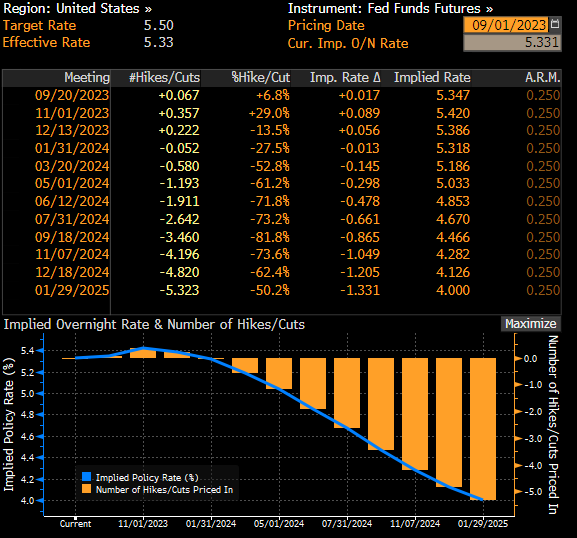

WIRP for the US, source Bloomber Finance L.P.

After the publication, the probability rate suggests that the Federal Reserve will not raise interest rates in the next meeting, with this probability dropping to just 7%. Market expectations are now shifting towards the possibility of a rate cut, with Fed Swaps fully pricing in such a move in May instead of June. Additionally, the lowered odds in Fed Swaps suggest that another rate hike this year is becoming less probable.

US100 index is currently trading 0.30% higher at 15,580 points, showing some resilience after a recent drop. The index has managed to recover and climb above the critical support level of 15,400 points. As it stands, the index is eyeing this year's highs around 16,000 points. From a technical perspective, the 15,400-point level is crucial. If this support is broken to the downside, it could trigger increased selling pressure, potentially driving the index lower. On the flip side, if the index sustains its position above this level, bullish momentum could carry it towards testing the year's highs at approximately 16,000 points. Keep an eye on these key levels for potential breakouts or breakdowns.

Company news:

-

MongoDB's (MDB.US) shares climbed 6.1% after reporting second-quarter results that substantially beat expectations and subsequently raised its full-year forecast for both revenue and EPS. Leading investment firms like Stifel and Morgan Stanley elevated their price targets for the cloud database company. The strong performance was attributed to better-than-expected user growth, particularly in Atlas's results, along with robust enterprise agreements and license revenue. Margins almost doubled, exceeding the consensus. The results have been seen as a sign of resilience in database software-related spending among large enterprises and have assuaged investor concerns, providing room for additional upside. While cash flow was lighter than expected, MongoDB's Q2 revenue and profitability exceeded even optimistic projections, solidifying the stock as a top pick for rebound potential.

-

Broadcom's (AVGO.US) shares dropped by up to 4.6% in premarket trading after announcing a Q4 revenue forecast that fell short of expectations. Despite the chipmaker's growth in AI chips, analysts note that investors were anticipating generative AI to have a more significant positive impact on the company’s outlook. The weaker forecast is attributed to a "soft landing" across the company's networking, broadband, and storage segments. While the stock has seen a 65% increase this year, the tempered outlook has led analysts to adjust their positions, with some noting that the company's growth is currently being offset by weaknesses in areas other than AI. Overall, analysts view the situation as a "well-executed soft landing," but there's a general sense that investors had hoped for more, particularly given the hype around AI capabilities.

-

Samsara (IOT.US) shares rise as much as 3.3% after the application software company reported second quarter results that beat expectations and raised its full-year forecast. Analysts say the report justifies the stock’s valuation.

-

Dell Technologies' (DELL.US) shares surged over 12% after reporting Q2 results that significantly exceeded expectations, primarily driven by gains in artificial intelligence (AI). With a total net revenue of $22.93 billion, outperforming estimates of $20.84 billion, Dell also saw strong performance in its Infrastructure Solutions Group and Client Solutions Group. The company has been identified as a strong player in the AI sector, which contributed to 20% of its server orders. Analysts from Morgan Stanley and Citi raised their price targets for Dell, praising its better execution, cost management, and potential for inclusion in the S&P 500. The strong financial performance comes amid a challenging macro environment, making the results particularly notable. As of the last close, Dell's stock has risen 40% this year.

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales