- Wall Street extends bullish momentum despite weaker macro data

- US labor market remains strong

- C3.ai plummets after new revenue forecasts

- The House passed debt-limit legislation

S&P 500 futures showed minimal movement following the passage of debt-limit legislation in the House, a collaborative effort between President Joe Biden and Speaker Kevin McCarthy. The legislation aims to control government spending until the 2024 election and prevent a disruptive default by the United States. Traders are eagerly anticipating the resolution of the debt ceiling case and the release of the US Non-Farm Payrolls report tomorrow, as these events have the potential to influence the Federal Reserve's interest rate decision for June.

In May, private payrolls exceeded economists' projections, with ADP reporting a growth of 278k jobs compared to the estimated 180,000. Moreover, the number of jobless claims filed last week was lower than expected. These positive indicators highlight the continued robustness of the labor market, a key area of the economy. However, there are concerns that this sustained strength could lead the Federal Reserve to contemplate another interest rate hike at its upcoming policy meeting later this month.

ISM manufacturing index dipped -0.2 ticks to 46.9 in May after bouncing 0.8 ticks to 47.1 in April. This is a seventh consecutive month in contraction (below 50), reflecting the gloom in manufacturing.

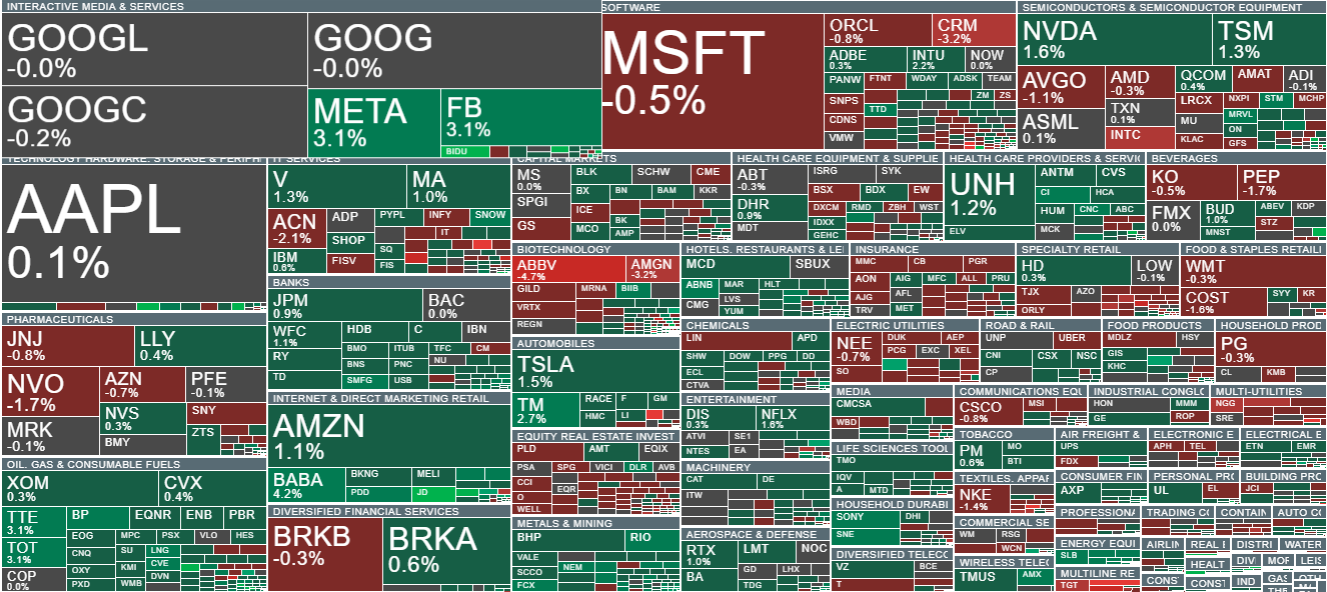

Shares of S&P500 companies, volume reflects market capitalization. Gains are being made by META (META.US), Nvidia (NVDA.US) and Amazon (AMZN.US). Source: xStation5

Shares of S&P500 companies, volume reflects market capitalization. Gains are being made by META (META.US), Nvidia (NVDA.US) and Amazon (AMZN.US). Source: xStation5

US500 index is currently trading at 4200 points, which serves as a support level. The price is hovering around the upper resistance of a bear market downward trend channel, indicating a critical juncture. The direction of the index will largely depend on the upcoming price action. Notably, there has been recent rejection from this level, and the price is currently experiencing some struggles as well. It has retraced from this week's highs at 2048 points. If the price break below the current support level, the next support line to watch for is at 4164 points. Traders and investors will closely monitor these levels to gauge the index's future movement.

US500 index is currently trading at 4200 points, which serves as a support level. The price is hovering around the upper resistance of a bear market downward trend channel, indicating a critical juncture. The direction of the index will largely depend on the upcoming price action. Notably, there has been recent rejection from this level, and the price is currently experiencing some struggles as well. It has retraced from this week's highs at 2048 points. If the price break below the current support level, the next support line to watch for is at 4164 points. Traders and investors will closely monitor these levels to gauge the index's future movement.

Company News:

- C3.AI (AI.US) plummets as much as 12% due to disappointing guidance for the fiscal first quarter. Company published revenue forecasts for next quarter and FY24 that disappointed analysts and prompted D.A. Davidson to cut the stock to neutral from buy.

- Nordstrom (JWN.US) initially rallied almost 5.0% and then price back to the base after the department-store chain reported better-than-expected quarterly revenue and profit. Analysts were optimistic about the improvements at the retailer’s off-price Rack stores.

- Salesforce Inc. (CRM.US) shares are down 3.0% after the software company reported its Q1 results and gave a forecast showing the company isn’t growing as fast as it used to. Analysts noted, in particular, the slowdown in contracted sales, though many continue to be positive on its long-term prospects.

- Veeva Systems (VEEV.US) shares are up more than 17% after the application software company reported Q1 results that beat expectations and raised its full-year forecast. Analysts said the company appears to be navigating well through macro weakness.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers