- Wall Street indices open higher

- US2000 tests 2,100 pts resistance zone

- GameStop surges 70% as interest in meme-stocks revives

- Stericycle rallies at double-digit pace after agreeing to be acquired by Waste Management

Wall Street indices launched today's trading higher - S&P 500 gains 0.3%, Dow Jones trades flat, while Nasdaq and Russell 2000 jump around 0.8% each. Meme-stocks are in the center of attention again after media reported that RoaringKitty, trader associated with 2021 mania, build a large position on GameStop. GameStop launched today's trading with an over-70% bullish price gap.

Economic calendar for the US session today is light, but there is one important release scheduled - ISM manufacturing index for May at 3:00 pm BST.

Source: xStation5

Source: xStation5

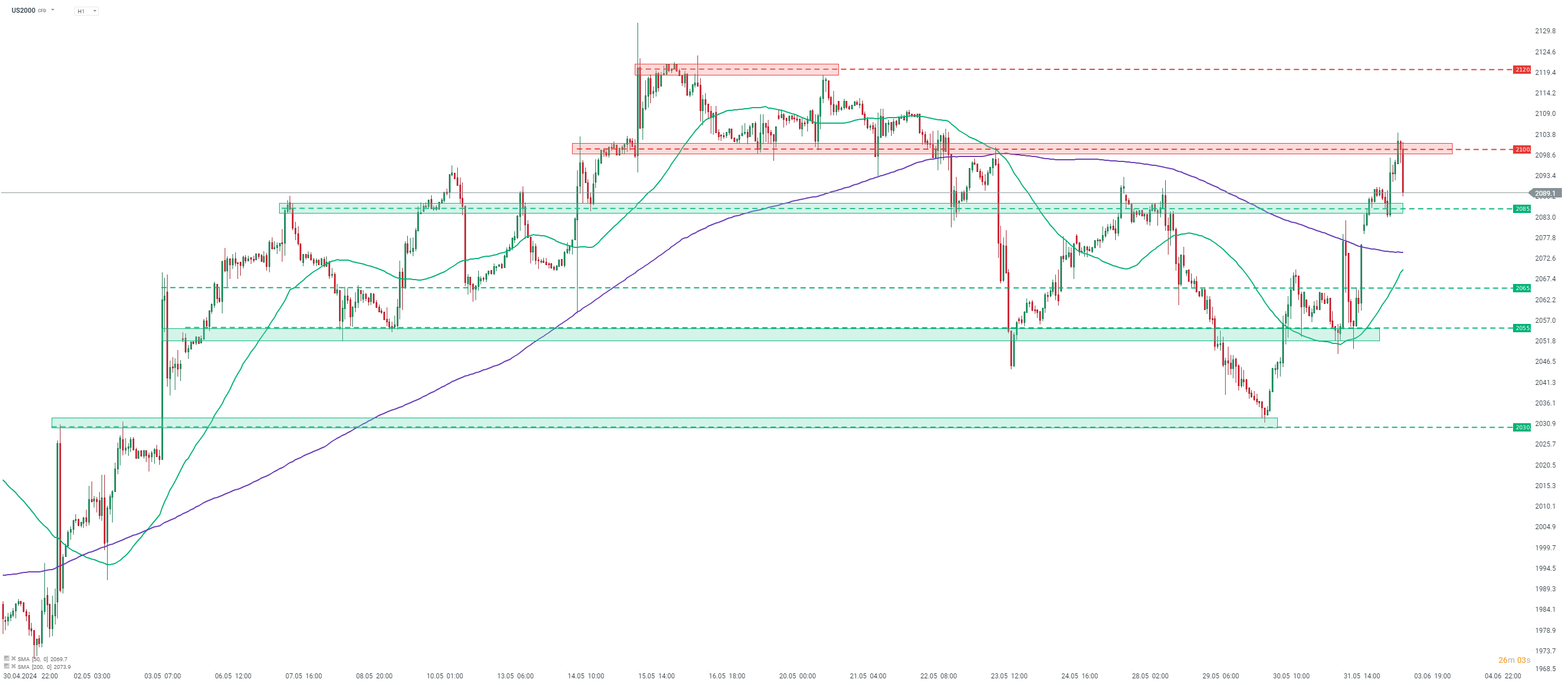

Russell 2000 is the best performing major Wall Street index today, as it is supported by renewed interest in meme-stocks. Taking a look at Russell 2000 futures (US2000) chart at H1 interval, we can see that the index climbed to the 2,100 pts resistance area and trades at the highest level since May 22, 2024. Clearing this area would pave the way for a test of 2,120 pts zone, marked with mid-May local highs. On the other hand, in case of a failure to maintain bullish momentum and a pullback from 2,100 pts area, the first near-term support zone to watch can be found in the 2,085 pts area and the next one can be found in the 2,065 pts area. So far, it looks like the latter option is in play with US2000 pulling back sharply after launch of US cash trading.

Company News

GameStop (GME.US) and other meme-stocks are on the rise again. GameStop (GME.US) is among top performers, launching today's cash session with an around-70% bullish price gap. The move higher was triggered by media reports signalling that RoaringKitty, a trader associated with Reddit meme-stocks mania, has amassed an over $180 million position in GameStop shares and call options. Other meme stocks - AMC Entertainment (AMC.US), Beyond Meat (BYND.US), BlackBerry (BB.US) - are also trading higher but not as much as GameStop.

Stericycle (SRCL.US), medica-waste disposal company, agreed to be acquired Waste Management (WM.US), North America's largest waste recycling company. Waste Management will pay $62 per each share of Stericycle, marking an around 20% over company's closing price on Friday. Transaction gives Stericycle enterprise value of $7.2 billion and is expected to close in the fourth quarter of 2024, following regulatory approval and approval from Stericycle's shareholders. Stericycle launched today's trading with a big bullish price gap and is gaining at a double-digit pace, while Waste Management trades slightly lower.

Nvidia (NVDA.US) and Advanced Micro Devices (AMD.US) trade higher today after executives of both companies made AI-related announcements over the weekend at an event in Taiwan. Jensen Huang, CEO of Nvidia, said that his company will premier Blackwell Ultra chip in 2025 and next-gen Rubin AI platform in 2026. AMD announced that it is speeding up introduction of new AI processors.

Analysts' actions

- Best Buy (BBY.US) upgraded to 'buy' at Citi. Price target set at $100.00

- Dell Technologies (DELL.US) downgraded to 'hold' at Citic Securities. Price target set at $151.00

- Broadcom (AVGO.US) rated 'buy' at Melius Research. Price target set at $1,850.00

- Target (TGT.US) rated 'underperform' at BNPP Exane. Price target set at $116.00

- Cava Group (CAVA.US) downgraded to 'neutral' at JPMorgan. Price target set at $77.00

GameStop (GME.US) launched today's trading with an over-70% bullish price gap. Source: xStation5

GameStop (GME.US) launched today's trading with an over-70% bullish price gap. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report