- Contracts are noted with a slight increase

- Bond yields are rising

- The dollar is also gaining

The last day of this week looks quite interesting. Indices from the USA are at historic highs, and bulls are fighting to permanently break through these levels. However, on the other hand, we are observing rising bond yields and the dollar, which adds additional supply pressure on the stock market.

US500

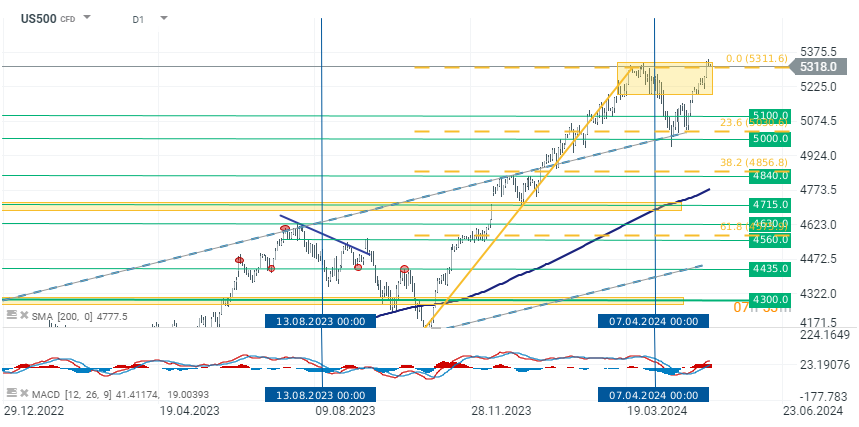

At the time of publication, contracts on the SP500 index are noted without significant changes at around 5310 points. For investors relying on technical analysis, we can see the beginning of a double top formation on the chart. If the bulls fail to break through the ATH around 5330 points, and then we observe a return to the downward trend, we can talk about the completion of the formation. For the bulls, the most important thing is to maintain a sideways trend or break through the ATH.

Source: xStation 5

Company News

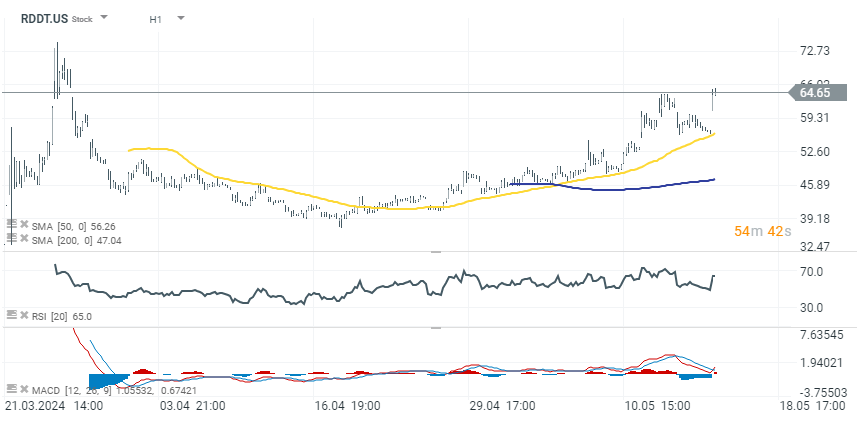

Reddit (RDDT.US): gains over 12% after announcing a partnership with Microsoft-backed OpenAI. This collaboration will integrate Reddit content with OpenAI's ChatGPT, allowing OpenAI's AI models to learn from Reddit content in real time. The deal also introduces AI-powered features for Reddit users and moderators and establishes OpenAI as an advertising partner on Reddit.

Source: xStation 5

GameStop (GME.US): GameStop's shares continued to fall, dropping an additional 30% after a 30% decrease yesterday. This decline was triggered by the announcement of disappointing preliminary Q1 results and the filing of a mixed securities shelf registration. The company expects lower net sales than anticipated and a significant net loss for the quarter.

Cracker Barrel Old Country Store (CBRL.US): Shares fell by 12.60% after Cracker Barrel announced it would cut its dividend by over 80% as part of a strategy to increase investments in renovating its restaurants and optimizing its menu.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?