- US indices launch cash trading session lower

- Dow Jones pulls back from 34,000 pts area

- Earnings from PepsiCo, MMM, Dow and Verizon Communications

Wall Street indices launched today's cash session lower. Attention is once again on banks after earnings from First Republic Bank showed that the bank experienced intense deposit flight during SVB turmoil and was close to collapsing. FRC launched today's cash trading session with an over-20% bearish price gap. Earnings releases are the main source of company-specific news right now with the Wall Street earnings season for Q1 2023 being in full swing. Among companies that reported ahead of the US session open today one can find PepsiCo, 3M, Verizon Communications or Dow.

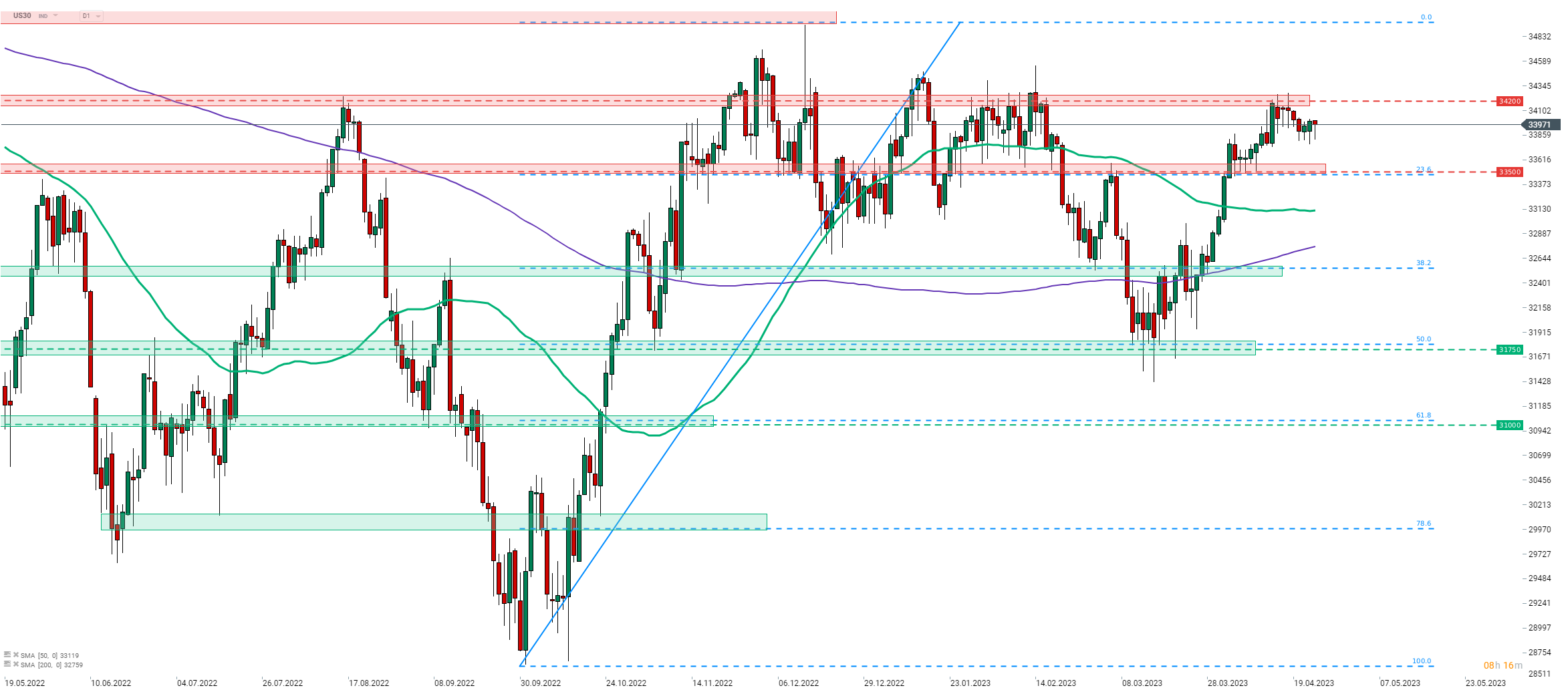

Dow Jones (US30) made an attempt at climbing back above the 34,000 pts mark yesterday but it turned out to be a failure. While the index futures have been trading lower throughout the day, part of those losses have been recovered in the first minutes of the US cash trading session. Should bulls regain control over the market and manage to push the index higher, a test of the 34,200 pts resistance zone may be looming in near future. However, one should keep in mind that reports from US mega-tech companies will be released over the next couple of days and they could be a key to determining future moves not only on tech-heavy Nasdaq-100 (US100) but also on the whole US stock market.

Source: xStation5

Company News

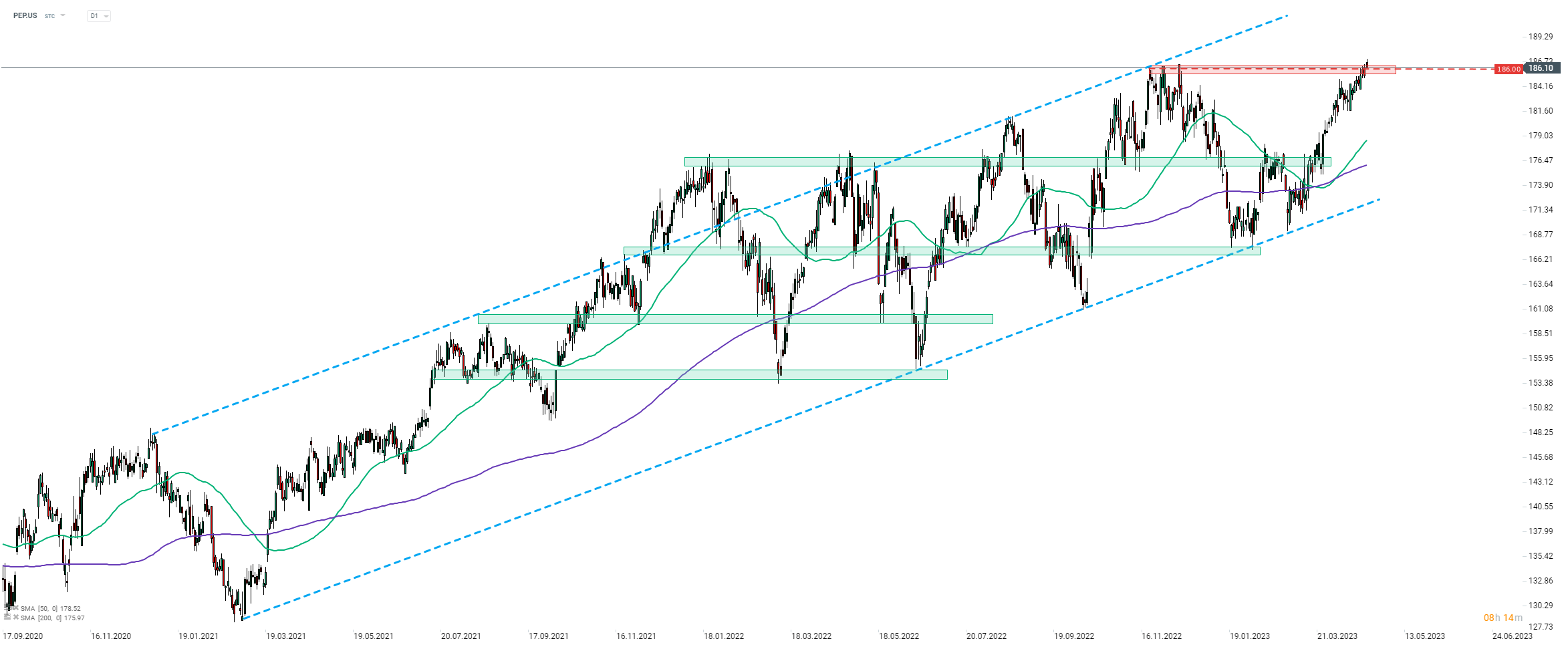

PepsiCo (PEP.US) reported better-than-expected Q1 2023 results ahead of Wall Street open today. Company reported core EPS at $1.50 (exp. $1.38) and a 10% YoY jump in net revenue to $17.85 billion (exp. $17.24 billion). Sales increased in Latin America (+21% YoY), Europe (+5% YoY) and Africa & Middle East (+1.5% YoY) while revenue in Asia-Pacific and China was 1.4% YoY lower. Sales in North America increase in all segments - Frito-Lay (+15% YoY), Quaker Foods (+9% YoY) and PepsiCo Beverages (+8.4% YoY). PepsiCo expects an 8% increase in organic revenue this year.

3M (MMM.US) said that it plans to cut around 6 thousand jobs globally, which will result in a $700-900 million pre-tax charge. Announcement came along with the release of solid Q1 2023 earnings. 3M reported adjusted EPS at $1.97 (exp. $1.58) and net sales at $8.03 billion (exp. $7.47 billion). CapEx at $475 million was also higher than $423.2 million expected. Company held full-year forecasts unchanged and still expects full-year adjusted EPS in the $8.50-9.00 range and full-year sales drop of 2-6%.

PepsiCo (PEP.US) launched today's trading higher, following the release of a better-than-expected Q1 2023 earnings report. Stock launched today's session above the $186.00 resistance zone and painted a fresh all-time high in the process. Source: xStation5

PepsiCo (PEP.US) launched today's trading higher, following the release of a better-than-expected Q1 2023 earnings report. Stock launched today's session above the $186.00 resistance zone and painted a fresh all-time high in the process. Source: xStation5

Dow (DOW.US) reported Q1 2023 results ahead of the opening bell today. Company reported a 22% YoY drop in net sales, to $11.85 billion (exp. $11.59 billion). Beat was driven by sales in Performance Materials and Packaging & Specialty Plastics units. Operating EPS came in at $0.58 (exp. $0.37) while operating EBITDA was 57% YoY lower at $1.36 billion (exp. $1.22 billion). Company said that it is progressing towards a goal of achieving $1 billion in cost savings in 2023. Dow said that net sales decline, that was seen in all company's units, is driven by overall deterioration in macroeconomic activity.

Verizon Communications (VZ.US) reported Q1 2023 results ahead of the Wall Street session open today. Company reported adjusted EPS at $1.20 (exp. $1.19) and operating revenue at $32.9 billion (exp. $33.64 billion). Wireless service revenue came in-line with estimates at $18.9 billion and the company had 633 thousand postpaid in wireless postpaid net adds (exp. +289.3k). Company maintained full-year forecasts and still expects adjusted EPS to reach $4.55-4.85 and capital expenditures at $18.25-19.25 billion.

Dow (DOW.US) is lower after release of the Q1 earnings report and is erasing all of yesterday's gains. An attempt to climb back above the 50-session moving average yesterday turned out to be a failure and the stock is now testing a support zone ranging around 38.2% retracement of the April-October 2022 downward move. Source: xStation5

Dow (DOW.US) is lower after release of the Q1 earnings report and is erasing all of yesterday's gains. An attempt to climb back above the 50-session moving average yesterday turned out to be a failure and the stock is now testing a support zone ranging around 38.2% retracement of the April-October 2022 downward move. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?