- Wall Street opens higher

- Europe's PMI comes out slightly lower

- Activision Blizzard rises after new information regarding the acquisition

On the last day of the week, markets are slightly recovering from significant drops from the previous two days. At the opening of the session, US500 gains 0.30%, while US100 increases by 0.40%. The US dollar slows its strengthening, causing a reaction in the stock market. Over the past three days, starting from the conference after the Fed's decision, US500 lost almost 3.0% of its value. Investors are currently beginning to accept the prospect of maintaining higher interest rates for longer than previously priced in.

US companies categorized by sector and industry. Size indicates market capitalization. Meta (META.US), Nvidia (NVDA.US), and Amazon (AMZN.US) are among the biggest gainers today. Source: xStation5

The US500 is currently trading at 4390 points, showing a 0.30% gain today, which follows three consecutive days of record losses. The index experienced a decline from the resistance line at 4560 points, ultimately finding support at the recent local low of 4380 points. The upcoming week will be pivotal in determining whether selling pressure will continue to exert downward pressure on the index. Traders should keep a close eye on the 4300-point level, which aligns with multiple significant peaks and lows and could act as a critical support zone.

Company News:

Activision Blizzard (ATVI.US) shares are gaining 1,7% after the UK's Competition and Markets Authority (CMA) has provisionally approved its $69 billion acquisition by Microsoft after initially blocking it due to cloud gaming concerns. Microsoft (MSFT.US) amended the deal, transferring cloud gaming rights for Activision Blizzard games to Ubisoft, which alleviated the CMA's apprehensions. While this is a preliminary decision, the CMA has initiated a consultation period until October 6th to gather third-party feedback on Microsoft's proposed solutions. A final verdict is anticipated to be before October 18th. Microsoft's vice chair and president, Brad Smith, expressed optimism about the decision and the company's efforts to address the CMA's residual concerns.

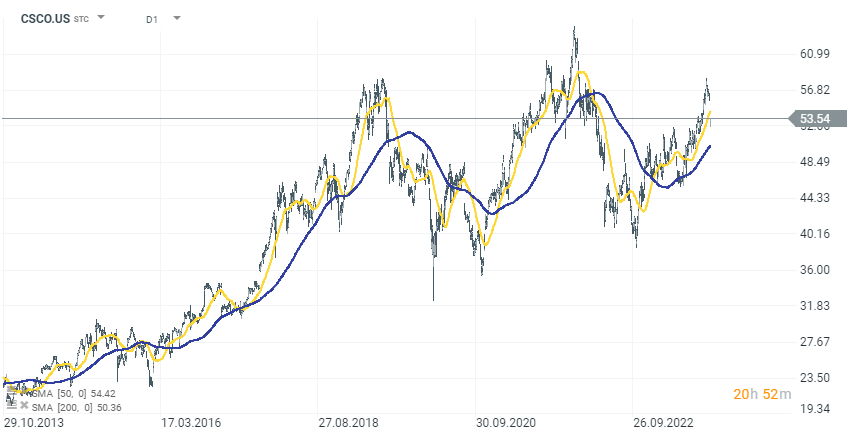

Cisco Systems (CSCO.US) announced yesterday its plans to acquire cybersecurity firm Splunk for $28 billion, marking Cisco's largest-ever acquisition to strengthen its software business and leverage artificial intelligence. The collaboration aims to shift from threat detection to predictive threat management, enhancing security analytics and ensuring observability across various cloud environments. This move is expected to boost Cisco's recurring revenue and improve gross margins and non-GAAP earnings within two years. The acquisition, set to close in the third quarter of 2024, underscores both companies' shared values of innovation and inclusion, positioning them as a top destination for software talent.

Source: xStation 5

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)