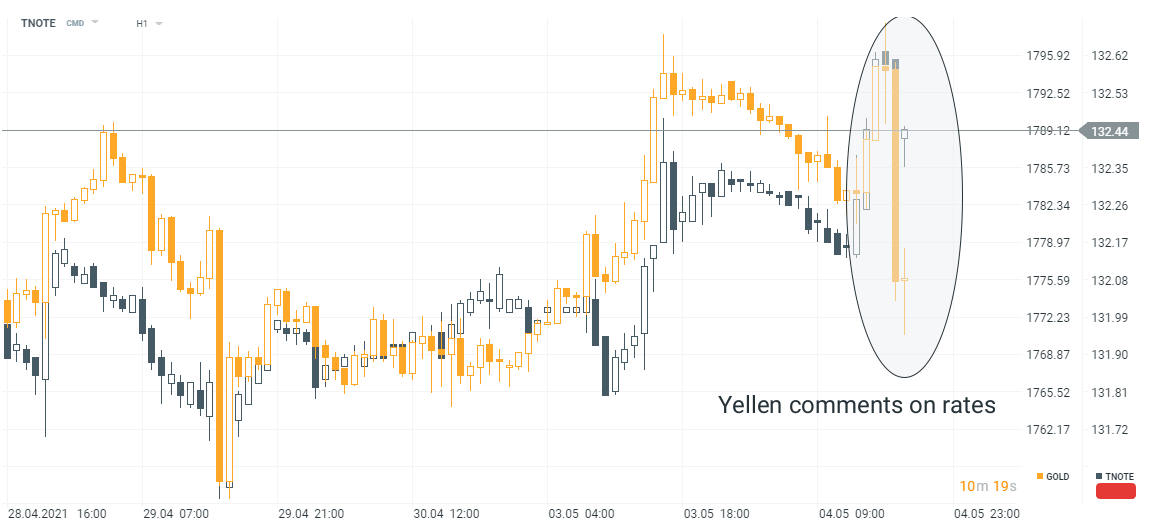

Over the last two hours, the US bond yields rebounded from around 1.56% to nearly 1.60% (thus the prices of these bonds fell). The increase in bond yields contributed to a sharp decline in gold prices - we have already mentioned the relationship between yields and gold many times in our posts.

The decline in US bond prices (and thus the gold sell-off) was probably caused by Janet Yellen comments, who suggested that there may be a need to raise interest rates in order to prevent overheating of the economy. The US Treasury Secretary presented a different point of view compared to the Fed. It should be remembered that any comments that even slightly suggest the earlier tightening of the US monetary policy may lead to further increases in bond yields and lower gold prices.

US Treasury bond yields rise (and their prices fall) and gold prices plummet. Source: xStation5

US Treasury bond yields rise (and their prices fall) and gold prices plummet. Source: xStation5

The price of gold fell below the lower bound of the wedge formation and below the 50 SMA (green line). The nearest support is located around $1,758/oz. Source: xStation5

The price of gold fell below the lower bound of the wedge formation and below the 50 SMA (green line). The nearest support is located around $1,758/oz. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

NATGAS muted amid EIA inventories change report