For the third time in five years Britons are set to head to the polls for a general election with December 12th selected as polling day. In theory there are a wide range of issues at stake here in selecting the next government, but for all practical means this is little more than another attempt to break the Brexit stalemate and as close to a 1-policy election as we’ve seen since the Second World War.

Summary:

-

General election set for Dec 12th

-

Beware of Conservatives lead in the polls?

-

Technical overview: GBPUSD and UK100

Given the recent flextension of the Brexit deadline to January 31st 2020 and the ongoing gridlock in UK parliament, caused in no small part by a minority government, it is little surprise that PM Boris Johnson has been pushing for a general election and last night he finally got his wish as MPs voted overwhelmingly in favour (438-20) of sending the public back to the ballot box. The date is all but confirmed as Thursday December 12th and in reality this will be little more than a vote on Brexit.

Beware of Conservatives' lead in the polls?

When MPs voted against the timetable motion on the latest withdrawal agreement bill (WAB) and effectively ended all hopes of passing it by Boris Johnson’s “do or die” pledge of October 31st, the government’s policy became clear - to push for an election. While they currently have a healthy lead in the polls, it is worth remembering Boris’s predecessor Theresa May and how badly her decision to call the last election in 2017 to increase her majority backfired spectacularly. The Tories lost their majority and were forced into a coalition with the DUP to form a new government (an issue that exacerbated the Irish border problems from a parliamentary arithmetic standpoint and ultimately led to May’s demise).

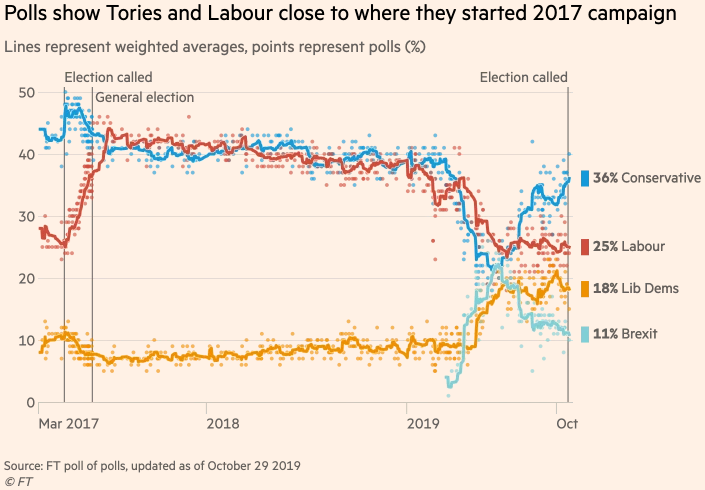

A poll of polls suggest a fairly healthy lead for the Conservatives but there are two key things to note here. Firstly, this is looking at the general popularity of each party and can vary quite widely due to actual seats won due to the UK’s first past the post system electoral system (for instance in 2017 the Conservatives won 49% of MPs with only 42% of the vote compared to Labour with 40% of the vote only getting 40% of MPs). Second, the Conservatives are polling around 10% lower than when Theresa May called the 2017 election and that proved to be a mistake as the party subsequently lost its majority. Therefore it is far from given that they will win seats this time out. Source: FT poll of polls

Questions over turnout

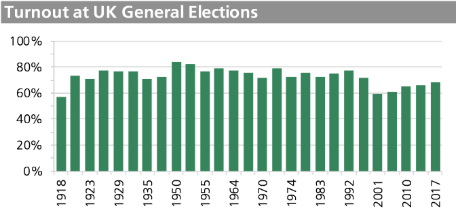

Turnout has increased in each of the past 4 elections to 68.7% in 2017. The EU referendum in 2016 (not shown) had a turnout of 72% - the highest in a public vote in 25 years since the 1992 election. Source: Parliament.UK

Turnout has increased in each of the past 4 elections to 68.7% in 2017. The EU referendum in 2016 (not shown) had a turnout of 72% - the highest in a public vote in 25 years since the 1992 election. Source: Parliament.UK

While we’ve seen some typically childish political bickering over the specific date of the election of late (Jeremy Corbyn’s claim that the 9th would be better than the 12th due to the extra 5 minutes of daylight marking a particular low point), the time of year is a valid consideration as far as turnout is concerned. This will be the first December election since 1923 and due to it being winter could suppress turnout amongst the elderly (seen as bad news for Conservatives and Brexiteers) while the Lib Dems have stated their feelings that it could also impact votes amongst students who are heading home at the end of term (seen as bad news for Remain given this demographic is the most anti-brexit). It is also worth noting that elections have typically been held in May or June, a time of year when people are expected to be feeling more positive and upbeat heading into the middle of the summer.

Technical overview

GBPUSD

GBPUSD has broken out of the downtrend that was in place since April 2018 in recent weeks. Possible support around 1.2750 and potential resistance seen around 1.3320. Source: xStation

UK100

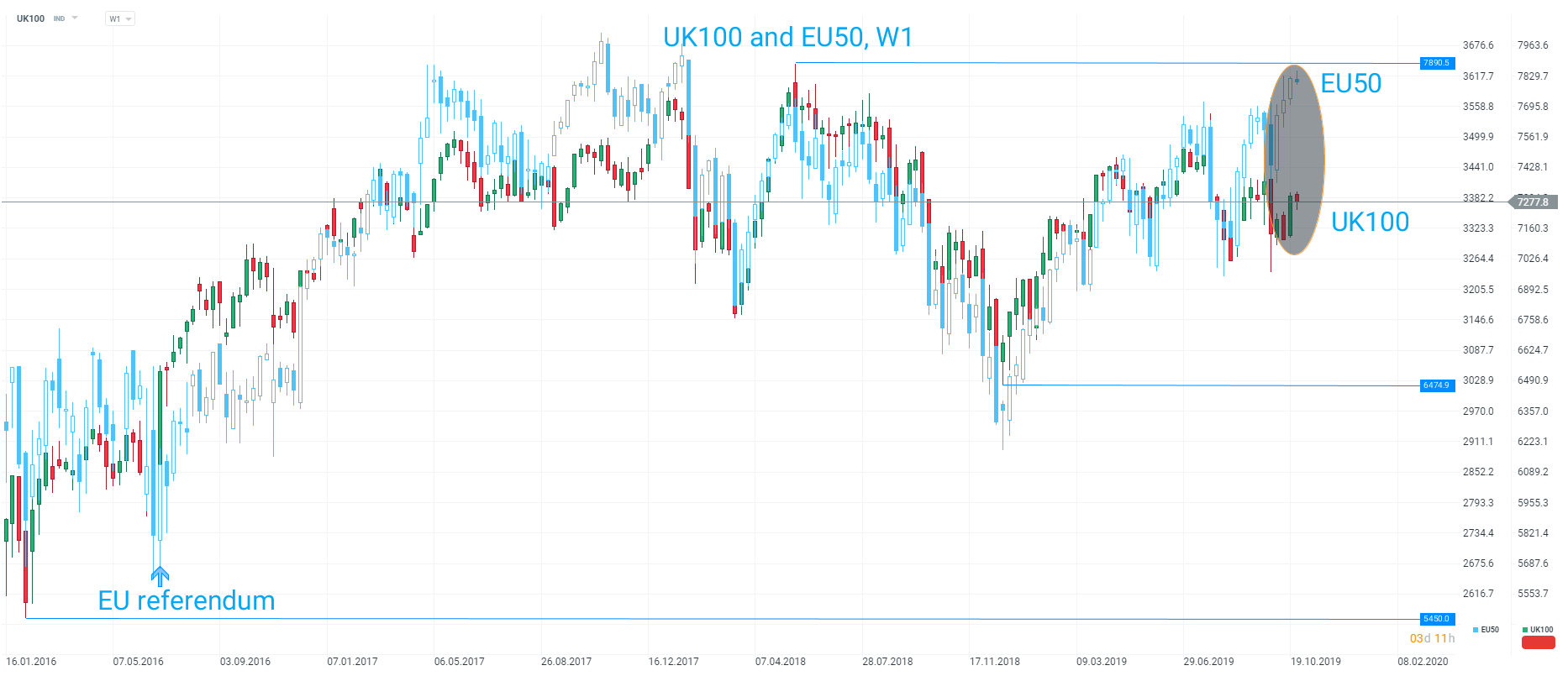

The UK100 remains quite some way above the level it trading on the 2016 EU referendum but the market has been lagging behind its peers in recent weeks - in part due to the recent GBP appreciation. Source: xStation

The UK100 remains quite some way above the level it trading on the 2016 EU referendum but the market has been lagging behind its peers in recent weeks - in part due to the recent GBP appreciation. Source: xStation

BREAKING: US jobless claims below expectations!🚨

Chart of the day: USDJPY (24.12.2025)

Morning Wrap (24.12.2025)

Daily Summary: Holiday Commodity Fever