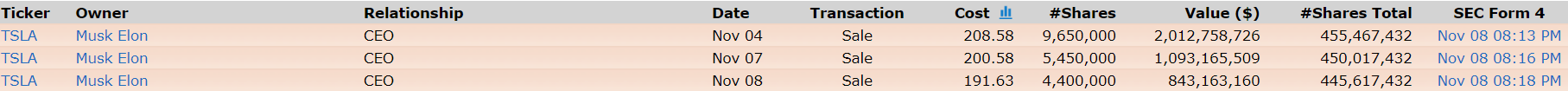

Tesla shares gain 3,3% after market open, thanks to a lower-than-expected US inflation reading. SEC documents on November 8 indicated that Elon Musk disposed of nearly $3.95 billion worth of shares. The company's shares have lost nearly 49% since the beginning of the year: In a filing with the SEC on Tuesday, Musk reported selling 19,500,000 shares in three days in November. Source; Finviz, SEC

In a filing with the SEC on Tuesday, Musk reported selling 19,500,000 shares in three days in November. Source; Finviz, SEC

- The sale came just days after Musk closed a $44 billion deal to buy Twitter. It is still unclear how much of the capital used to buy Twittter came from Musk's personal wealth. What is known is that $13 billion was raised in debt financing. Musk this year also sold shares on April 28 (valued at about $8.35 billion) and August 9 (valued at about $6.8 billion) as reported - in case he lost a lawsuit with Twitter. Musk also stressed that he would not sell any more Tesla shares. However, the latest transaction shows that the opposite has happened;

- Sentiment around Tesla has been dampened by the slowdown in China, which according to Musk is 'in the middle phase,' slowing demand in the U.S., concerns about the global health of the economy, and growing competition in the EV market from the Volkswagen Group and Ford. According to the Bloomberg Billionaires Index, Musk's wealth stands at $179 billion, having melted nearly 40% from historic highs. The lower-than-expected CPI reading gave Wall Street hope for an improved macro outlook. At the same time, the drop in inflation points to decelerating price pressures due to weakening demand in the economy, which de facto could herald a weakening of Tesla's next quarterly results.

Tesla stock(TSLA.US), D1 interval. The RSI Relative Strength Index is now still near historic lows at 30 points, which could herald at least short-term rebound. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street