Summary:

-

ADP and ISM both come in well above forecast

-

ISM non-manufacturing at highest level since 1997

-

US30 rallies to new record high

There’s been two strong data points from the US this afternoon with the latest readings on both the labour market and the services sector delivering pleasing beats. First off the ADP employment change rose to 230k from 168k previously, comfortably higher than the 185k expected. The data which relates to last month is the highest since the April release and the previous reading was revised higher by 5k from 163k beforehand for good measure. This will no doubt have raised the bar somewhat for Friday's more widely viewed NFP report which is expected to see 185k jobs added - note these forecasts were made before today’s print.

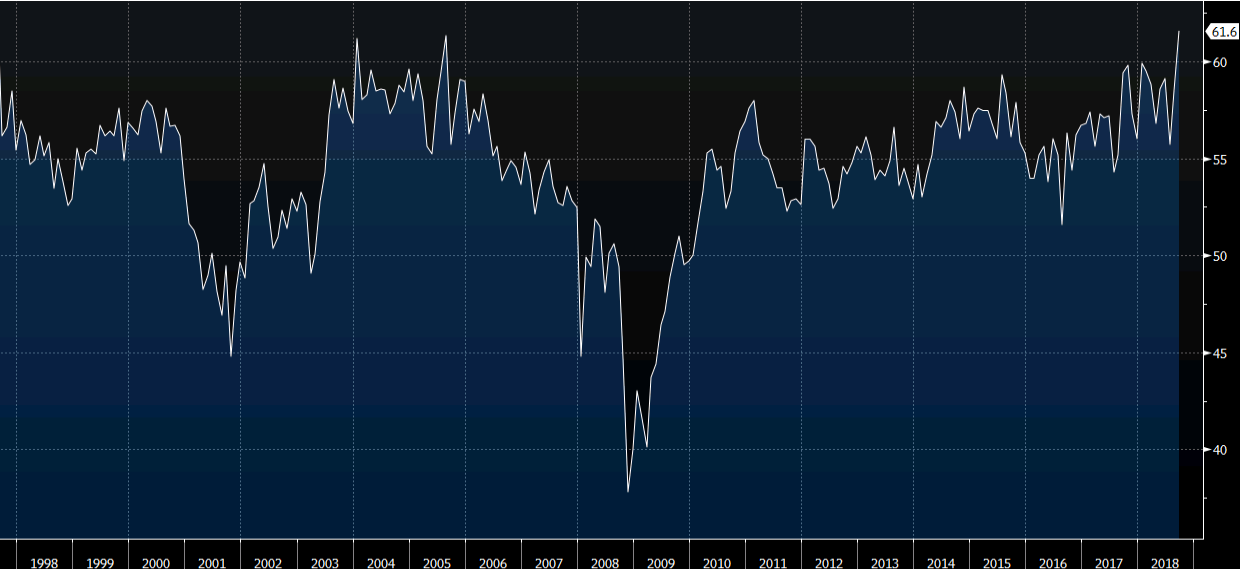

Just under 2 hours after the ADP release there was more positive news for the US as the ISM non-manufacturing PMI rose to its highest level since 1997. The print of 61.6 for the headline was above the 58.0 expected and 58.5 previously. In addition there was strong readings seen for several of the components with prices paid (64.2 vs 62.8 prior), new orders (61.6 vs 60.4 prior) and employment 62.4 vs 56.7 prior) all rising.

The ISM non-manufacturing figure surged higher for September and you have to go back more than 20 years to find a higher reading. Source: Bloomberg

The Wall Street open which occurred in between these two data points saw some choppy trade but not long after the ISM release all US indices made new highs for the day. The US30 is the strongest and has pushed up to notch another record peak. This market was the only one of the US indices not to close the gap higher seen over the weekend and is clearly leading the charge higher. The new intrad-day peak is presently at 26961 and at the moment the bulls are clearly in control of the tape and enjoying this latest run up.

The US30 is on track for a 3rd consecutive good day of gains with the market rallying up to post a new all-time high of 29961. Source: xStation

The US30 is on track for a 3rd consecutive good day of gains with the market rallying up to post a new all-time high of 29961. Source: xStation