Global stock markets pulled back in the afternoon erasing early gains amid more hawkish remarks from Powell and potential further sanctions against Russia. During the second day of his testimony, FED chair Powell confirmed that is willing to do all he can to bring down inflation. He also mentioned that it will be appropriate to continue raising interest rates throughout the year and if inflation does not fall, he is willing to increase by more than 25bps in a meeting or meetings. Meanwhile Bloomberg reported that President Biden is poised to impose sanctions on a number of Russian oligarchs and their families today. New measures would be broader than those implemented by the EU. Washington allegedly plans to prohibit oligarchs travel to the US and will target their families.

Earlier Putin told French Pres. Macron that the goals of Russia's operation in Ukraine - it's demilitarization and neutral status - will be achieved in any case. This is not very optimistic news, considering that talks between Russian and Ukrainian officials to secure a ceasefire have started on the Belarus-Poland border.

Earlier markets moved higher amid a report of a deal with Iran that could allow it to export more oil. However later in the session WSJ reported that there is no definitive end to the Iran talks. No deal has been reached but negotiations did not collapse either.

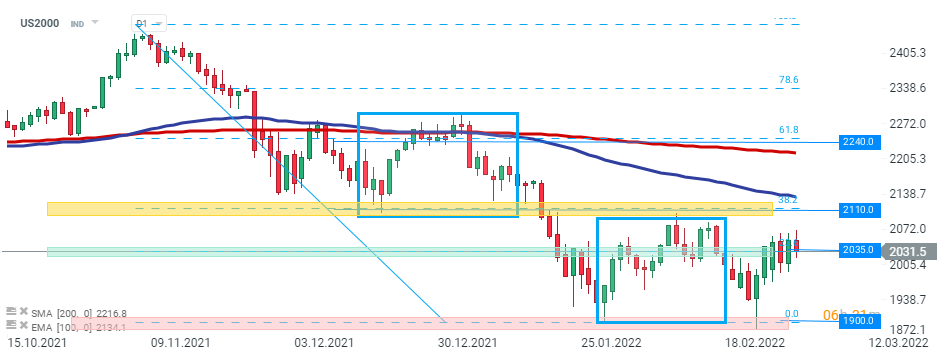

US2000 again returned to the local support at 2035 pts which coincides with 23.6% Fibonacci retracement of the last downward correction. If sellers manage to maintain control, support at 1900 pts may be at risk. Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales