Shipping stocks, such as Israel ZIM Integrated Shipping (ZIM.US), German Hapag-Lloyd (HLAG.DE) and Danish AP Moeller-Maersk (MAERSKA.DK) are falling today by 17%, 6% and 5% respectively as Wall Street reacted to digested ceasefire talks in Gaza and potentially disrupting impact of Hurricane Beryl in the Gulf of Mexico. ZIM is losing today the most due to the highest operational leverage and transatlantic spot freight costs exposure.

- Egypt and Quatar help US to mediate between Gaza and Israel, to end the 9-month conflict. If it succeeds, a peace can put the pressure on freight rates due to falling number of Houthi attacks in the Red Sea.

- Maersk drops today despite that the company raised the 2024 profitability outlook citing strong demand and Red Sea crisis twice this year, citing "continued strong container market demand" and disruptions caused by an ongoing crisis in the crucial Red Sea region.

- According to Maersk commentaries, still strong demand and geopolitic could pressure freight rates higher in the second half of the year. Also, ZIM Board expected rising freight rates to continue in H2 2024. However, in the successful Gaza ceasefire scenario, lower tensions may lead to pull back in freight rates.

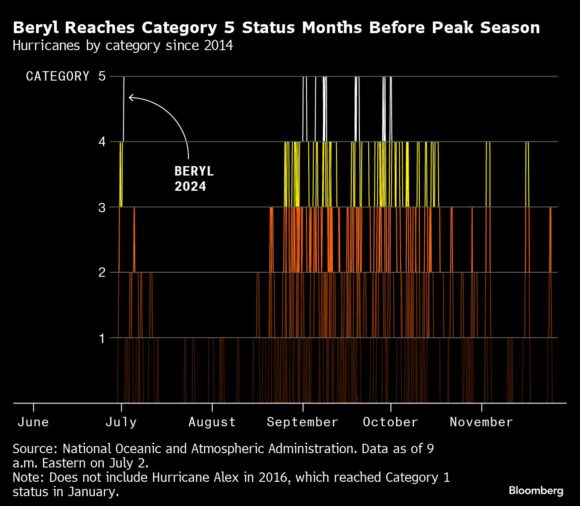

Also, Hurricane Beryl (Category 5) made landfall in Texas today, with a number of ports in the region closing in preparation. Some companies may see operational pressure because of that. Source: NOAA, Bloomberg Finance L.P

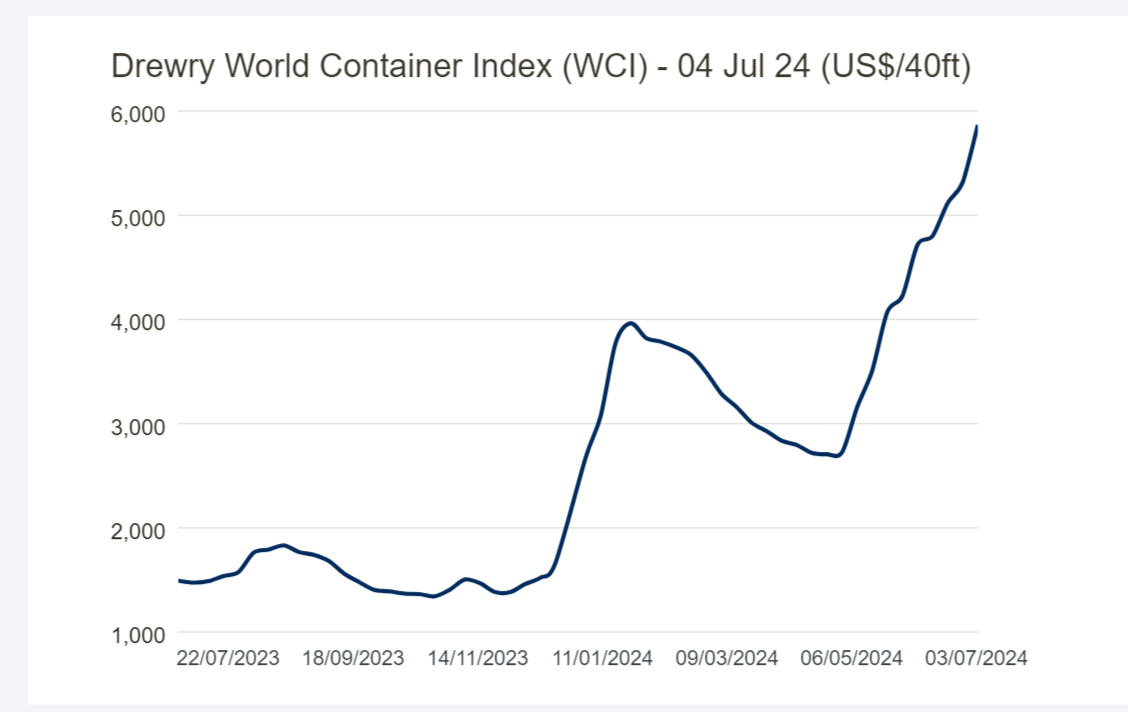

Freight rates for 40ft container are soaring and almost doubled since May 2024. Source: Drewry

Freight rates for 40ft container are soaring and almost doubled since May 2024. Source: Drewry

ZIM (ZIM.US, D1 interval)

Shares of ZIM are testing SMA50 today, with double-top technical pattern. If SMA50 support fails, the first important zone is $17 per share and $13 where we can see 61.8 Fibonacci retracement of the rising wave since the fall of 2023.

Source: xStation5

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street