Rising yields are the main theme in the markets today. Sell-off on the bond market that has been observed throughout September has pushed 10-year US yields above 4.50% mark, the highest level since 2007. German yields moved 7 basis points higher today above the 2.80% mark - the highest level since 2011. A pick-up in bond yields is providing support for USD and triggering risk-off moves in the markets. While Wall Street indices recovered from earlier losses, precious metals are still down on the day. Gold is trading 0.4% lower while platinum drops 1.5% and silver plunges 1.9%.

GOLD

Gold has been struggling to find direction for some time. Taking a look at H4 interval, we can see that the precious metal is moving sideways in a triangle pattern. A key resistance zone to watch can be found in the $1,948 area, while key support can be found near $1,903 per ounce. A local support can be found in the $1,916 area and this is also where today's declines were halted.

Source: xStation5

Source: xStation5

PLATINUM

Platinum is trading in a downtrend. However, taking a look at D1 interval we can see that the bearish momentum has eased recently. Currently, a short-term resistance to watch can be found in the $949 area while short-term support can be found near recent lows at $880.

Source: xStation5

Source: xStation5

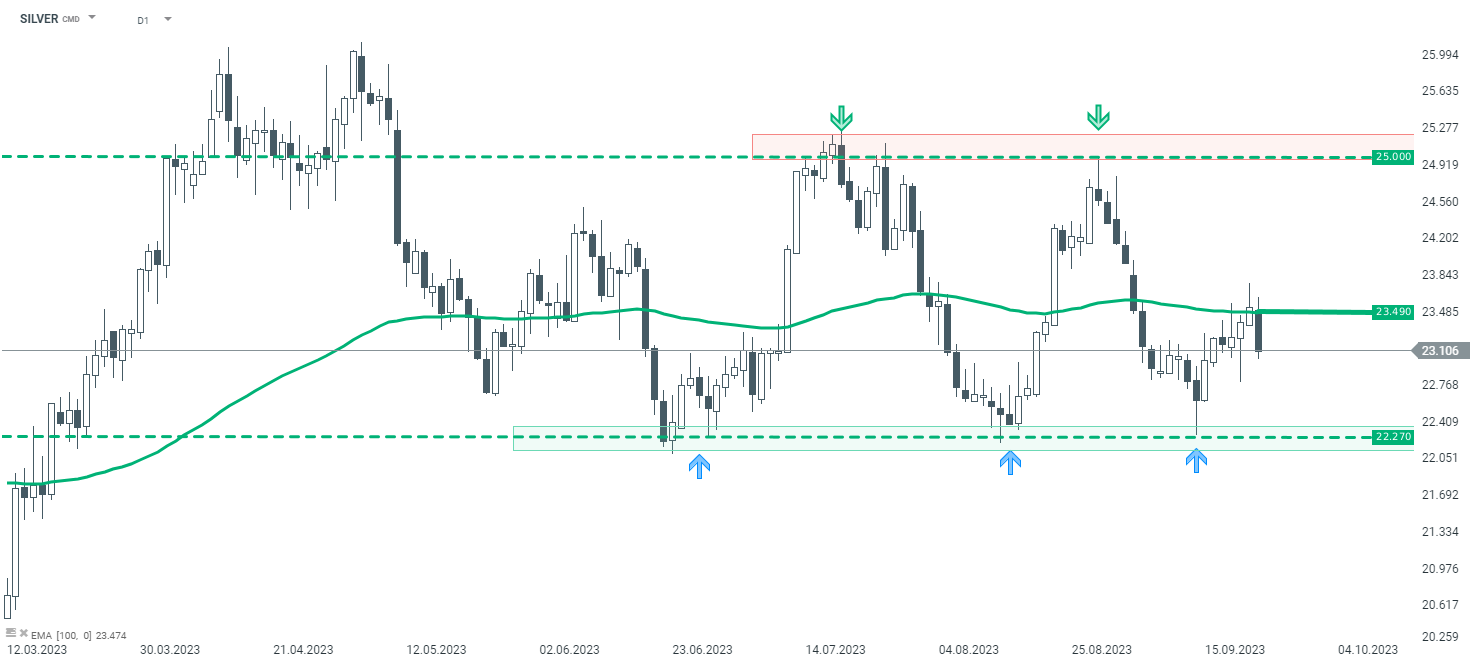

SILVER

Silver has been trading sideways for some time between $25 resistance zone and $22.27 support. Unless we see a break out of this trading range, continuation of the sideways move is the base case scenario. It should be noted that price has recently bounced off the 100-session exponential moving average and a test of the aforementioned support at $22.27 cannot be ruled out.

Source: xStation5

Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)