Shares of Pioneer Natural Resources (PXD.US), the third largest oil producer in the key US Permian Basin region, are trading over 10% higher in premarket today. Trigger for such a big jump were reports from Bloomberg News and Wall Street Journal, which hinted that ExxonMobil (XOM.US), one of US oil supermajors, is closing in on an agreement to acquire Pioneer Natural Resources. Reports hint that a deal could value Pioneer as high as $60 billion, representing an around 20% above yesterday's closing price. If reports are true it would likely be the largest takeover announced this year.

ExxonMobile and Pioneer Natural Resources are the biggest acreage holders in the Permian Basin and a tie-up of the two would create an oil company with an output of around 1.2 million barrels per day! Analysts note that production in the Permian Basin is highly fragmented and consolidation would benefit from economies of scale, suggesting that there is a strong rationale behind the deal.

Financial details behind the deal were not disclosed. However, even though the value of the deal is massive, ExxonMobil should not have much of an issue with pulling it off given that it had a cash pile of almost $30 billion at the end of Q3 2023, thanks to high energy prices that sent its net profit to $59 billion last year.

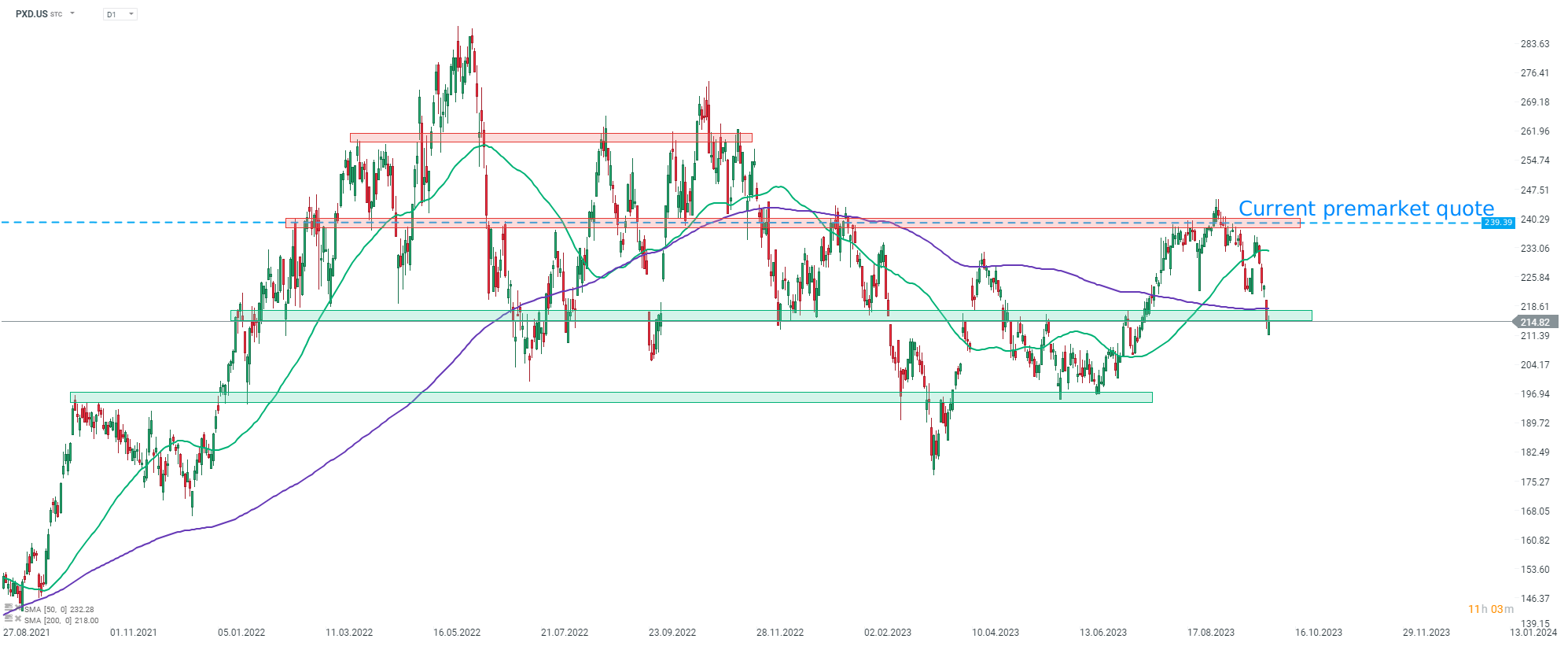

Pioneer Natural Resources (PXD.US) is trading over 11% higher in premarket on ExxonMobil takeover rumors. ExxonMobil (XOM.US) is down almost 2%. Source: xStation5

Pioneer Natural Resources (PXD.US) is trading over 11% higher in premarket on ExxonMobil takeover rumors. ExxonMobil (XOM.US) is down almost 2%. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡