Pinterest (PINS.US) stock trades over 8.0% higher on Friday after the image-sharing platform beat quarterly revenue estimates and its monthly user numbers also topped expectations.

-

Company earned $ 0.11 per share, topping market expectations of 6 cents per share. However, the figure came in lower than the prior-year quarter's adjusted earnings of $ 0.28 per share.

-

Revenue jumped 8% YoY to $ 684.55 million and analysts’ projections of 666.7 million. However today's figure was considerably lower than the 43% growth rate it reported the prior year in the same quarter.

-

Global MAUs increased slightly to 445 million from 433 million recorded in the second quarter. However, global average revenue per user (ARPU) soared 11% to $ 1.56. Pinterest's latest earnings report has defied the trend of online advertising companies posting results that haven't met analyst expectations.

-

"Despite the challenging macro environment, we are delivering performance and a distinct value proposition to advertisers, reaching users across the full funnel," Pinterest's new Chief Executive Bill Ready said in a statement.

-

Pinterest expects that Q4 revenue will "grow mid-single digits on a year-over-year percentage basis." Analysts on average expected adjusted earnings of 6 cents a share on sales of $667 million, according to FactSet.

-

Operating expenses are expected to grow around 35% YoY for 2022.

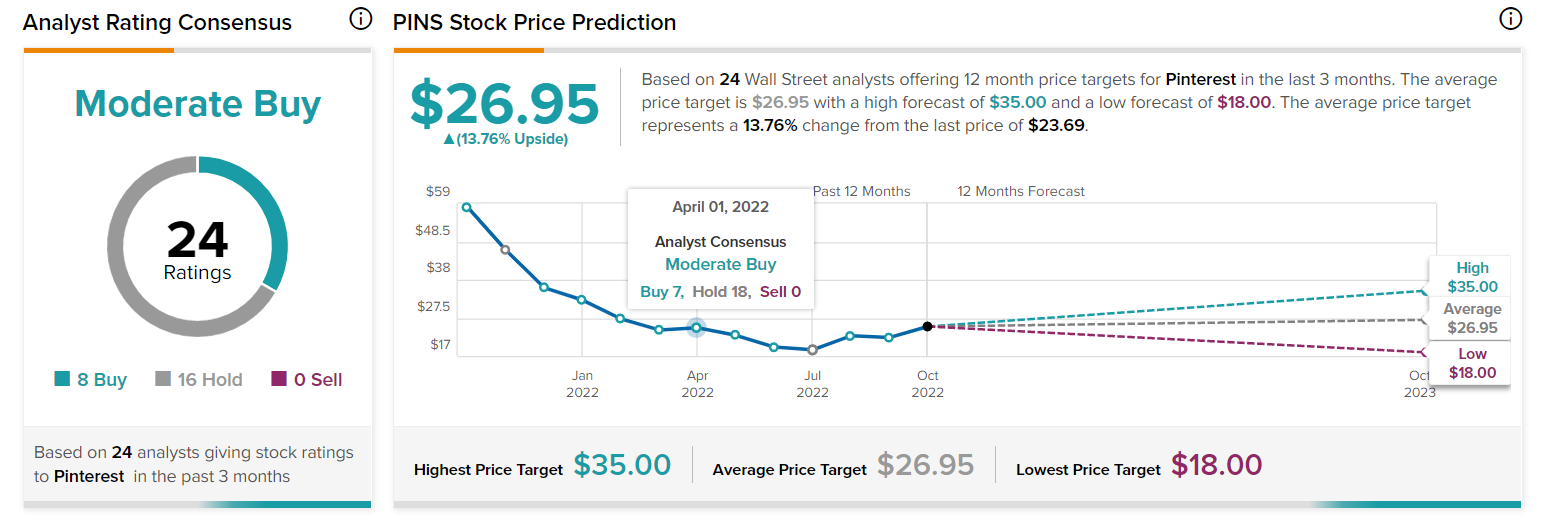

Pinterest has a Moderate Buy consensus rating based on eight Buys and 11 Holds. The average price target of $26.94 implies 16.0% upside potential to current levels. Source: tipranks.com

Pinterest has a Moderate Buy consensus rating based on eight Buys and 11 Holds. The average price target of $26.94 implies 16.0% upside potential to current levels. Source: tipranks.com

Pinterest (PINS.US) stock fell nearly 40.0% so far this year. In recent weeks the price has been moving sideways. Perhaps fresh earnings will be a catalyst for a bigger move. Nearest resistance to watch is located around $27.10 and coincides with 78.6% Fibonacci retracement of the upward wave started at the beginning of the pandemic. Nearest support can be found at $16.00 where lows from July are located. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?