Oil trades almost 1% higher, extending rebound into the second trading session. This comes after Brent (OIL) plunged to the lowest level in almost three weeks yesterday in the morning. However, yesterday's declines were recovered later during the day, with oil benchmarks finishing trading higher. There are two main stories to watch for the oil traders right now - Middle East and Fed policy.

When it comes to the Middle East, the situation remains tense, with the US launching retaliatory airstrikes against Iran-backed militants in Iraq and Syria over the week. The strikes were a retaliation for the drone attack that killed 3 US servicemen at a military outpost in Jordan last week. While the risk of a direct US-Iran conflict, which would cause turmoil on oil markets, is still slim, it is a risk that needs to be taken into account.

Meanwhile, Federal Reserve is expected to begin rate cut cycle later this year. While this would be positive for oil prices due to a likely USD weakening, Fed members (including Fed Chair Powell) have been playing down the possibility of rate cuts beginning as soon as at the March meeting. This, in turn, provided a lift for US dollar, which is keeping commodity prices in check.

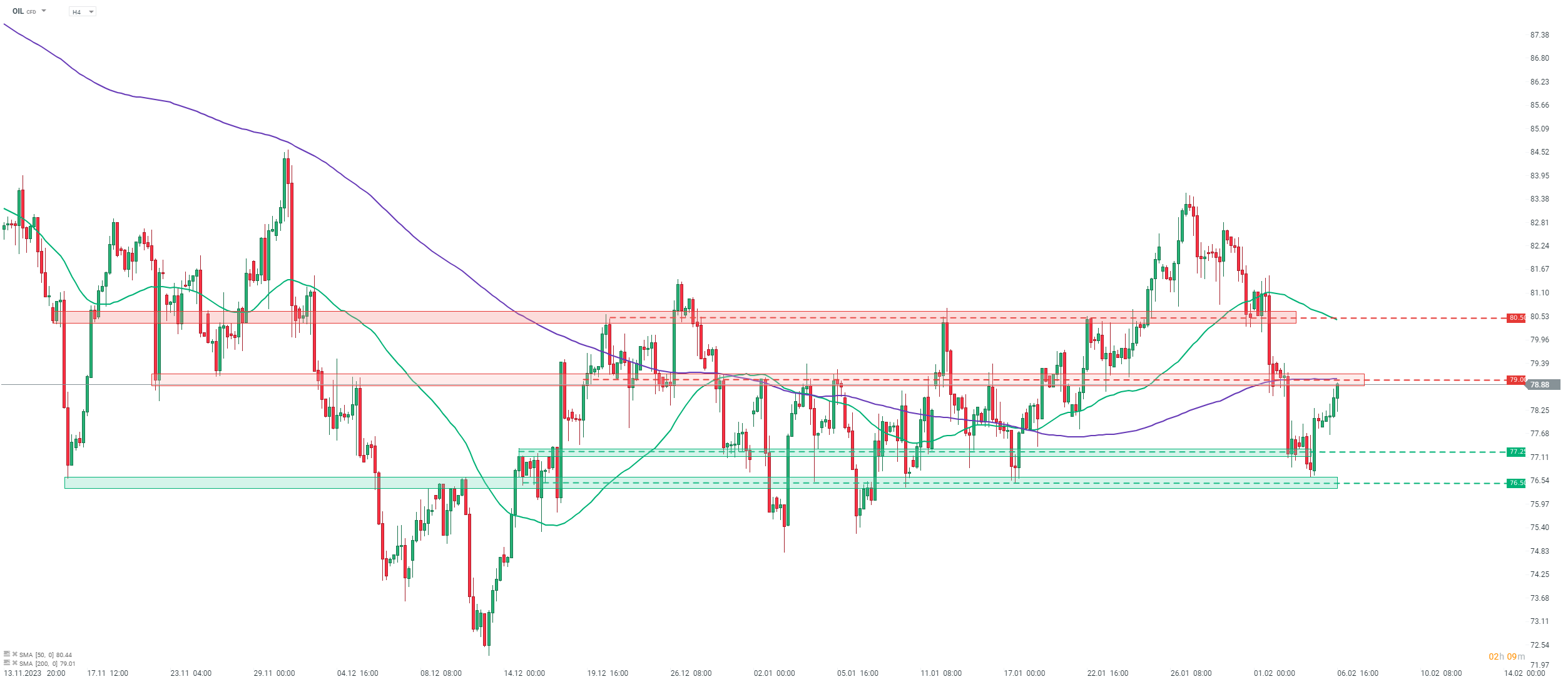

Taking a look at Brent (OIL) at H4 interval, we can see that the price bounced off the $76.50 support zone at the beginning of this week and started to erase recent gains. The $79 resistance zone, marked with previous price reactions and 200-period moving average (purple line) is being tested at press time. A break above this area would pave the way towards the $80.50 resistance zone, marked with 50-period moving average (green line). Note that oil prices have been more or less confined to a $5-wide range since the beginning of this year, and such a situation may continue unless a strong catalyst emerges.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?