Oil is taking a hit today following yesterday's OPEC+ decision. While decision to extend the main 3.66 million barrel production cut through 2025 was expected, decision on voluntarily output cuts turned out to be a surprise. It was expected that those cuts will be extended until the end of 2024, but instead OPEC+ decided to extend them only through September 2024. Moreover, production is expected to start gradually rising afterwards.

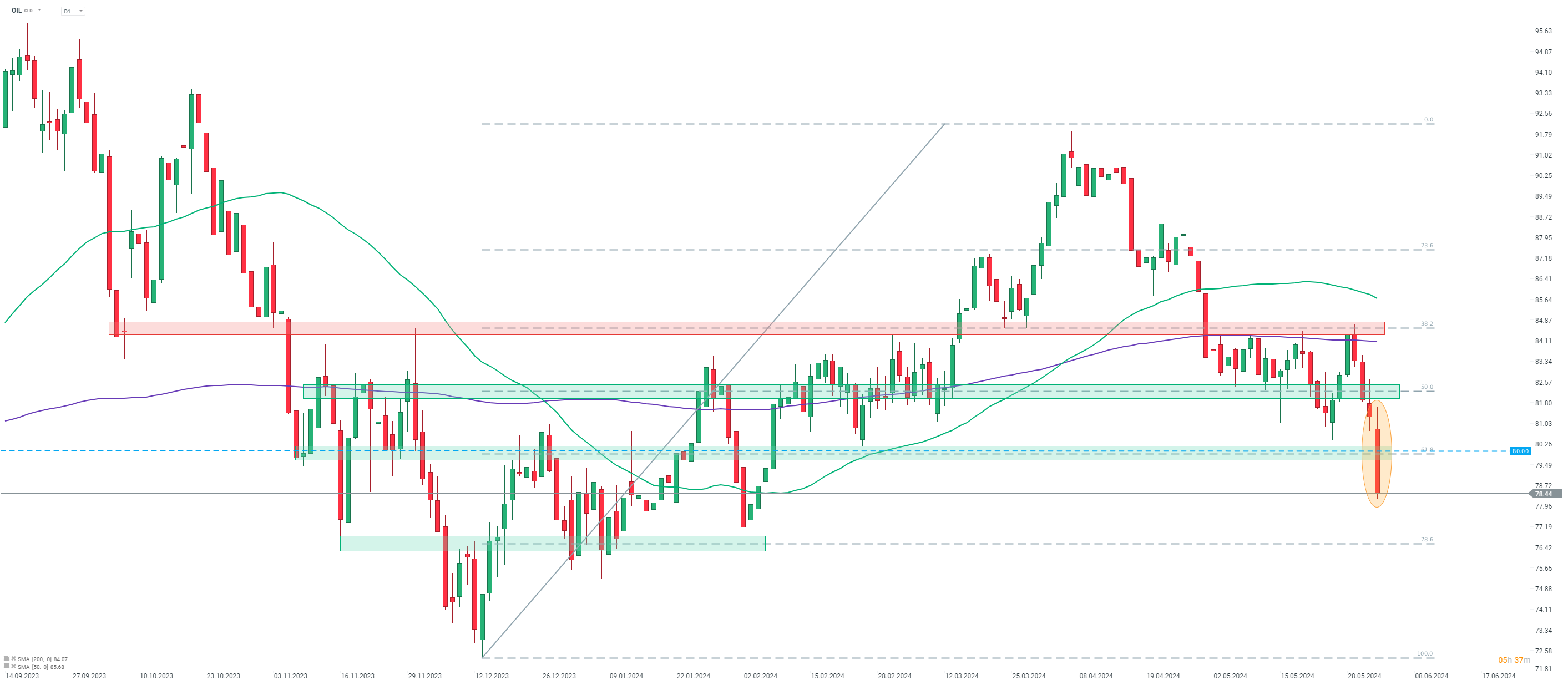

This is weighting on oil prices today with Brent (OIL) and WTI (OIL.WTI) dropping over 3% each. Taking a look at Brent chart at D1 interval, we can see that this grade of oil dropped below $80 per barrel mark for the first time since early-February 2024 and is trading near 4-month lows. The next major support zone to watch can be found in the $76.50 per barrel area and is marked with previous price reactions and 78.6% retracement of the upward move launched in mid-December 2024.

Source: xStation5

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

NATGAS muted amid EIA inventories change report