Summary:

-

NZDUSD falls to lowest level in almost 2 months

-

Widespread USD strength to start the year but PMI drops

-

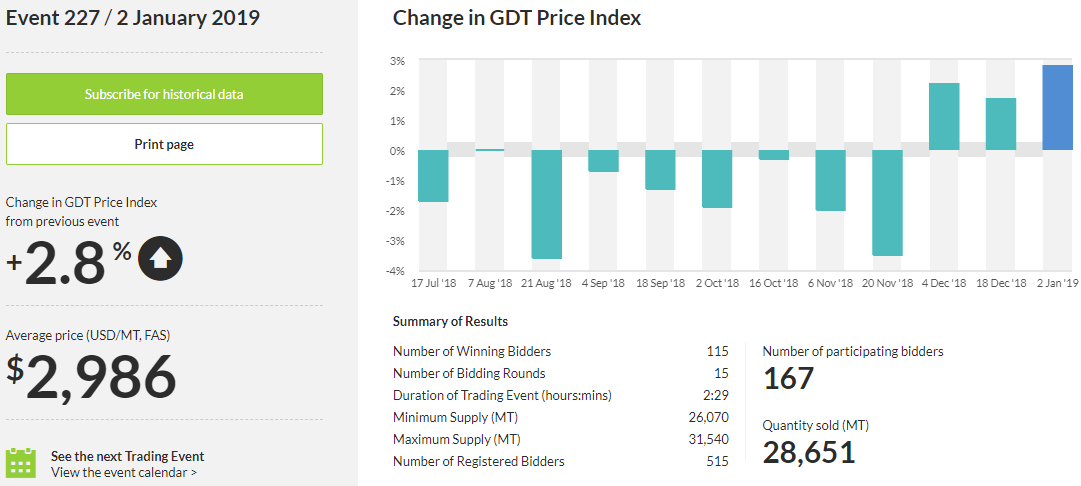

GDT index rises by 2.8%

There’s been a potentially significant push lower in the NZDUSD today, with the pair falling down to trade at levels not seen since the start of November. The cross first declined overnight after the soft Chinese manufacturing data with the Caixin PMI for December falling below 50 to indicate a contraction for the first time since May 2017. These declines were bought however and the market was actually fractionally higher around the time of the European open but since the some broad strength in the greenback has seen price fall firmly lower. There has been a little bounce this afternoon following a soft reading in the latest look at the US manufacturing sector and some positive data for the Kiwi.

NZDUSD has bounced off its lows this afternoon after some supportive data but the move has already faded and a daily close around these levels, or even lower, could be seen as a clear negative for the market. Source: xStation

Looking at the recent data releases in more detail the US markit manufacturing PMI for December came in at 53.8 vs a consensus forecast of 53.9. While this is only a small miss on the expected, it represents a sizable drop on the 55.3 seen for the previous month and is the lowest since September 2017. Furthermore employment fell to 52.7 from 55.3 - the lowest since June 2017 - and new orders dropped to 54.3 from 56.7 - the lowest since September 2017. Just a few minutes after, the global dairy trade index was announced to have risen by 2.8% in the latest fortnightly auction, the biggest increase in quite some time. This increase also makes it 3 consecutive gains and indicates that after a prolonged slump the worldwide price of milk is recovering. As a large exporter of milk, the New Zealand dollar is sensitive to price fluctuations and a recovery could be seen as supportive of the currency.

For the 3rd consecutive release, the GDT price index rose, with the gain of 2.8% the biggest in quite some time. Source: globaldairytrade.info

In falling lower today, the NZDUSD has also breached the lower bound of the Ichimoku cloud on D1. While the supporting lines remain above the cloud, with price below it there is some suggestion that the longer term trend may be turning lower and if that is the cae then a retest of the 2018 bottom around 0.6425 could lie ahead. 0.6695 had previously acted as support and could now be seen as the first level of resistance to any rallies. Note, the daily candle is yet to close and if it does end below 0.6695 then it would further confirm this possible break lower.

NZDUSD has moved below the D1 cloud and could seen to be moving into a downtrend. 0.6695 is a key line in the sand in the short term and if price remains below there on a daily closing basis then further declines may well lie ahead. Source: xStation

NZDUSD has moved below the D1 cloud and could seen to be moving into a downtrend. 0.6695 is a key line in the sand in the short term and if price remains below there on a daily closing basis then further declines may well lie ahead. Source: xStation