Novavax (NVAX.US) reported higher-than-expected revenue for the third quarter, primarily due to U.S. government grants for clinical trials. Despite a year-over-year decline in revenue, from $734.58 million to $187 million, the company is focusing on optimizing these grant opportunities. To address the smaller-than-anticipated COVID-19 vaccine market, Novavax has reduced its liabilities and is preparing to cut costs by an additional $300 million in 2024.

Management expects the U.S. market for COVID-19 vaccines to demand 30 to 50 million doses in the 2023-2024 season. They also highlighted that over 15 million people in the U.S. have received updated COVID-19 shots, which is lagging behind the previous year's vaccinations.

Novavax has secured broad access to its COVID-19 vaccine across U.S. pharmacies and has received authorization for its updated vaccine. The company has already made significant cost reductions, cutting operating expenses by 47% compared to the previous year, and is on track to exceed its global restructuring and cost reduction plan. Moving forward, Novavax is focused on initiating a cost reduction program targeting over $300 million in 2024, maintaining financial stability, and advancing its vaccine technology.

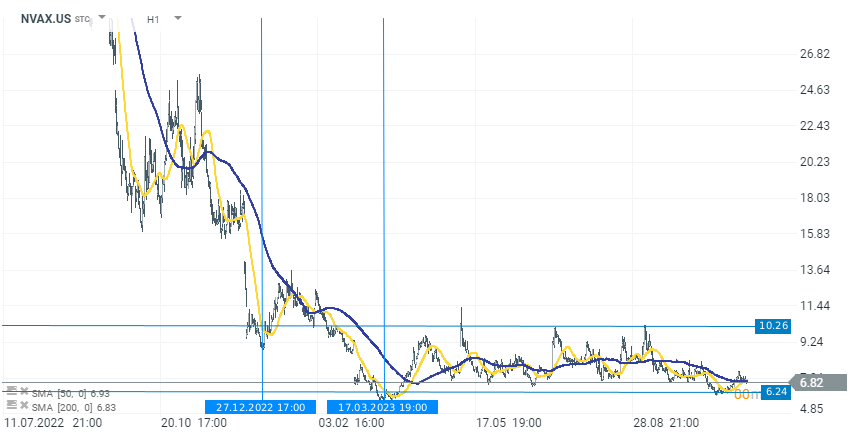

Looking at the chart technically, Novavax's (NVAX.US) price has been in a sideways channel since the beginning of this year fluctuating between $6.20 per share and $10.20 per share. Compared to 20221, the stock is trading lower by a glaring -98%. Today after the results, the stock is gaining 1.40% before the market open. Source xStation 5.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?