- High expectations ahead of the NFP report

- Traders should pay attention to wage data

- USD looks stretched heading to the report

The NFP report is always the highlight even when the dominating story is something else – like the coronavirus this time around. The US dollar has been surging since the beginning of the year and the NFP could a reality check on this trend. Traders should focus on those 3 things:

1. The headline number

After a weak report for December (+145k) the consensus officially sees a modest improvement (+165k) but actual expectations are much higher after a stellar ADP report (+291k). ADP is strongly correlated with NFP but on month to month basis it’s been less reliable lately than in the past and ISM employment indicators actually deteriorated in January. Still, a reading below 170-180k would be considered a disappointment.

2. Wage growth

2. Wage growth

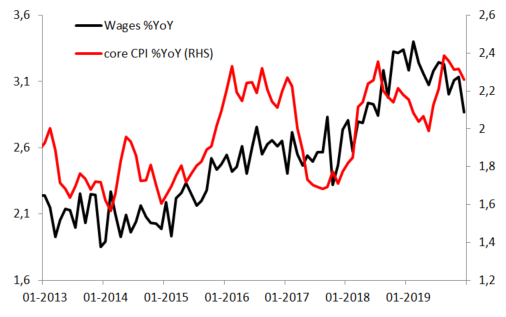

While employment gains continue push unemployment rate lower (currently 3.5%) wage growth stalled in 2019 and actually has been slowing down lately. Should wage growth accelerate towards 4% the Fed would be under pressure to raise rates again so the data is key for the dollar. Market consensus sees improvement to 3%.

3. USDCAD

There are 2 NFP reports today at 1:30pm GMT – in the US and Canada. After a strong report last month investors expect a modest increase in employment (15k). USDCAD has been rising lately on USD strength and declining oil price but the pair sees a strong resistance zone just above 1.33. If the zone is about to keep the pair in the long-term range traders need to see a weaker US report and/or stronger report from Canada.

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report