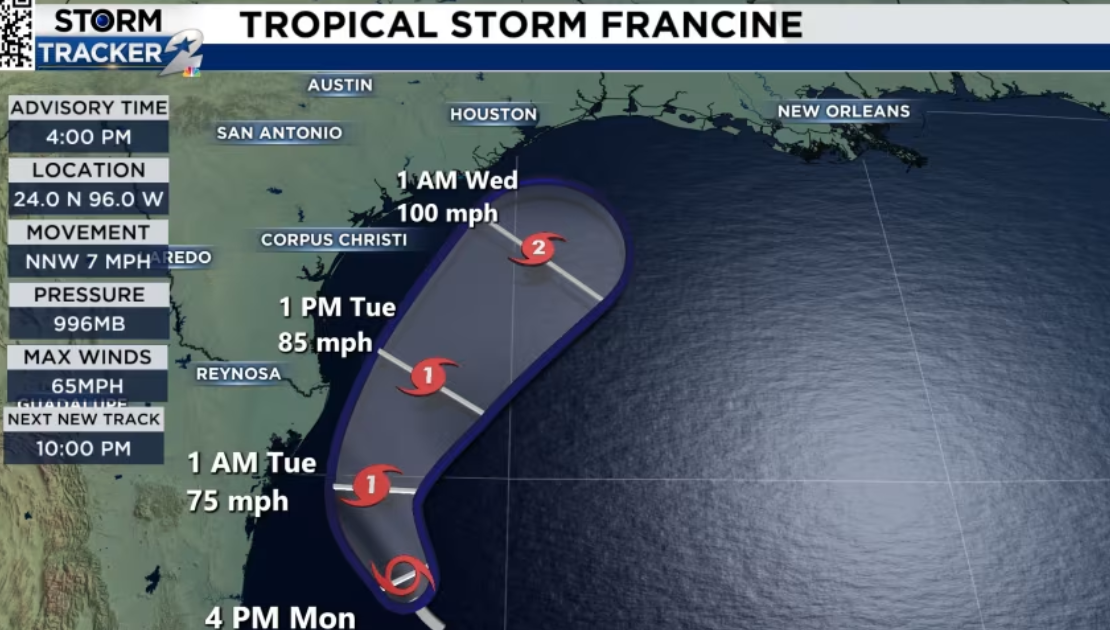

Henry Hub (NATGAS) natural gas futures have halted declines and are rebounding more than 4.5%, as traders prepare for the hurricane to hit the US East Coast. The U.S. National Hurricane Center indicates that the path for Hurricane Francine will pass through the key LNG-producing territories of Louisiana and Texas; the expected route has been revised more toward the east. Metereological agencies have raised the expected strength of the hurricane, in recent hours.

- Flows on Tuesday morning, at U.S. LNG terminals, fell by 12.6 billion cubic feet and appeared to be down 1.1% from the previous week. Francine, however, is yet to reach the US coast. The hurricane could last up to several days;

- As a result, the market is discounting the news today, as well as Francine's elevation to Category 2 hurricane; oil is losing in the face of expected lower demand at refineries, in the region and gas prices are rising on a wave of supply concerns at key LNG terminals Freeport, Cheniere, Calcasieu, Cameron and Plaquemines located in the region. According to Bloomberg sources, the latter two terminals have already seen sharply lower and zero gas flows, respectively

Source: KPRC, Click2Houston

Source: KPRC, Click2Houston

NATGAS (M15 interval)

A breakout above $2.15 per MMBtu could open a path for the bulls toward $2.30, but a potentially temporary and minor impact from Francine could initiate another 1:1 downward correction and lead to a test of the $2.12 area on NATGAS. Demand in Asia remains subdued, with Asian LNG futures, for November, trading at a discount to October (backwardation). Filling of European gas storage facilities is at a seasonal high, at 93% vs. 86% 5-year average.

Source: xStation5

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?