U.S. natural gas (NATGAS)-based futures are gaining nearly 3% today on higher temperature forecasts that could drive demand for electricity generated by burning gas to fuel air conditioning. Moreover, weak year-on-year production data and lower-than-expected inventories have undercut sentiment of an oversupplied market after an unusually mild winter that decimated demand.

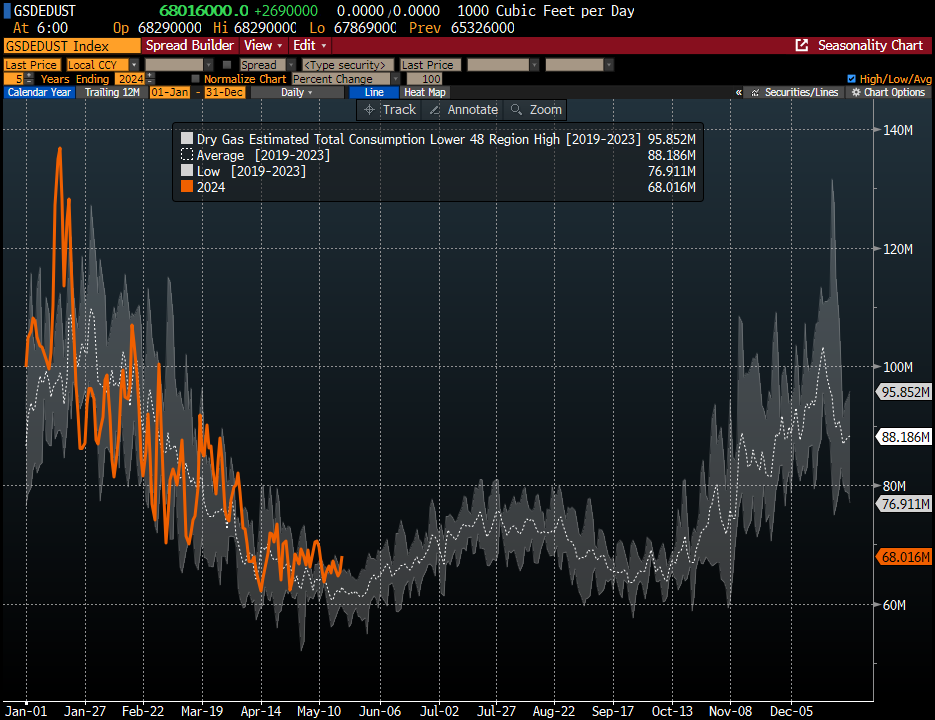

Demand for natural gas in the continental U.S. zone is now climbing above a five-year trading range showing the seasonality of demand for the commodity.

Demand for natural gas in the continental U.S. zone is now climbing above a five-year trading range showing the seasonality of demand for the commodity.

Source: Bloomberg Financial LP

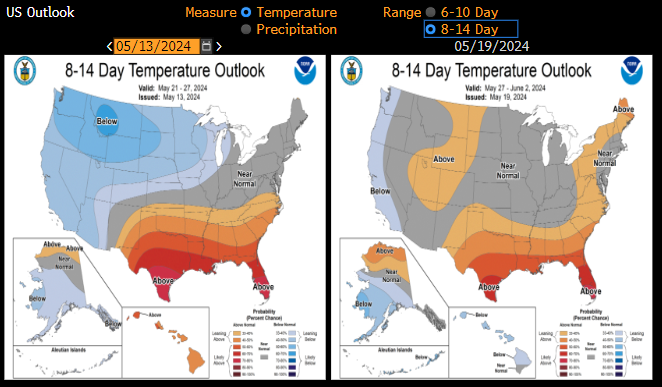

Early hot weather in Texas further bolstered upward movements in contracts. Source: Bloomberg Financial LP

NATGAS is trading at its highest levels since the beginning of the second half of January this year. The most important support point in the short term all the time may remain the 200-day EMA (gold curve on the chart). If the increases continue, the $3 zone could be an interesting test point for the buyers' side.

NATGAS is trading at its highest levels since the beginning of the second half of January this year. The most important support point in the short term all the time may remain the 200-day EMA (gold curve on the chart). If the increases continue, the $3 zone could be an interesting test point for the buyers' side.

Source: xStation

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

NATGAS muted amid EIA inventories change report