-

US indices ended yesterday's session relatively weak. The benchmark Nasdaq of technology companies gained just 0.06% on the day, while the S&P500 itself lost 0.28%. The Dow Jones was the worst performer on the day, losing 0.51%.

-

The mood of Asia-Pacific markets is mixed, with the Nikkei up 0.25%, the Kospi losing 0.2%, the Nifty 50 rising 0.08% and the S&P/ASX 200 gaining 0.57%. The Hang Seng performed relatively well, gaining 0.78%.

-

European index futures point to a higher opening of the session on the Old Continent.

-

Investor attention will focus today on PMI data readings and Nvidia results (after the US session).

-

Australia's Woodside Energy is in talks with unions over possible strikes. According to Bloomberg, talks are expected to continue into the evening and the outcome of these meetings alone could be key to gas market sentiment.

-

US debt securities fared slightly better during early trading in Asia, halting the rapid wave of declines seen last week.

-

PMI data from Australia surprised on the downside. The reading for manufacturing came in at 49.4 points compared to the last 49.6 points, while services fell from 47.9 points to 46.7 points. The Composite index falls at 47.1.

-

Japan's PMI index readings surprised slightly above analysts' expectations. Manufacturing data at 49.7 against the last reading of 49.6. Services at 54.3 against the last reading of 53.8. The Composite index rises to 52.6 against the last reading of 52.2.

-

New Zealand Q2 retail sales were -1.0% q/q (-2.6% expected).

-

The US Department of Commerce eases export restrictions on 27 Chinese entities, and US Secretary of Commerce Raimondo herself met with Chinese Ambassador Xie Feng. The talks were described as "productive". A meeting of the Secretary in China is scheduled for next week.

-

Two tankers (one with LNG, the other with petroleum products) collided in the Suez Canal

-

API data show smaller-than-expected drop in oil stocks

-

Oil is currently gaining around 0.3% and US gas prices are trading at yesterday's closing levels.

-

Precious metals are trading higher, with gold adding 0.3% and silver over 0.9%.

-

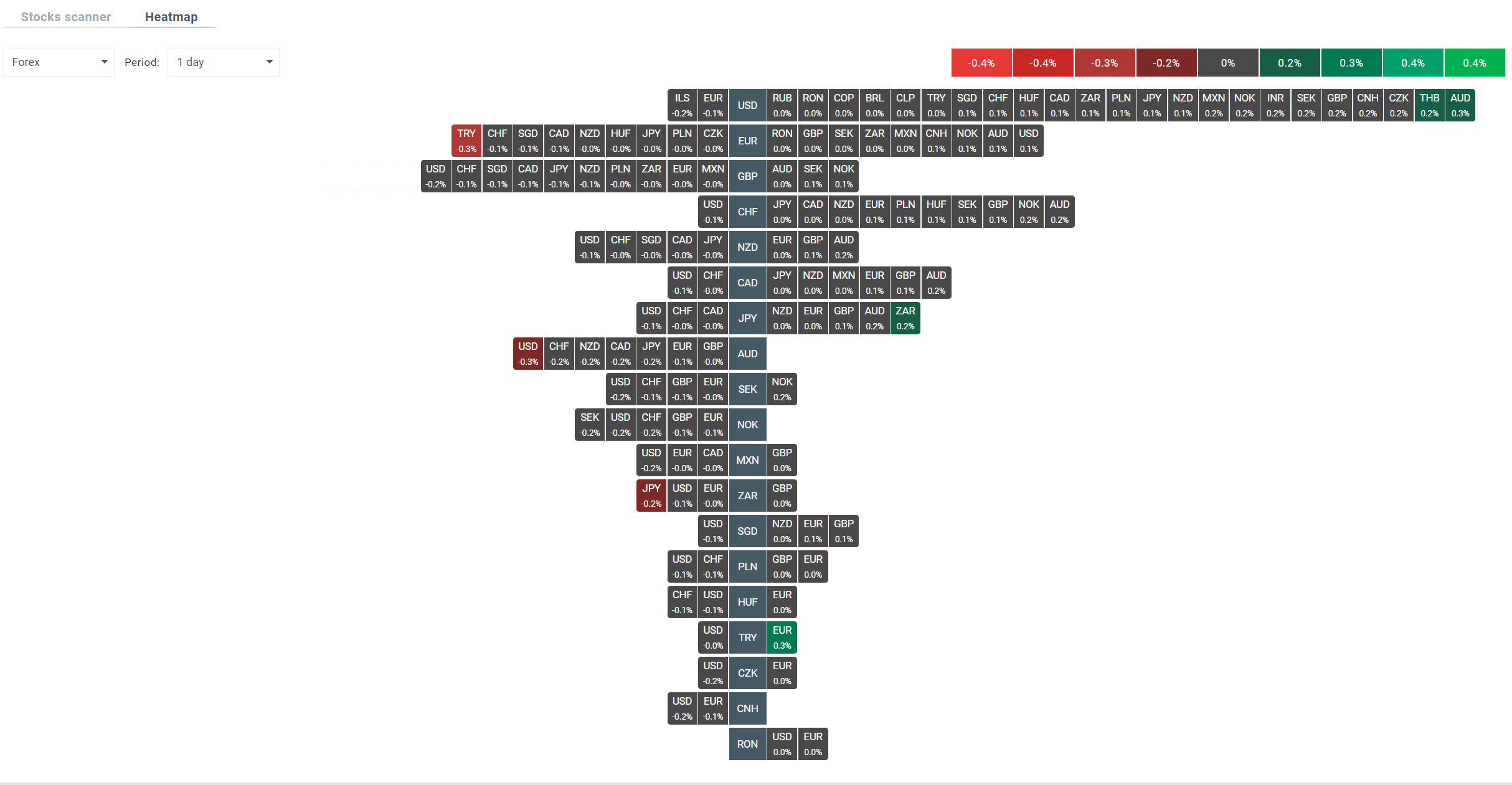

AUD and JPY are the strongest of the major currencies, with USD and CHF performing the weakest.

Current heatmap on FX market. Source: xStation 5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report