- Markets resume standard trading after the Easter break.

- US stock index futures are trading higher. The initial upward movement came before Tesla's announcement that it is offering five-year zero-interest financing for its refreshed Model Y in China. Interestingly, the company's results themselves will be released today after the close of the Wall Street session.

- However, we are seeing a slightly different mood in Europe, as the declines observed yesterday on Wall Street are taking hold here. Markets on the Old Continent are therefore trying to "catch up" on yesterday's performance. Recall that the Nasdaq lost 2.55% yesterday.

- Shares of Chinese companies associated with cross-border trade and payments rose after the government began to seek to combat US tariffs, planning to promote the operation of free trade zones.

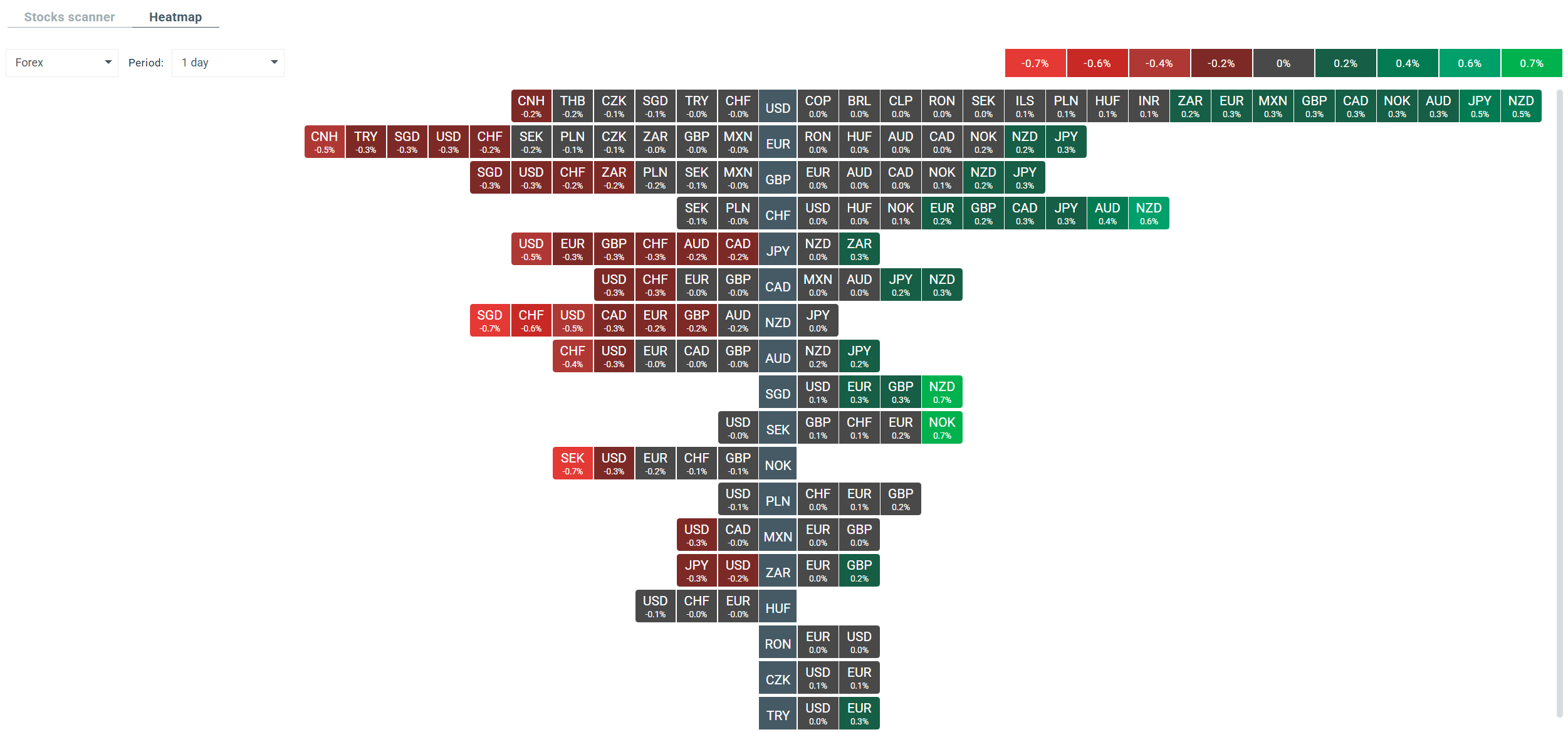

- On the broad FX market, the Japanese yen is currently the best performer, while the US dollar is proving to be the biggest loser. Antipodean currencies are doing relatively well, while the euro is also not doing so well.

- Gold continues its upward trend and is trading near $3,480 per ounce. Broad-market uncertainty supports this precious metal, which is gaining over 1.6% today alone.

- Bitcoin resumes its upward momentum and tests its 100-day exponential moving average. The cryptocurrency has increased by over 4% since yesterday.

- The most important events of the day will be Tesla's and SAP's quarterly results. Macro data from the Polish labor market, numerous speeches by FED and ECB bankers (including Lagarde) and the industrial price index from Canada.

Current volatility on the currency market. Source: xStation

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?