-

US indices managed to snap a losing streak and finish yesterday's session higher. S&P 500 gained 1.12%, Dow Jones moved 1.01% higher and Nasdaq rallied 2.03%. Russell 2000 jumped 1.92%

-

Stocks in Asia also traded higher. Nikkei gained 1.2%, S&P/ASX 200 added 0.6% and indices from China traded 0.5-1.5% higher. Kospi traded flat

-

DAX futures point to a higher opening of the European cash session today

-

According to a Politico report, White House administration is reportedly considering sending a top level official to Kyiv, Ukraine. Secretary of State Blinken or Defense Secretary Austin are likely options

-

US Treasury Secretary Yellen said that China will face consequences and its future appeals for sovereignty and territorial integrity may not be respected if it does not help stop Russian invasion of Ukraine

-

The Australian jobs report for March showed an employment gain of 17.9k (exp. +35k). Unemployment rate remained unchanged at 4.0% (exp. 3.9%)

-

Bank of Korea delivered an unexpected 25 basis point rate hike, bringing benchmark rate to 1.5%

-

New Zealand manufacturing PMI moved from 53.6 to 53.8 pts in March

-

Cryptocurrencies are trading mostly higher but BItcoin and Ethereum trade flat

-

Oil as well as other energy commodities pull back slightly on Thursday morning

-

NZD and JPY are the best performing major currencies while USD and AUD lag the most

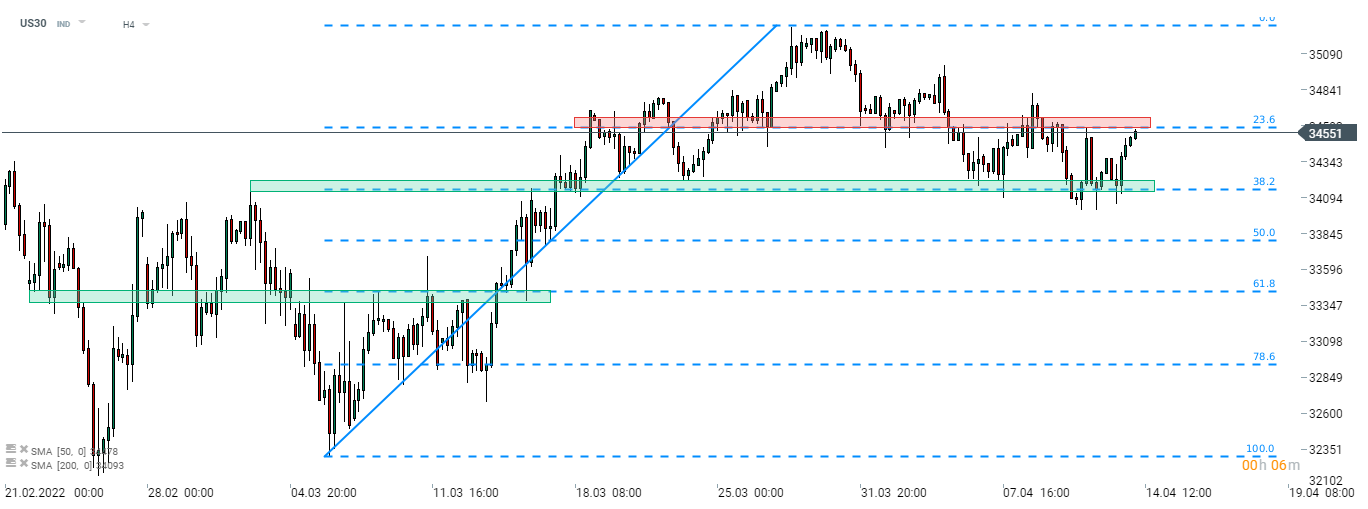

US indices managed to snap a losing streak. Dow Jones (US30) found support at 38.2% retracement of the upward move launched at the beginning of March and started to recover. The index is currently testing a resistance zone marked with 23.6% retracement in the 34,600 pts area. Source: xStation5

US indices managed to snap a losing streak. Dow Jones (US30) found support at 38.2% retracement of the upward move launched at the beginning of March and started to recover. The index is currently testing a resistance zone marked with 23.6% retracement in the 34,600 pts area. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report