-

US indices took a dive yesterday. S&P 500 dropped 1.69%, Dow Jones moved 1.19% lower and Nasdaq slumped 2.18%. Russell 2000 dropped 0.71%

-

Indices from Asia traded lower as well. Nikkei dropped 1.7%, S&P/ASX 200 moved 0.6% lower and Kospi declined 0.9%. Indices from China traded mixed

-

DAX futures point to a lower opening of the European cash session today

-

Reports surfaced claiming that Russia has used chemical weapons against Ukrainian soldiers and civilians in Mariupol. However, this claims were neither confirmed by Ukraine President Zelensky, nor by the Western military or intelligence

-

Shanghai authorities divided the city into smaller areas and classified each area into one of three categories. This was done to allow more targeted restrictions rather than a citywide lockdown

-

Chinese Premier Li Keqiang said that new measures will be studied and adopted to better support economy as concerns over economic outlook mount

-

US State Department ordered all non-essential government employees to leave Shanghai amid deteriorating Covid situation

-

Some media hint at possibility of lockdown being imposed in Guangzhou, a major manufacturing hub housing China's busiest airport

-

Cryptocurrencies trade higher on Tuesday. Bitcoin gains 1.5% and approaches $40,000 area. Ethereum gains 1.4% and tests $3,000 area

-

Oil is trading around 1% higher today. Brent approaches $100.50 while WTI trades near $96.30

-

Precious metals trade higher with platinum and palladium adding more than 1%

-

AUD and NZD are the best performing major currencies while CAD and JPY lag the most

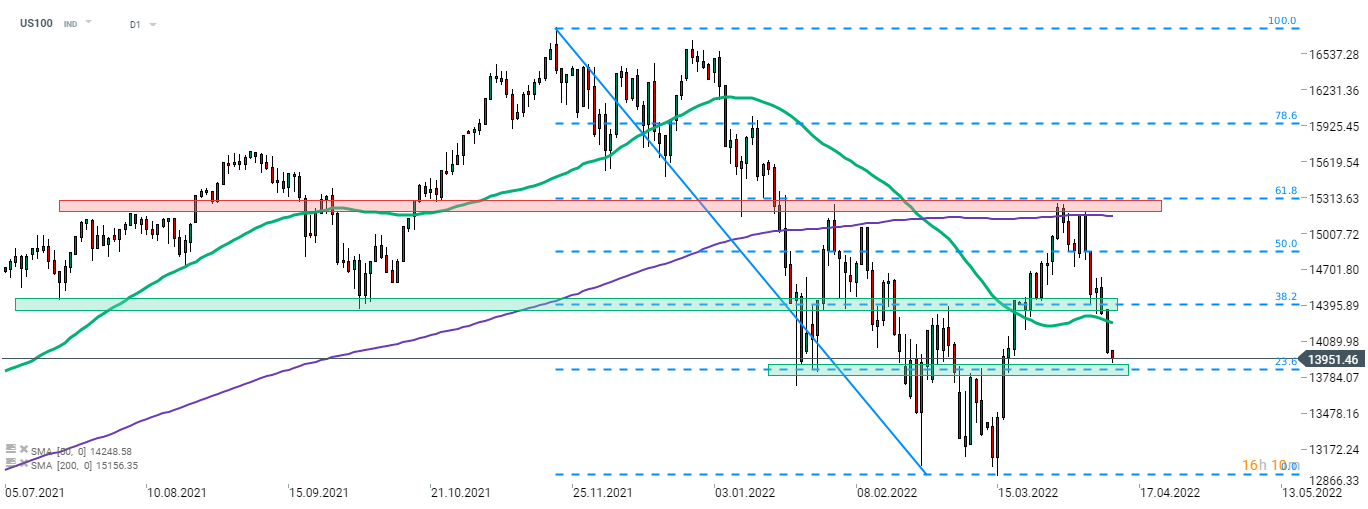

Rising US yields continue to put pressure on equities, especially the tech sector. Nasdaq-100 (US100) dropped over 2% yesterday and moved below the psychological 14,000 pts level. Index is eyeing a test of the support zone ranging around 23.6% retracement of the downward move launched in November 2021 (13,850 pts area). Source: xStation5

Rising US yields continue to put pressure on equities, especially the tech sector. Nasdaq-100 (US100) dropped over 2% yesterday and moved below the psychological 14,000 pts level. Index is eyeing a test of the support zone ranging around 23.6% retracement of the downward move launched in November 2021 (13,850 pts area). Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report