- Yesterday's stronger-than-forecast U.S. labour market data supported Wall Street sentiment, lifting U.S. bond yields. The S&P 500 index rose 2.3% yesterday, marking its record session since November 2022, while the DJIA rose nearly 700 points, closing the session 1.8% higher and posting its record high since July 16.

- The Nasdaq 100 was up more than 3%, supported by gains in semiconductor companies, with Nvidia rising nearly 5% and gaining another 1% today in post-market close trading. Today, however, U.S. index futures gave back some of yesterday's gains and retreated in a range of -0.3% to 0.4%

- Inflation data from China came in slightly stronger than expected, supporting the sentiment of the Hang Seng Index, which gained nearly 1.4% today during the Asian session. The MoM inflation rate rose 0.5% in July, while a 0.3% increase was expected, following 0.2% in June. The year-on-year decline was -0.8%, a larger -0.9% was expected, after -0.8% in June.

- The magnitude of the surprise, however, was relatively small, and Mainland Chinese stocks fell as markets worried that stronger-than-expected inflation print was primarily due to seasonal, weather factors

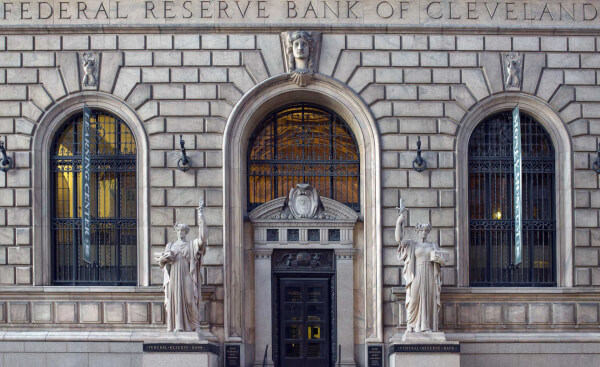

- Barkin's comments from the Fed indicate that bankers are not giving the recent slightly weaker manufacturing ISM and NFP data too much weight.

- In Barkin's view, unlike the markets, the Fed cannot react to 'future data' and 'tail risk' - it focuses on the readings that are coming in, rather than trying to forecast the future.

- Barkin's assessment is that the Fed is not currently seeing dynamic hiring at companies, but neither are layoffs. He would be more concerned about the lack of job creation in the US economy than the rise in unemployment, which he believes will continue to rise

- Austen Goolsbee of the Fed stressed that policy is currently restrictive, and the economy looks as if a 'normalization' process is underway. He also pointed out that if the Federal Reserve has already 'overreacted' to the restrictiveness of its policy, it should keep a close eye on economic conditions in order to react

- Analysts at JP. Morgan pointed out that the lack of 'haste', on the part of the Federal Reserve increases the short-term risk of the broad equity market

- EURUSD is trading at 1.092, and USDJPY is retreating 0.2% to 146.8. Japan's Nikkei and Topix indices gained almost 0.6% and 1%, however Nikkei futures (JAP225) are currently losing more than 2%

- Brent Crude Oil rose above $79 per barrel, making up nearly 8% from Monday's low. There is little volatility in the agricultural commodities market, with gold and silver maintaining yesterday's gains

- Markets await final inflation data from Germany (for July, (7 AM GMT) and Canadian employment change (1:30 PM GMT)

- Bitcoin is slipping from near $62K but still holding near $61K after yesterday's nearly 10% rally. Ethereum is also gaining - more than 1% and rising above $2,600. The rise in bond yields has not stopped the cryptocurrency market, where optimism has risen with the rebound in equity markets

- Donald Trump said, that the US president should 'have some say' about Fed's monetary policy. For the first time, traders on Polymarket give both US presidential candidates Trump and Harris almost the same chances (50%) to win US election

Source: xStation5

Source: xStation5

Daily summary: The Market recovers losses and awaits rate cuts

Three markets to watch next week (13.02.2026)

IBM Goes Against the Tide: Three Times More Entry-Level Employees

US OPEN: The market looks for direction after inflation data