-

US indices slumped yesterday, erasing all of post-FOMC gains. S&P 500 dropped 3.56%, Dow Jones moved 3.12% lower and Nasdaq slumped 4.99%. Russell 2000 dropped 4.04%

-

Indices from Asia-Pacific followed Wall Street's lead and also slumped. S&P/ASX 200 dropped 2.2%, Kospi dropped 1.1% and indices from China traded 2-4% lower

-

DAX futures point to a slightly lower opening of the European cash session

-

Josep Borrell said that agreement on next sanctions package on Russia has almost been reached by EU members

-

Hungary's Orban said that his country will need 5-year exemption from Russian oil embargo

-

According to RBA Statement on Monetary Policy, interest rates in Australia will need to increase further as inflation is seen staying above goal until at least 2024

-

ECB's Holzmann said that European Central Bank will discuss raising rates and may even decide to deliver a rate hike in June

-

Cryptocurrencies trade mostly higher. Ripple trades over 2% higher, Ethereum gains 0.5% and Bitcoin adds 0.1%

-

Precious metals pull back amid USD strengthening. Platinum is top laggard with a drop of 2.7%

-

Energy commodities do not experience major moves on Friday. Brent and WTI trades 0.2% higher

-

USD and CAD are the best performing major currencies while JPY and CHF lag the most

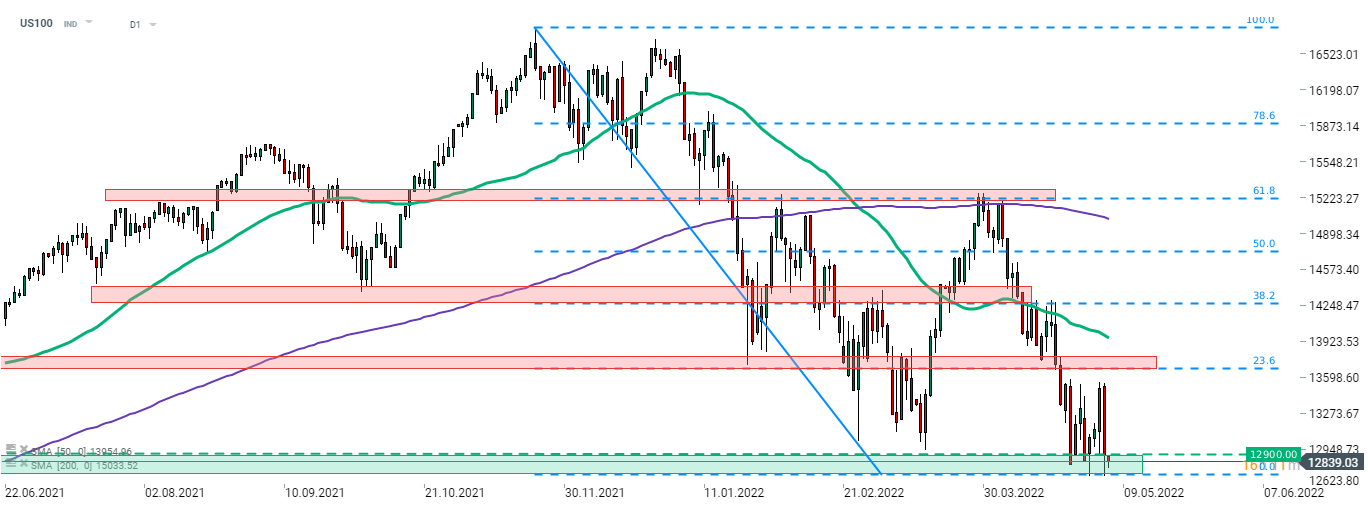

Nasdaq-100 (US100) and other US indices slumped yesterday, erasing all of the post-FOMC gains. US100 is once again testing a support zone ranging below 12,900 pts handle. While yesterday's plunge was very steep, it looks like the situation has calmed somewhat during overnight trading. Source: xStation5

Nasdaq-100 (US100) and other US indices slumped yesterday, erasing all of the post-FOMC gains. US100 is once again testing a support zone ranging below 12,900 pts handle. While yesterday's plunge was very steep, it looks like the situation has calmed somewhat during overnight trading. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers