- Futures based on U.S. stock indices gained yesterday after the close of the cash session following the release of Apple's quarterly results. The company reported better-than-expected earnings and revenue results and announced a $110 billion share buyback.

- Today, bullish momentum in APAC markets was extended by the Hang Seng, which added 1.39% intraday. Stock markets in Australia and New Zealand also did very well, with gains of more than 0.6%. Indexes from mainland China and Japan were not traded today due to the ongoing holiday.

- European stock index futures point to a positive opening in the last session this week.

- Slightly better market sentiment, however, does not serve the dollar, which retreats 0.44% against the Japanese yen and is trading near the 153.00 zone. The key defining aspect of trading on the world's reserve currency will be the US NFP data scheduled for 01:30 pm BST.

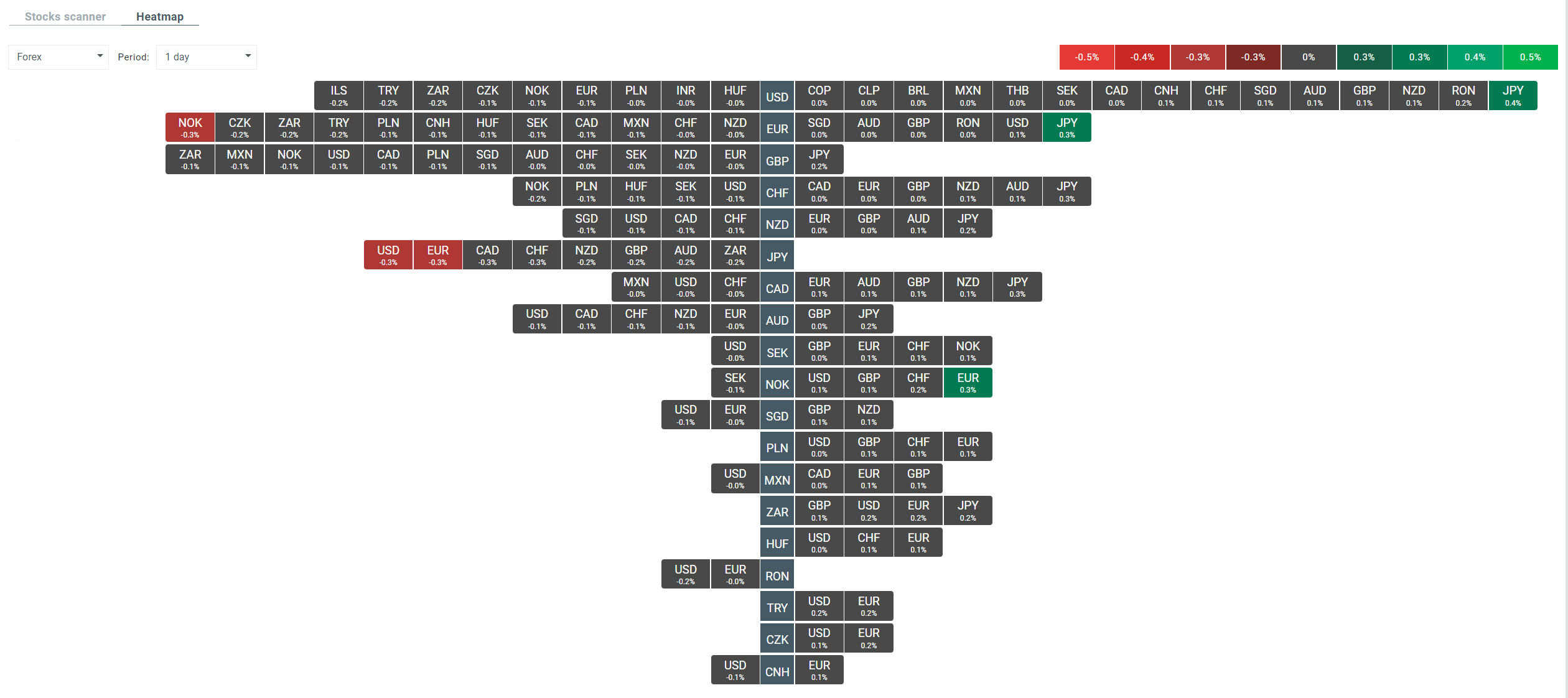

- In the broad FX market, it is the Japanese currency that is performing best against a basket of other currencies of the world's major economies.

- Key macro events in today's session include Eurozone unemployment, final UK and US services PMIs, US NFP, the US ISM Non-Manufacturing report and the Norges Bank interest rate decision.

- Among those who will present (or have already presented) their quarterly results in Europe are: Societe Generale, Credit Agricole and Daimler Truck.

- JP Morgan expects OPEC+ to extend production cuts until the second half of this year.

- The company Block owned by Jack Dorsey says it will buy bitcoin for 10% of its gross profit each month.

- Cryptocurrencies regained some ground today, with bitcoin momentarily even coming close to testing the $60,000 zone. Ethereum is also oscillating very close to the $3,000 zone.

Heatmap representing volatility in the currency market just before the opening of the cash session in Europe. Source: xStation

Heatmap representing volatility in the currency market just before the opening of the cash session in Europe. Source: xStation

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales