-

US indices finished yesterday's trading lower after Russian President Putin signed a decree requiring payments for natural gas to be made in rubles. S&P 500 dropped 1.57%, Dow Jones declined 1.56% and Nasdaq moved 1.54% lower

-

Stocks in Asia traded mixed on the final trading day of the week. Nikkei dropped 0.4%, Kospi declined 0.6%, S&P/ASX 200 finished more or less flat while indices from China traded higher

-

DAX futures point to a slightly higher opening of the European cash session today

-

Russian invasion of Ukraine is now focused on eastern and southern part of the country

-

An oil depot in Belgorod, a Russian city near the Ukraine border, exploded last night. Russian blamed it on the Ukraine airstrike. An ammo depot in the same city exploded few days earlier

-

UK intelligence says that fact Russia is drawing reinforcements from Georgia is yet another proof that Kremlin did not expect such resistance and losses

-

Lockdown in the eastern part of Shanghai was extended. Lockdown in the western part begins today so almost whole city is now under Covid restrictions

-

Goldman Sachs says that there is virtually no chance for US recession over next 12 months but this risk increased to 38% in a year after

-

Chinese Caixin manufacturing PMI dropped in March from 50.4 to 48.1 (exp. 50.0)

-

Japanese manufacturing PMI jumped in March from 52.7 to 54.1 (exp. 53.2)

-

Oil trades lower with WTI dropping below $100 per barrel. Precious metals trade mostly higher

-

USD and EUR are the best performing major currencies while JPY and NZD lag the most

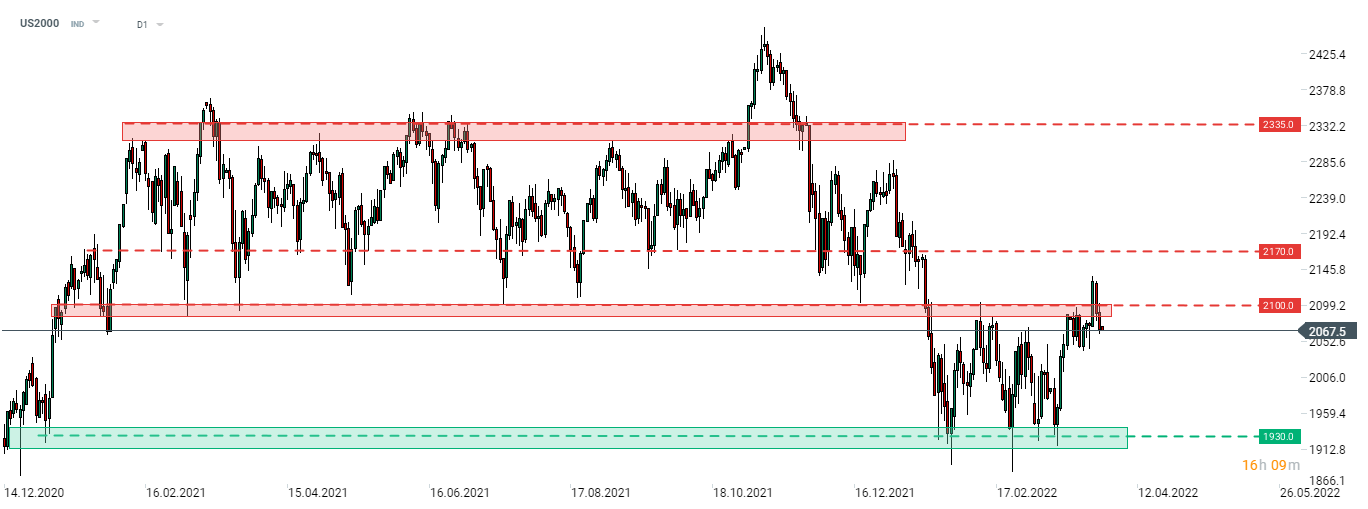

Russell 2000 (US2000) has already erased whole of gains made on peace talks optimism earlier this week. An attempt of breaking above the upper limit of the trading range was a failed one and a pullback into the range can be observed today. Source: xStation5

Russell 2000 (US2000) has already erased whole of gains made on peace talks optimism earlier this week. An attempt of breaking above the upper limit of the trading range was a failed one and a pullback into the range can be observed today. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers