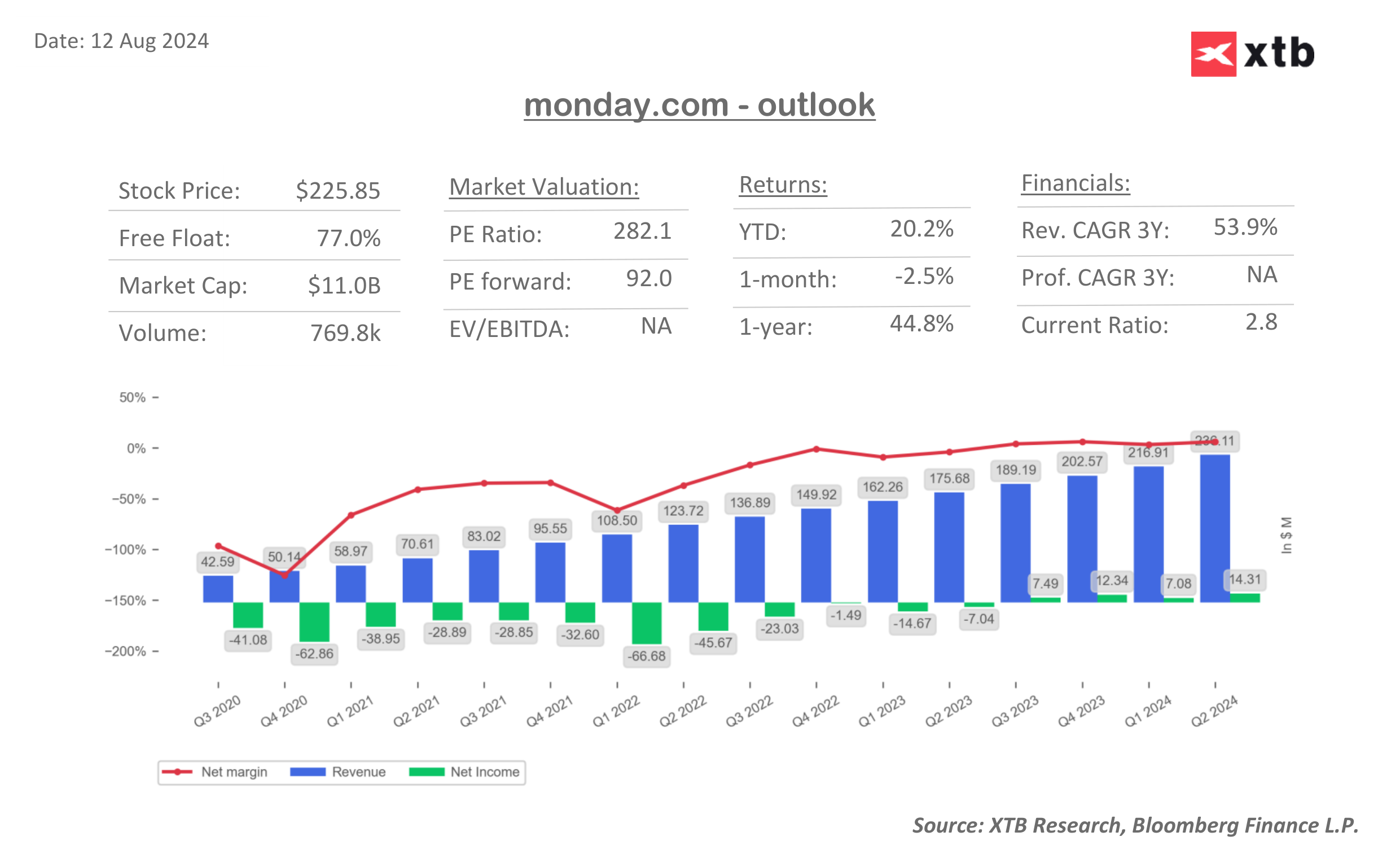

Monday.com reported its highest quarterly revenue in 2Q24 while improving costs. This left the company on track to end the year with positive EPS for the first time. At the operating profit level, the company also reported a significant improvement. In addition, Monday.com raised its outlook for the full year 2024, all of which is pushing the company's stock up nearly 10% in pre-market trading.

Monday.com quotes in pre-session trading are approaching local maximums. Source: xStation

Monday.com quotes in pre-session trading are approaching local maximums. Source: xStation

Monday.com develops software applications worldwide, offering Work OS, a cloud-based operating system for work. The company provides solutions for marketing, CRM, project management, software development and other fields, as well as business development and customer success services. It serves a variety of organizations, including educational and government institutions.

In 2Q24, the company continued its strong revenue momentum, reaching $236.1 million in sales (+34% y/y), beating analysts' consensus by more than 3%. Although the growth rate is down compared to previous years, it still remains at high levels. It looks even better when compared to cost dynamics, which (at the operating level) increased by 24% y/y. Lower cost dynamics allowed the company to achieve the lowest share of costs in total sales in the last 5 quarters, which allowed the company to achieve a record high adjusted operating profit of $38.4 million (+131% y/y).

Strong operating results translated into an increase in adjusted EPS to $0.94 (more than doubling year-over-year profitability) versus consensus estimates of $0.56.

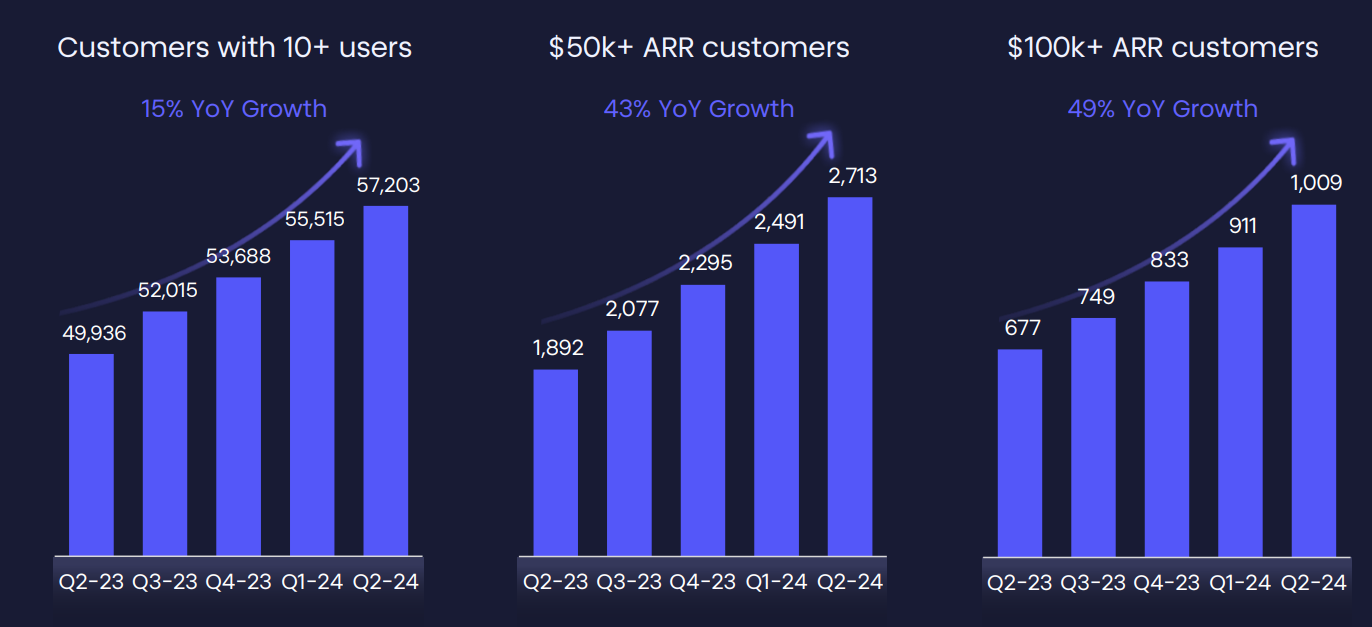

The company has been increasingly acquiring new large customers, and it is in this segment that the number of customers has grown the fastest (+49% y/y). However, it is worth remembering that this is mainly due to the effect of a low base (compared to the total number of customers with more than 10 returning users of 57,203).

Source: Monday.com

Source: Monday.com

Adding to the strong Q2 results, the company also raised expectations for 2024. Monday.com now expects revenue of around $956-961 million (previously $942-948 million) vs. consensus expectations of $947.85 million. At the adjusted operating profit level, the company expects between $100-105 million (+66% y/y).

2Q24 FINANCIAL RESULTS:

- Revenues: $236.1 million (+34% y/y); estimates: $228.9 million

- Adjusted operating profit: $38.4 million (+131.2% y/y); estimates: $20 million

- Adjusted operating profit margin: 16%; (vs 9.5% a year earlier); estimates: 8,7%

- Adjusted EPS $0.94 (vs $0.41 a year earlier); estimates: $0.56

- EPS $0.27 (vs -$0.15 a year earlier), estimates $0.04

- Cash and equivalents $1.29 billion (+30% y/y), estimates $1.28 billion

3Q24 OUTLOOK:

- Revenue: from $243 million to $247 million, a year-on-year increase of 28% to 31%.

- Adjusted operating profit: from $19 million to $23 million and an operating margin of 8% to 9%.

- Free cash flow: from $70 million to $74 million and a free cash flow margin of 29% to 30%.

2024 OUTLOOK:

- Revenue: from $956 million to $961 million, (+31% to 32% y/y)

- Adjusted operating profit: from $100 million to $105 million and operating margin of 10% to 11%.

- Free cash flow: $270 million to $275 million and free cash flow margin of 28% to 29%.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡