McDonald's (MCD) reported lower than expected comparable sales growth, lower than expected revenue but higher earnings per share (EPS) for the fourth quarter and full year of 2023, sending its stock price slightly higher in pre-market trading.

Key Highlights:

- Comparable sales: Global comparable sales increased 3.4% year-over-year (YoY), which was lower than Bloomberg estimate of 4.79%. US comparable sales grew 4.3%, while International Operated Markets and International Developmental Licensed Markets increased 4.4% and 0.7%, respectively. Estimations for both figures were higher than prints for Q4 2023.

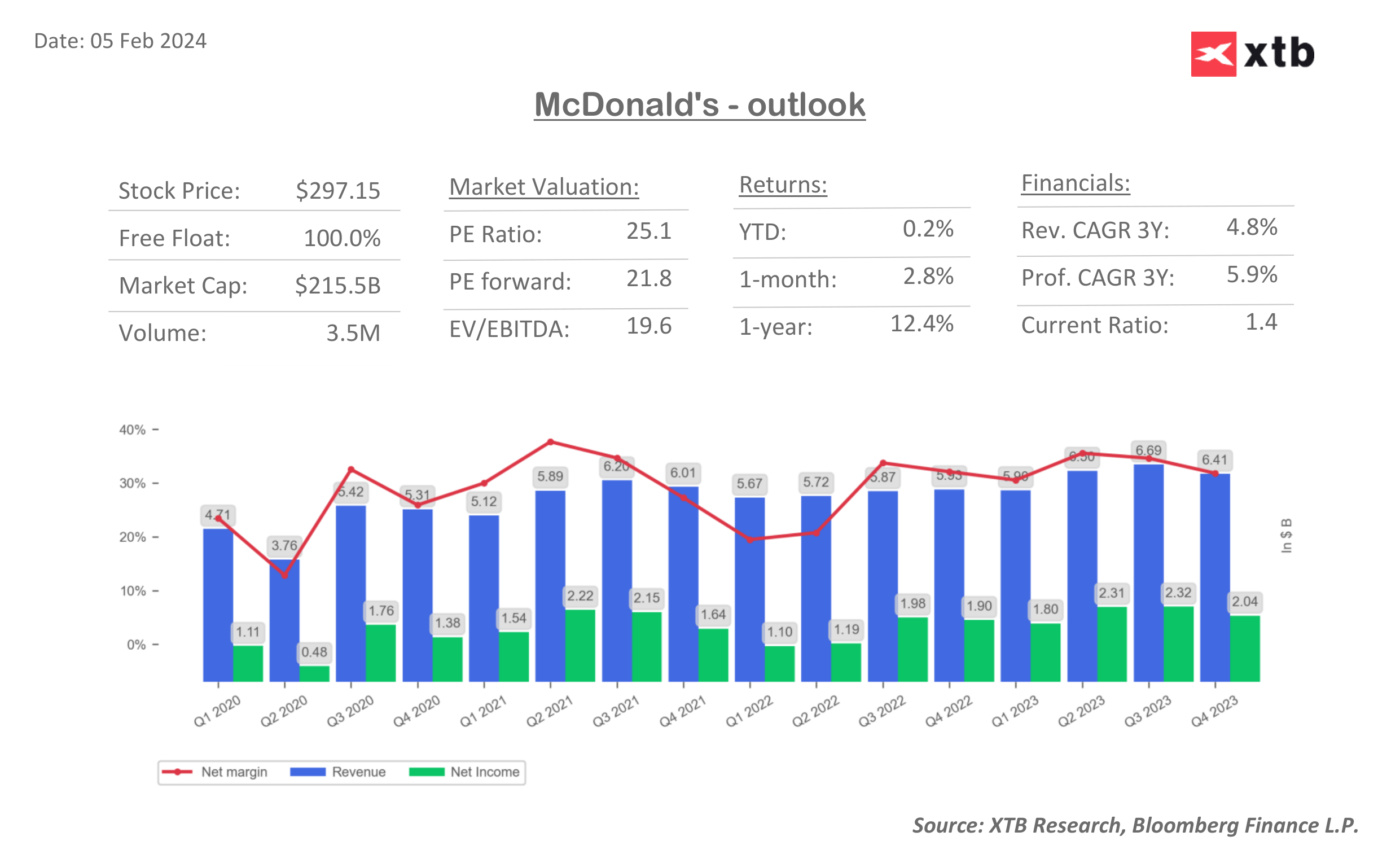

- Earnings: Adjusted EPS of $2.95 came in above the analyst consensus estimate of $2.82, representing a 14% increase YoY. Revenue of $6.41 billion was slightly below the estimate of $6.45 billion but still grew 8.1% YoY.

- Profitability: Operating income rose 8.5% YoY to $2.80 billion. The company expects its 2024 operating margin to be in the mid-to-high 40% range.

- Expansion: McDonald's plans to open more than 2,100 new restaurants globally in 2024, with over 1,600 net additions. The company expects to invest $2.5 to $2.7 billion in capital expenditures, with a focus on the US and International Operated Markets.

- Outlook: The company sees 2024 free cash flow conversion rate in the 90% range and expects year-over-year interest expense to increase by 9% to 11%. Despite "macro challenges," McDonald's CEO expressed confidence in the business's resilience.

Market Reaction:

McDonald's stock price rose about 0.3% in pre-market trading on the news. Analysts were generally positive on the results, despite that comparable sales growth came out below expectations, as the company's expansion plans were more important for the future.

The company has 33 buys recommendation, 10 holds and 0 sells. The stock increased 0.18% this year and 12.86% in 12 months.

Key data for MCD.US. Source: Bloomberg Finance LP, XTB

MCD stock is flat this year but is only 1.5% short to all-time high. Source: xStation5

MCD stock is flat this year but is only 1.5% short to all-time high. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡