Summary:

- DOE crude oil inventories: -4.1M vs -1.4M exp

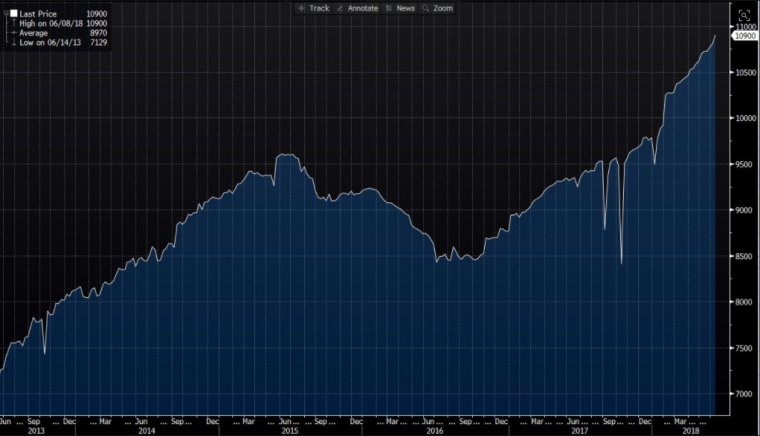

- US production rises by 100k to 10.9M - new record high

- Oil jumps higher in initial reaction

The largest draw in the DOE inventory release since the start of April has caused a spike higher in the price of oil, although another rise in US production threatens to cap any substantial gains. The headline reading of -4.1M was larger than the expected drop of 1.4M and marks an even bigger fall compared to the prior reading of 2.1M. A couple of the components were also potentially supportive for oil with the following releases shown in the actual vs expected format:

- Gasoline: -2.3M vs +1.0M

- Distillates: -2.1M vs +0.5M

- Cushing: -0.7M vs -1.0M

While the majority of this is supportive of the price of crude, another rise in US production is not. In the past week production rose by a further 100k barrels, taking the total amount to 10.9M - another record high.

US oil production rose once more to a new record high of 10.9M in the past week. Source: Bloomberg

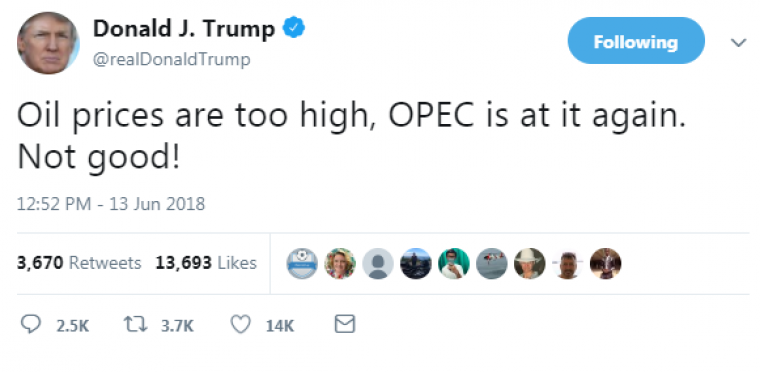

Donald Trump can’t seem to stay out of the headlines as far as the markets are concerned, and the US president could soon cause a notable impact on the oil market. An ominous sounding tweet from Trump was posted a couple hours before the DOE release, stated his view that oil prices are too high, blaming OPEC. This is the second time that Trump has tweeted on Oil prices in recent months but as of yet it has failed to cause a negative reaction. However, if there are more concrete signs that he will take action to send price lower then that will likely effect the market.

Trump took to Twitter to vent his frustration at what he calls "too high" oil prices earlier today. Source: Twitter

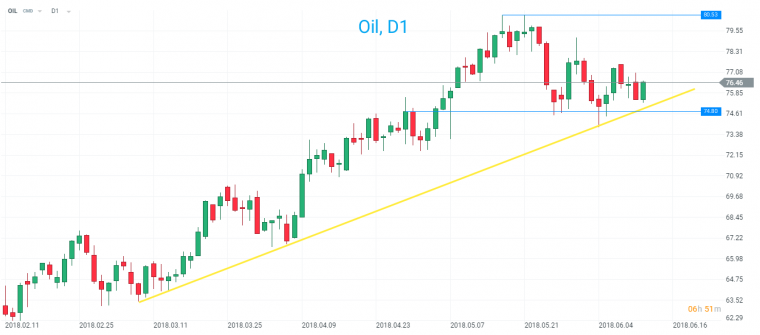

Oil has moved back above the 76 handle following the release and looks to have respected the key support in the region around 74.80 once more. A rising trendline going back to March and a key prior swing level reside around this region and have managed to attract enough buying pressure to curb the latest bout of selling.

Oil has managed to remain above key support around 74.80 once more and is moving higher following the DOE release. Source: xStation

Disclaimer

This article is provided for general information purposes only. Any opinions, analyses, prices or other content is provided for educational purposes and does not constitute investment advice or a recommendation. Any research has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk, we do not accept liability for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.