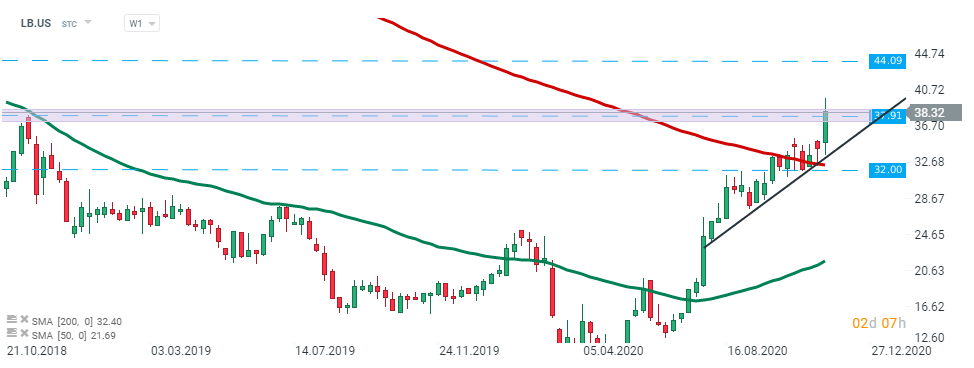

L Brands (LB.US) stock launched today’s session with a massive bullish price gap, however buyers were unable to hold onto gains and price pulled back. Currently stock is testing strong support at $37.91. If buyers will manage to halt declines here, then another upward impulse towards $44.09 could be launched. On the other hand, if sellers will manage to break below, a bigger downward correction may start. The nearest support lies at the upward trendline. Source: xStation5

L Brands (LB.US) stock launched today’s session with a massive bullish price gap, however buyers were unable to hold onto gains and price pulled back. Currently stock is testing strong support at $37.91. If buyers will manage to halt declines here, then another upward impulse towards $44.09 could be launched. On the other hand, if sellers will manage to break below, a bigger downward correction may start. The nearest support lies at the upward trendline. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street