American semiconductor giant, Intel (INTC.US) was one of the weakest semiconductor stocks during last months. Also, its revenues and earnings trends are not even comparable with its peers. However, company shares soared 10% during last 5 sessions as markets weigh in opportunities about new Lunar Lake AI chips, which will debut this year (Q3 2024). After yesterday 6% rally, today Intel gains almost 3% in pre-market trading.

- Successful debut may also improve next 'laptop and PC cycle', which may be good sign for Intel future business and sales, boosting demand for 'private AI' capabilities.

- Intel claims that Lunar Lake chips are 40% faster than Qualcomm’s Snapdragon X Elite, produced with ARM (ARM.US), used by Microsoft. Laptops using the chips had 60% better battery life, according to analysis.

- We can see also the trend of Wall Street speculative 'playing' on stocks of 'weaker technology stocks' such as Tesla and Apple before, this year. It's still unknown will the history repeat with Intel shares, which are sill almost 28% down on year-to-date basis.

- Clearbridge portfolio managers informed that Intel may perform better in the second half of the year as an 'underappreciated opportunity of AI PCs ramp over the next few quarters in enterprises, where Intel has a stronghold'.

- Analysts claim that Intel's advanced technology roadmap can lead to stabilization in market share in the PC and server markets, now depressed and very important for Intel. Main catalyst may come from cyclically ageing hardware infrastructure and growth of IT workloads.

Intel (INTC.US) D1 interval

Intel shares are still well below (almost 15%) SMA200 level (red line) but escaping consolidation zone and trading range since 23 April - 7 July.

Source: xStation5

Source: xStation5

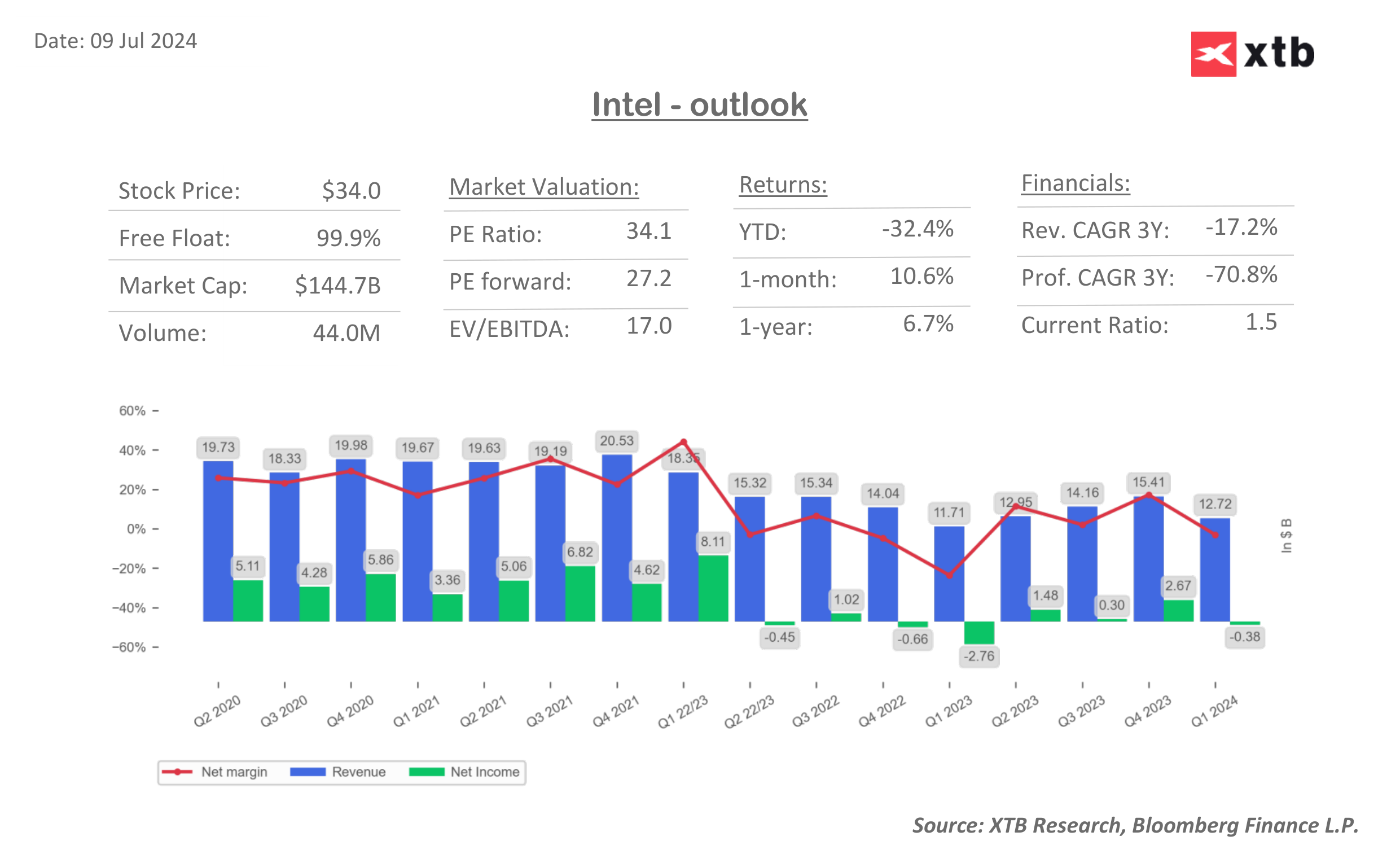

Intel financial dashboards

Source: XTB Research

Source: XTB Research

Source: XTB Research

Source: XTB Research

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street