HCA Healthcare (HCA.US) stocks rose over 7% in pre-market trading after the hospital operator said it will return, or repay early, approximately $6 billion of government assistance received as part of the CARES Act. HCA said the initial emergency had passed and that available cash from operations would be sufficient to repay the money. The company also issued better-than-expected third-quarter revenue guidance. HCA is expecting revenue to increase to $13.30 billion versus $12.69 billion in the year-ago period. Analysts project revenue of $12.67 billion for the quarter.

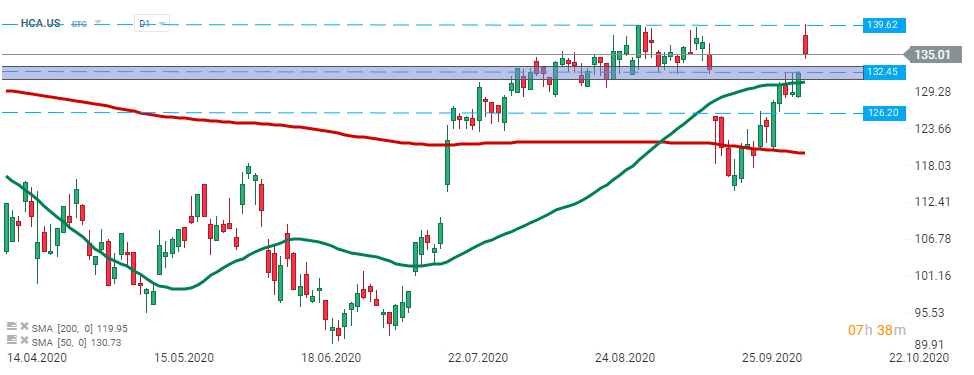

HCA Healthcare (HCA.US) stock launched today’s session with a bullish price gap however buyers failed to uphold the momentum and price bounced off the resistance at $139.62. The nearest support to watch lies at $132.45, where the lower limit of aforementioned price gap is located. In addition, this area is marked with the previous price reactions and 50 SMA (green line). Source: xStation5

HCA Healthcare (HCA.US) stock launched today’s session with a bullish price gap however buyers failed to uphold the momentum and price bounced off the resistance at $139.62. The nearest support to watch lies at $132.45, where the lower limit of aforementioned price gap is located. In addition, this area is marked with the previous price reactions and 50 SMA (green line). Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street