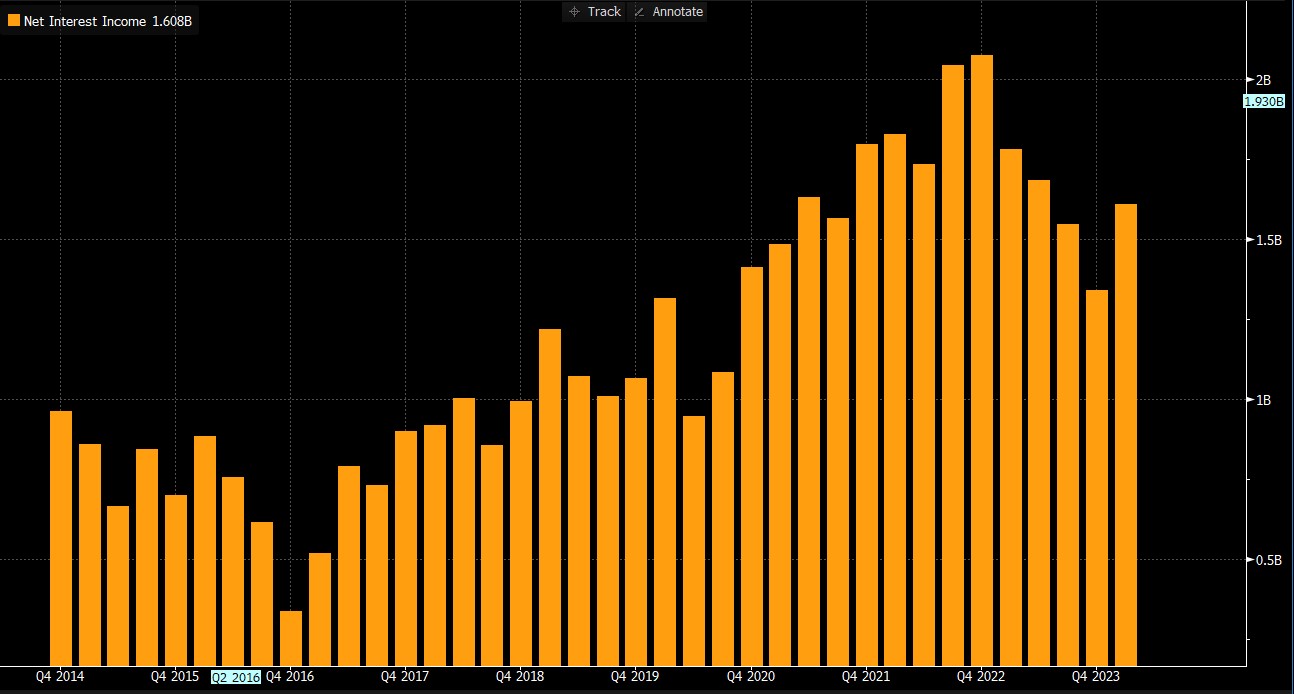

Goldman Sachs' 1Q24 results significantly exceeded expectations. Strong EPS, coupled with robust revenue dynamics, as well as a substantial decrease in credit loss provision, provide a solid foundation for potential stock price increases. For the first time in 4 quarters, the company recorded a QoQ increase in net interest income, reaching a level close to 2Q23.

Net interest income Goldman Sachs. Source: Bloomberg Finance L.P.

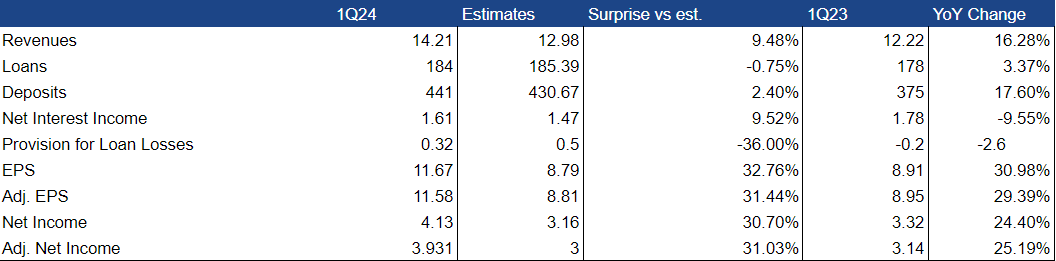

Improvements in every segment (particularly in investment banking) propelled revenues to a record level over the past two years, reaching $14.2 billion (+16.3% y/y).

In the key Banking and Markets segment, Goldman Sachs reported revenues of $9.73 billion, surpassing market expectations by 15%, thereby exceeding even the most optimistic scenarios. Particularly notable was the significant increase in investment banking fee revenues (+32% y/y), driven by a rise in successfully executed M&A transactions in the global market.

The company reduced its credit loss provision to $318 million (compared to $577 million in 4Q23) on a q/q basis. A year earlier, during the same period, it reported a result of -$171 million, stemming from a one-off event, namely the partial sale of the Marcus portfolio. This year's reserve value was significantly below market expectations (-36% compared to expectations).

The company achieved a net income of $4.13 billion, surpassing expectations by 30.7%. On a y/y basis, net income increased by 24.4%. EPS rose to $11.67 (+31% y/y growth). After adjustment, its value stood at $11.58. Both values exceeded analysts' expectations by approximately 32%.

The company also announced a dividend of $2.75 per share. The dividend date was set for May 30th, with the dividend payment scheduled for June 27th.

Goldman Sachs' 1Q24 results (in bln $, except for EPS) Source: Company's financial report, Bloomberg Finance L.P.

After Goldman Sachs' results, there has been a strong increase in the stock price in pre-market trading. The price has risen by over 4% so far. Source: xStation.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡