Precious metals are gaining, supported by the US consumer price inflation reading, which came in line with forecasts, while the y/y growth rate of core CPI indicated 3.2% y/y vs. 3.3% forecasts. The data, while essentially mixed provided markets with considerable relief and lifted valuations of assets negatively correlated with the dollar. Yields on 10-year bonds fall to 4.66%, while the USDIDX dollar index loses 0.5%. In the wake of rising market demand for bullion, GOLD gains nearly 0.5% and SILVER gains nearly 1.8% to around $30.5 per ounce.

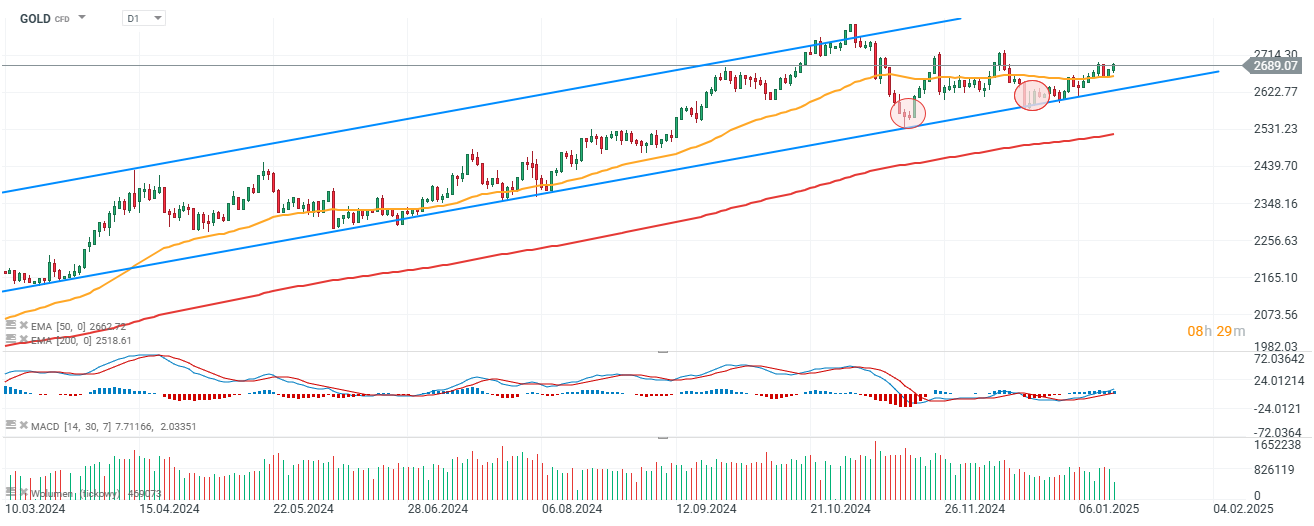

GOLD (D1 interval)

Gold maintains an upward trend and has recently respected the lower limit of the uptrend structure twice; while drawing a potentially bullish formation of two increasingly higher lows. Historical peaks are located at the level of $2,800 per ounce.

Source: xStation5

SILVER (D1 interval)

Silver has held support in the form of the EMA200 (red line) and is returning to growth, preparing for a test of the EMA50 and EMA100; both averages run around $30.7 per ounce.

Source: xStation5

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

Silver surges 5% 📈

Morning wrap: Tech sector sell-off (06.02.2026)