Gold is once again on an upward wave, driven by falling bond yields in the US and Europe. Today, we additionally learnt data from the US that shows a weakening economy, which may cast doubt on more than one hike from the Fed.

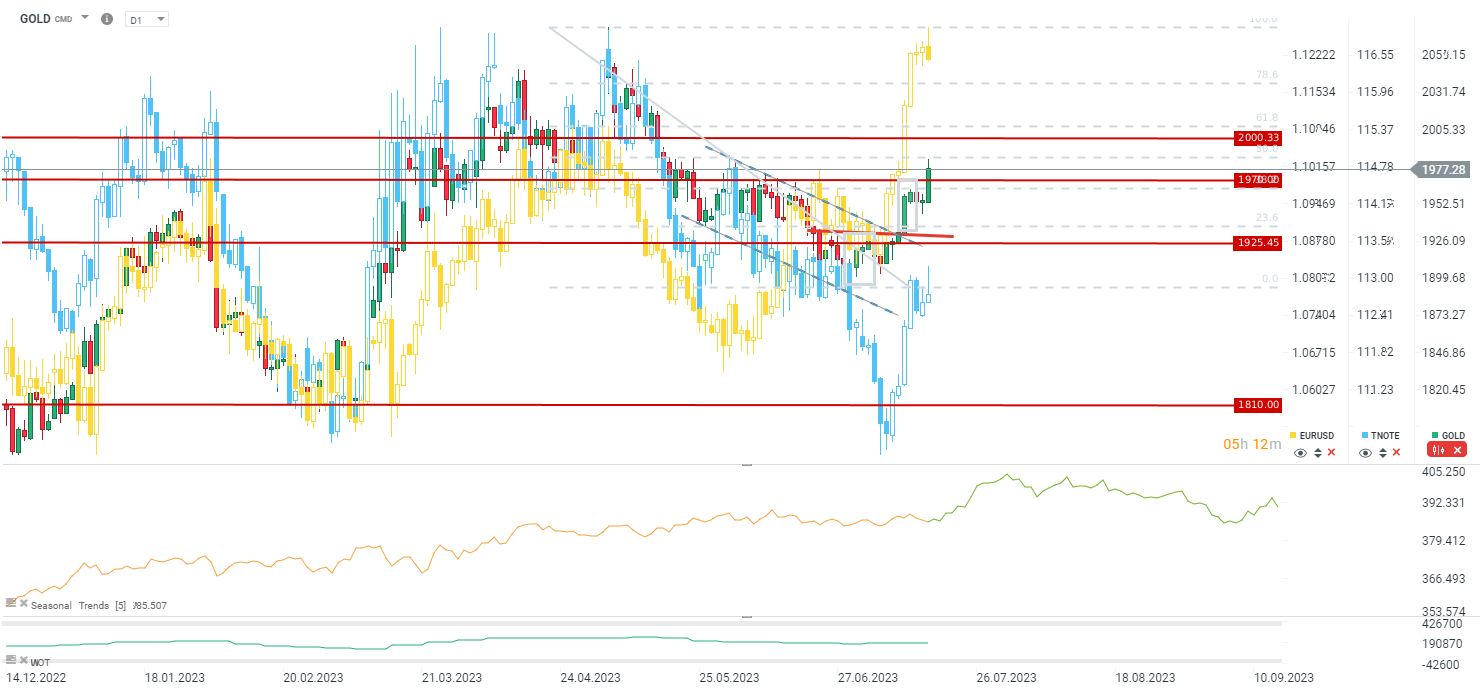

Yields in the US, based on bond price levels (TNOTE) were today at levels seen on 29 June. TNOTE is credited with a v-shaped rebound, while even larger increases are seen on the EURUSD, which support further increases in gold prices. Today, gold has already found itself above $1980 per ounce.

Until the Fed decision, we will not know much more information from the US economy and, due to the shutdown period, neither will US bankers speak. Nonetheless, even if the Fed remains hawkish at the upcoming meeting, the market is likely to remain set as it is now, given the available economic data.

Gold tested the $1985 per ounce area today, on a wave of falling yields and high EURUSD levels. Although there are signs of profit-taking on the currency pair, the levels still provide incentive for gold prices to rise. If the price holds today at levels last seen in early June, there will be a chance later this week to move above the 50.0 retracement of the $1985 per ounce level. Source: xStation5

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?