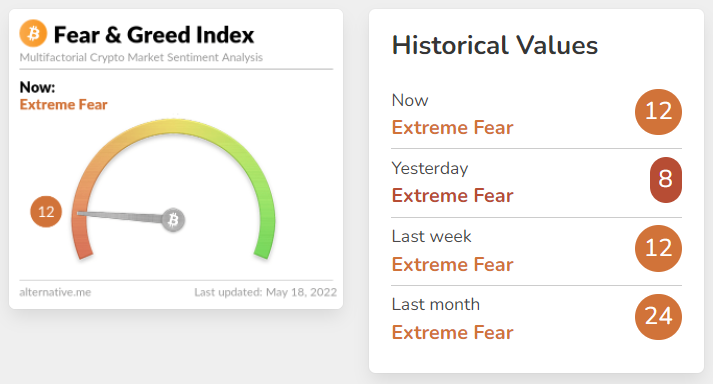

During today's session, the popular 'Fear and Greed Index' showed a reading of 12 points, which confirms that we are currently dealing with an extremely negative sentiment, and the risk aversion in the cryptocurrency market remains high after the total collapse of the Luna cryptocurrency and the associated algorithmic stablecoin UST.

The index showed that the mood in the crypto market is very negative. In the past, this has often heralded a rebound. Source: alternative.me

The index showed that the mood in the crypto market is very negative. In the past, this has often heralded a rebound. Source: alternative.me

-

Bitcoin fell below key support at $ 29,000, while Ethereum drops below $ 2,000 as stock market sentiment plummets again;

-

Ethereum is performing better than Bitcoin and is trading above the summer 2021 lows, while Bitcoin is trading below these levels. This could potentially caused by progress regarding Ethereum 2.0 and the initial success of the Beacon chain; For Ethereum holders, the transition to 2.0 will mean an almost complete stoppage of supply, which may have a positive impact on the price of the token;

-

Digital assets face a potentially difficult period. Recently, the cryptocurrency market has shown a strong correlation with the stock market, especially with the technological NASDAQ index. The Federal Reserve starts the QT program in June, and money is leaking from the financial markets as sentiment towards risky assets declines. Potential declines could lead to another 'cryptocurrency winter' which may last until the next Bitcoin 'halving' in early 2024. Until now, the repeating cycle pattern worked flawlessly. On the other hand, tech companies' prices have already experienced large sell-offs which may cause a rebound. At the same time, a return to historic peaks in the coming months seems very unlikely.

Ethereum plunged below psychological support at $ 2000 and if current sentiment prevails, the next target for sellers is located around support $1900 which coincides with 61.8% Fibonacci retracement of the last massive upward wave. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?