EURUSD has been on the rise over the past hour or so, with gains accelerating over the past half an hour. This comes after comments delivered by ECB member Holzmann. Holzmann struck a hawkish note, signaling that he is among policymakers opting for a rate hike at the September meeting (September 14, 2023). However, he has cautioned that the case for a rate hike is there unless a major surprises appear. It should be noted that flash CPI data for August from European countries will be released later this week and this is a data point that has the most impact on decision-making process at ECB.

Comments from ECB Holzmann

- There is a case for a rate hike unless major surprises appear

- ECB should begin debate on ending PEPP reinvestments

- ECB is behind the curve and we can access policy once we are at 4%

- ECB isn't in clear on inflation, and labor markets are tight

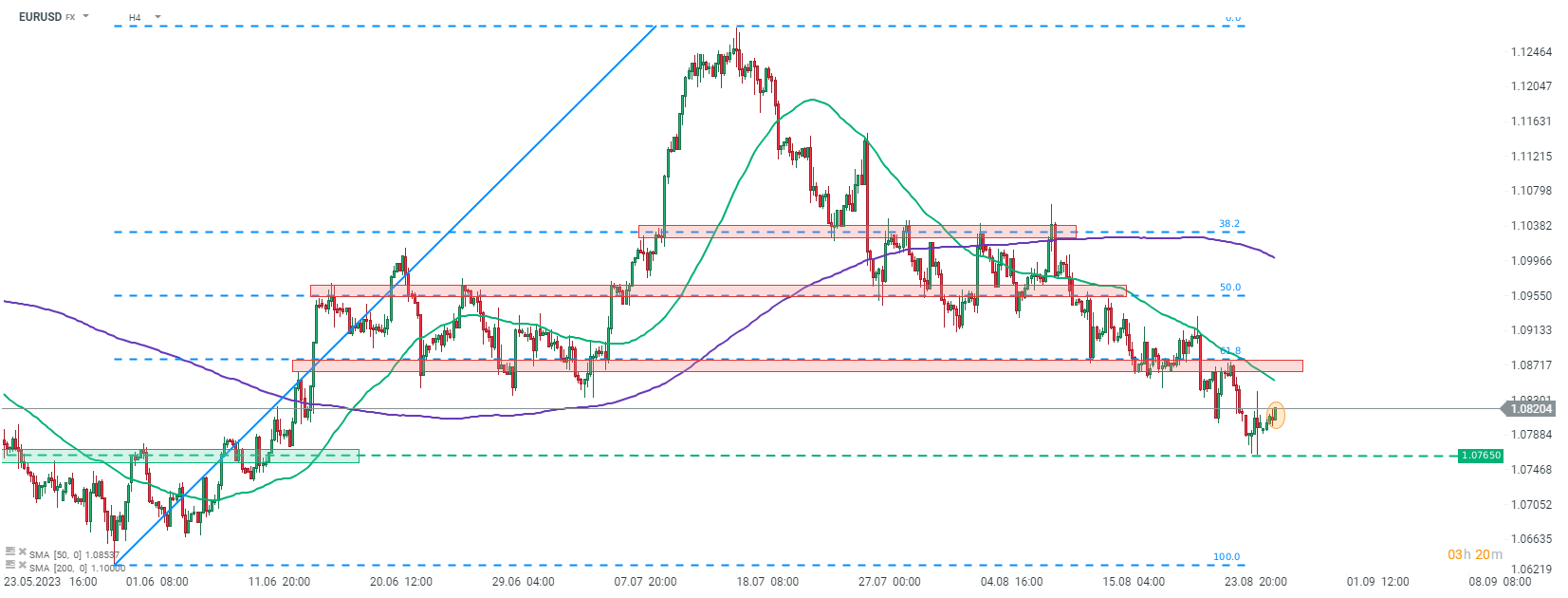

Taking a look at EURUSD chart at H4 interval, we can see that sell-off on the main currency pair looks to have been halted at the 1.0765 area - at least for now. Pair is trading near daily highs in the 1.0820 area and should current sentiment prevail, the 1.0880 resistance zone, marked with 61.8% retracement may become the next target for buyers. Traders should keep in mind that apart from the aforementioned inflation data from Europe, US NFP report for August will also be released this week and it may add to volatility on the pair.

Source: xStation5

Source: xStation5

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts