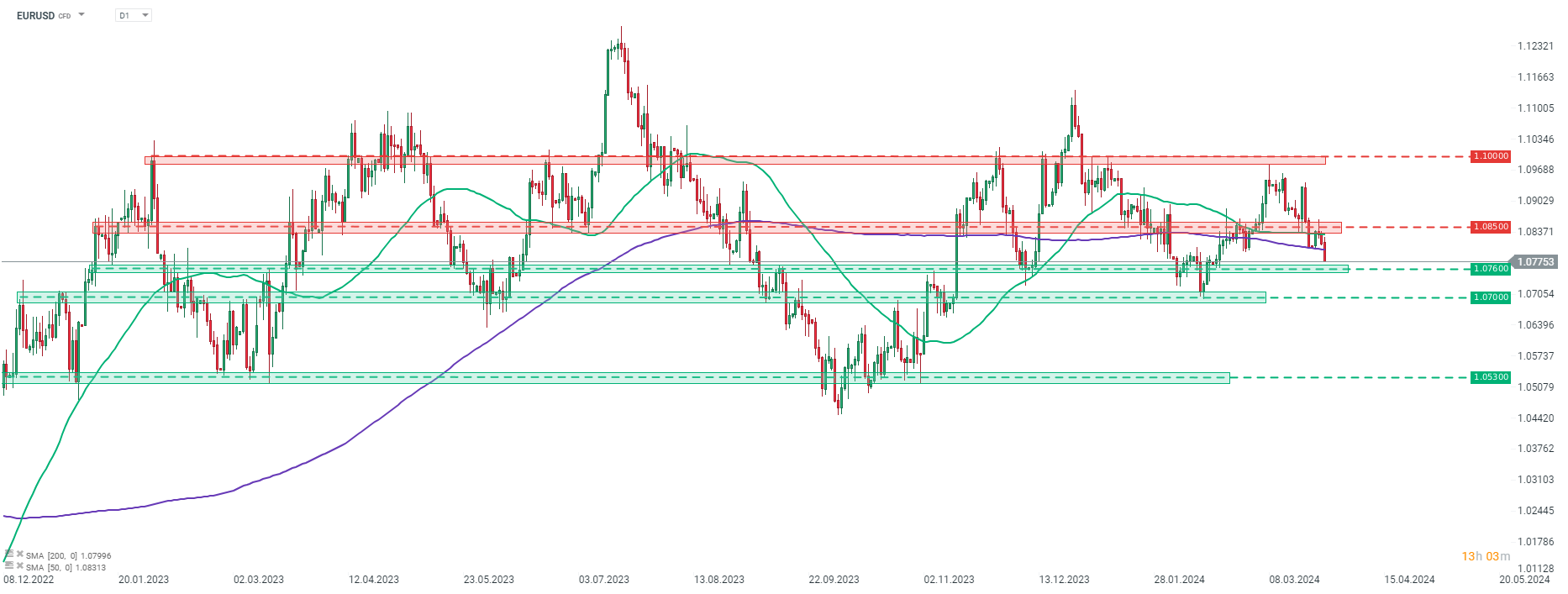

Sell-off on EURUSD continues. The main currency pair failed to break above the resistance zone ranging below 1.10 area around three weeks ago and has been pulling back since. Pair broke below the 1.08 mark today and dropped to the lowest level in 5 weeks.

The move lower today is mostly driven by USD, which is the best performing G10 currency at press time. US dollar's strength is supported by yesterday's comments from FOMC member Waller, who said that while recent economic and inflation data has been better-than-expected, he is in no hurry to cut rates. Moreover, EUR lost some ground today following comments from ECB member Panetta. Panetta said that restrictive policy is dampening demand and contributing to a rapid fall in inflation. Panetta added that as risks to price stability have diminished, conditions to start policy easing are materializing.

Taking a look at EURUSD chart at D1 interval, we can see that the attempt to break below 1.08 area, also marked with 200-session moving average (purple line) last week was a failure and the pair recovered slightly afterwards. However, bulls were unable to push the pair above 50-session moving average (green line) and 1.0850 resistance zone, and the sell-off resumed. Should the pullback continue, the 1.0760 area may offer some support, but a key support zone can be found in the 1.0700 area.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)