Summary:

-

US core durable goods misses; GDP inline

-

Earlier German inflation rose more than expected

-

EURUSD drops to 1-week low below 1.17; Gold under pressure

There’s been several data releases from the US this afternoon with the feeling a little mixed. Closer to home the most recent figures on German inflation have shown a bigger than forecast increase .The EURUSD has come under pressure since the announcements and fallen to its lowest level in a week. Let’s look more closely at the data to try and explain why this reaction could have occurred.

First off the US. The GDP release will attract several headlines, but given that it is the final of three releases for the second quarter its market impact is often not that great. The data itself showed an increase of 4.2%, which is no doubt impressive but it’s also inline with the prior reading and the expected so therefore will have a lesser market impact. Having said that growth of 4.2% is still very high compared to recent history and you have to go back to 2014 to find a higher reading. This could well explain some of the move higher seen in the USD since its release.

Given that the GDP was expected to be strong some traders will likely have been focusing on the durable goods orders number, and here there was some less good news. On the face of it a big jump in the headline figure in year-on-year terms to 11.8%. More importantly the core reading disappointed with a print of 7.3% on the same basis and this has taken the gloss of what appears to be a solid number.

While the durable good orders rose strongly the core reading actually declined and this could be seen as a bit of a worrying sign going forward. Source: XTB Macrobond

While the durable good orders rose strongly the core reading actually declined and this could be seen as a bit of a worrying sign going forward. Source: XTB Macrobond

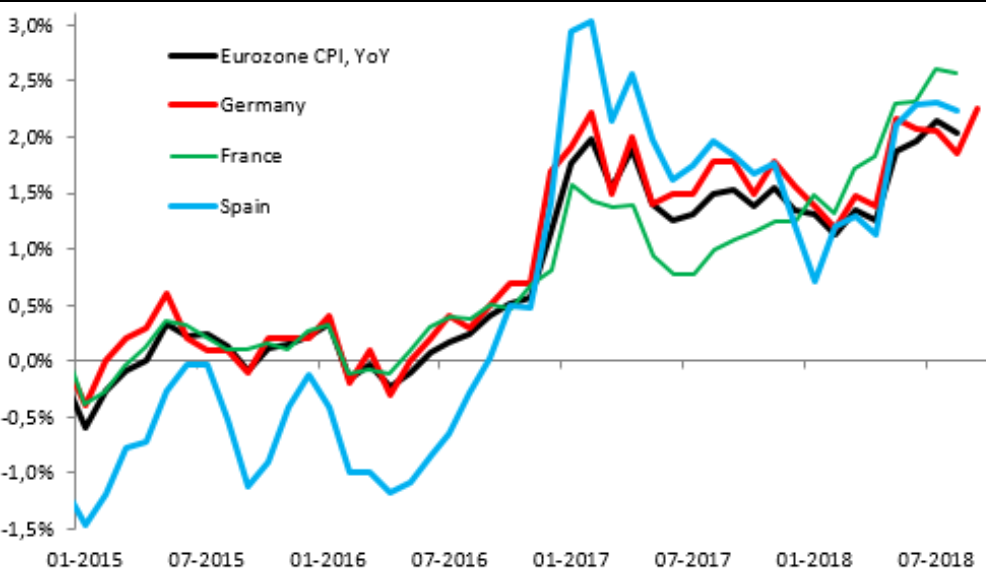

Turning our attention to German inflation, a rise of 2.3% year-on-year means that the metric accelerated in September to its highest level since early 2011. A consensus forecast for this was in line with the prior reading of 2.0% and there is clearly a beat. The core reading, as shown by the HICP came in at 2.2%, well above the expected 1.9% - which was also in line with the prior. As the largest economy in the Eurozone, German figures often carry heightened importance and the strong beat will have raised expectations for tomorrow’s Euro wide figure.

German inflation has risen strongly in the month of September and this could suggest a rise in the Euro wide number due out tomorrow. Source: XTB Macrobond

Given these data points from the US and Eurozone the EURUSD is an obvious place to look for the market reaction, and the pair has made a fairly clear drop lower in the past hour. This cross has fallen below 1.17 again in the past hour after dropping earlier this morning on some concerns surrounding the Italian budget. This market had been near to a 3-month high yesterday but a combination of a rising US dollar since the Fed and this Euro weakness have seen price pull back. If anything the declines could be seen to be more led by USD strength as evidenced by the fall seen in Gold which has declined by almost $10 since the release to trade at its lowest level in over a month. For the EURUSD the resistance around 1.1850 was respected once more with a high made at 1.1815 and the neckline of a possible inverse head and shoulders there remains intact.

The EURUSD has come back under pressure today after once more failing to break resistance from 1.1800-1.1850. Source: xStation