The U.S. Securities and Exchange Commission has approved spot funds for Ethereum, but the market did not react with euphoria after the decision. Although the price impact is still not visible, the debut can be counted as a success.

- After 2.5 hours of the first session, U.S. Ether ETFs recorded about $361 million in inflows, placing them among the top 15 U.S. exchange-traded funds

- Analysts at Bloomberg Intelligence expected the BlackRock Ethereum Trust (ETHA) to reach about $200 million in volume in its first session (20% of the $1 billion BlackRock Bitcoin Trust, Jan. 11); the fund appears on track to beat those projections

- Typically, an ETF's first day of trading brings net inflows of around $1 million; in the case of Ethereum, the number looks quite spectacular.

- The highest trading volumes in the first session of spot ETFs are recorded, without surprise, by Grayscale (ETHE) with almost $150 million in volume and BlackRock (ETHA), which recorded more than $71 million.

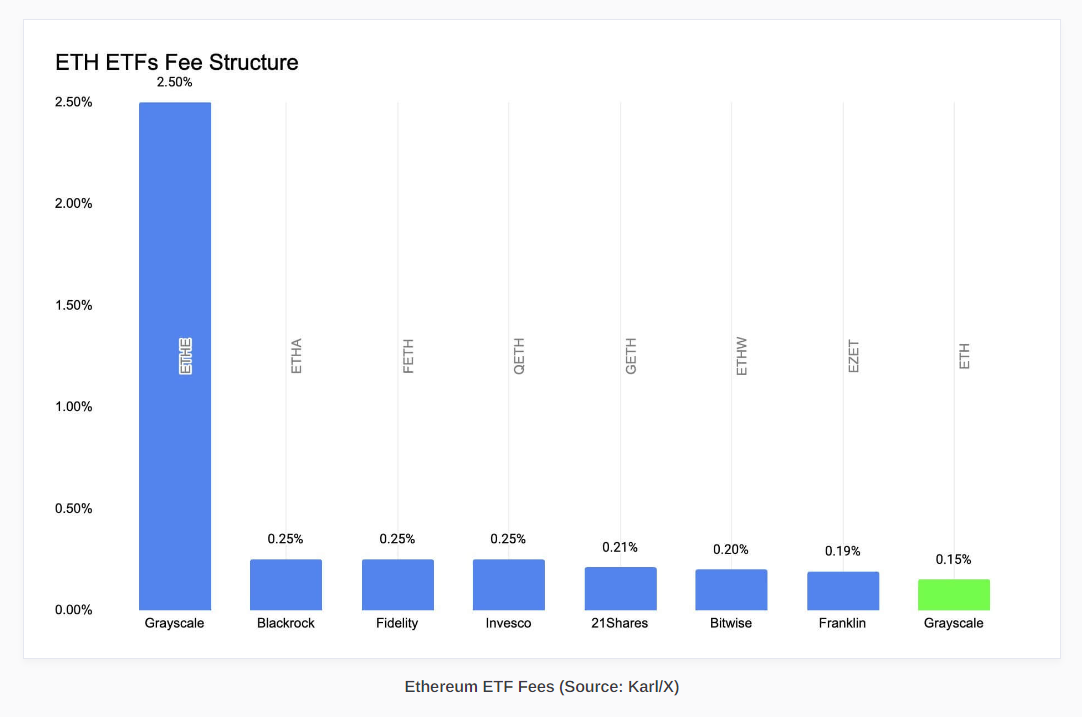

- It's worth noting that due to Grayscale's high fees, sales of equity units may accelerate, weighing on sentiment in the short term - we saw a similar case with the funds' debut for Bitcoin, in January 2024.

- On the other hand, Grayscale offers the cheapest fund at the same time, so there may simply be a conversion of one to the other.

- Bloomberg Intelligence estimates that net inflows into ETH funds in 2024 will be about $5 to $6 billion, or about 20% the size of inflows into funds that have been accumulating Bitcoin since January.

- Given Ethereum's lower market capitalization, and EIP-1558's 'burn' mechanism (further reducing ETH supply, in case of higher net usage), the impact of buying pressure on the price is likely to be significant, in the medium term. It is also worth remembering that about 40% of ETFs are subject to staking. Howver, as for now Ethereum is still not as 'deflationary' as Bitcoin.

In the first minutes of trading, the volume on the largest Ethereum ETF, the Grayscale Ethereum Trust (a converted fund), was not very large. Nevertheless, the situation changes dynamically basically from minute to minute and two hours later the volume is close to $150 million!

ETHE.US and the price of Ethereum. At the bottom, the volume, which at first did not deviate from the average, but is now significantly higher. Source: Bloomberg FInance LP, XTB

It was expected that, as with Bitcoin, there would be a strong outflow of funds from Grayscale. Nevertheless, Grayscale has noticeably reduced the fees for its Ethereum Mini Trust fund. The company currently offers both the cheapest and most expensive Ethereum ETFs. There is also speculation that the conversion is to be tax-free, which could further reduce any potential sell-off.  Cost comparison of spot Ethereum ETFs. Source: Cryptoslate.com

Cost comparison of spot Ethereum ETFs. Source: Cryptoslate.com

Ethereum (D1 interval)

In a correction scenario, short-term support should be sought around $3350, where we see the 38.2 Fibonacci retracement of the upward wave from January. Long-term price support, on the other hand, can be found in the vicinity of $2,800 - $3,200, where the 61.8 Fibo retracement runs. An invariably important resistance level is around $3650, where we see the 23.6 Fibo; a rise above this level could open the way for an impulse above $4000 for ETH.

Source: xStation5

Source: xStation5

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

Morning wrap: Tech sector sell-off (06.02.2026)