- European stocks close higher

- S&P 500 and Nasdaq both hit new ATH’s

- Delta variant is bringing back lockdowns in Asia

- Precious metals under pressure

European indices bounced back after yesterday's losses, supported mostly by materials, consumer cyclicals and energy stocks. On the data front, Germany's consumer price inflation rate eased to 2.3% YoY in June, from a near 13-year high of 2.5% hit in the previous month and in line with analysts' estimates. DAX rose 0.88%, CAC40 added 0.14% and FTSE 100 finished 0.21% higher.

US indices also moved slightly higher in line with its European peers. Both the S&P 500 and Nasdaq hit new record highs, thanks to solid performance of major US banks stocks. Financial sector welcomed the news that major players like Morgan Stanley and JP Morgan will increase their dividends and capital payouts following the annual "stress test" last week. However upward move is capped by concerns over the spread of the highly infections Delta virus variant. Several countries including Australia, Malaysia and Thailand introduced new lockdowns or an extension to the current restrictions, Indonesia reported record number of new daily cases over the weekend, while Spain and Portugal announced travel restrictions on unvaccinated British tourists. Meanwhile Friday's data from the US labour market may be of key importance for investors. On the other hand, today's readings show a mixed picture - decreasing price pressure in Europe, which gives a chance to keep monetary policy unchanged. In turn, US consumer sentiment increased tp the highest levels since February 2020 and it seems that this trend is likely to continue in the near future.

WTI oil rose 0.20% and is trading slightly above $73.00 a barrel, while Brent is trading 0.12% higher, near $74.80 although there are many indications that OPEC + will significantly increase production in August. In turn, gold lost ground and fell 1% while silver is trading 1.20 % lower amid a stronger US dollar.

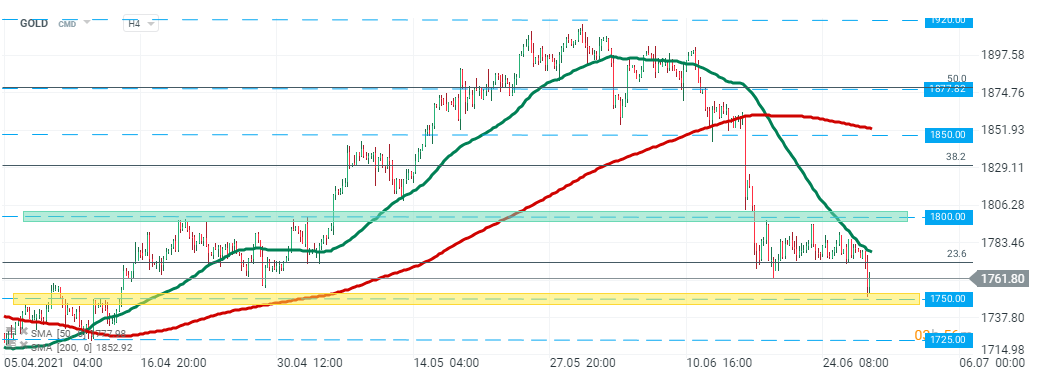

GOLD broke out from the local consolidation zone during today’s session and price is testing major support at $1750. If sellers will manage to uphold pressure then downward move may accelerate towards next support at $1725. On the other hand, if the buyers manage to regain control, then another upward move may be launched towards the upper limit of the consolidation zone at $1800. Source: xStation5

GOLD broke out from the local consolidation zone during today’s session and price is testing major support at $1750. If sellers will manage to uphold pressure then downward move may accelerate towards next support at $1725. On the other hand, if the buyers manage to regain control, then another upward move may be launched towards the upper limit of the consolidation zone at $1800. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause