- German inflation accelerates more than expected

- Strong GDP figures from the US

- Twitter (TWTR.US) and Amazon (AMZN.US) are expected to report earnings after market close

European indices erased most of the early gains and finished today’s session lower as the treasury yields rose after US data release and the inflation rate in Germany accelerated more than expected in April. Earlier in the session sentiment was lifted by a bag of strong quarterly earnings reports from Unilever, Nokia, and planemaker Airbus. Among oil majors, Royal Dutch Shell posted better-than-expected quarterly earnings. At the end of the session DAX fell 0.9%, CAC40 lost 0.07% and FTSE100 finished slightly below the flat line.

Also main US indices pared early gains and the S&P 500 and Nasdaq fell from their intraday records. Bulls failed to uphold initial rally in tech shares after investors digested a set of mixed data from the US economy. Weekly jobless claims reached a new low since the pandemic struck and GDP grew 6.4% in Q1 of 2021. However both of these readings did not exactly match analysts' expectations. On the corporate front, earnings from Apple and Facebook both crashed market expectations yesterday, while Caterpillar reported a rise in adjusted first-quarter profit. Meanwhile, Ford said a global semiconductor shortage may slash second-quarter production by half. Amazon, Twitter, Mastercard, Nio and Gilead Sciences will report their quarterly results today after the market closes.

Both WTI crude and Brent rose more than 1.6% as optimistic forecasts on recovering demand in the second half of 2021 overshadowed, at least for now. concerns about the impact of rising COVID-19 cases in Asia and South America. Elsewhere gold fell 0.7% to $ 1,768.00 / oz, while silver is trading 0.6% lower, around $ 26.00 / oz as the yield on the benchmark 10-year Treasury note rose to an over 2-week high of 1.677%.

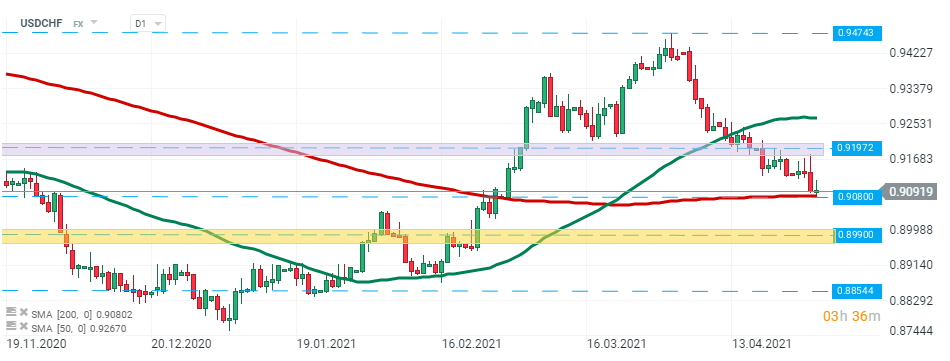

USDCHF fell sharply during yesterday’s Fed Chair Powell conference, however today buyers managed to halt declines around local support at 0.9080 which is additionally strengthened by 200 SMA ( red line). Should break lower occur, then downward move may be extended to the 0.8990 level. However as long as the pair sits above the aforementioned 0.9080 level then another upward impulse towards resistance at 0.9197 may be launched. Source: xStation5

USDCHF fell sharply during yesterday’s Fed Chair Powell conference, however today buyers managed to halt declines around local support at 0.9080 which is additionally strengthened by 200 SMA ( red line). Should break lower occur, then downward move may be extended to the 0.8990 level. However as long as the pair sits above the aforementioned 0.9080 level then another upward impulse towards resistance at 0.9197 may be launched. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report